10 Cheapest Car Insurance Companies for 2026 [Save Big With These Providers!]

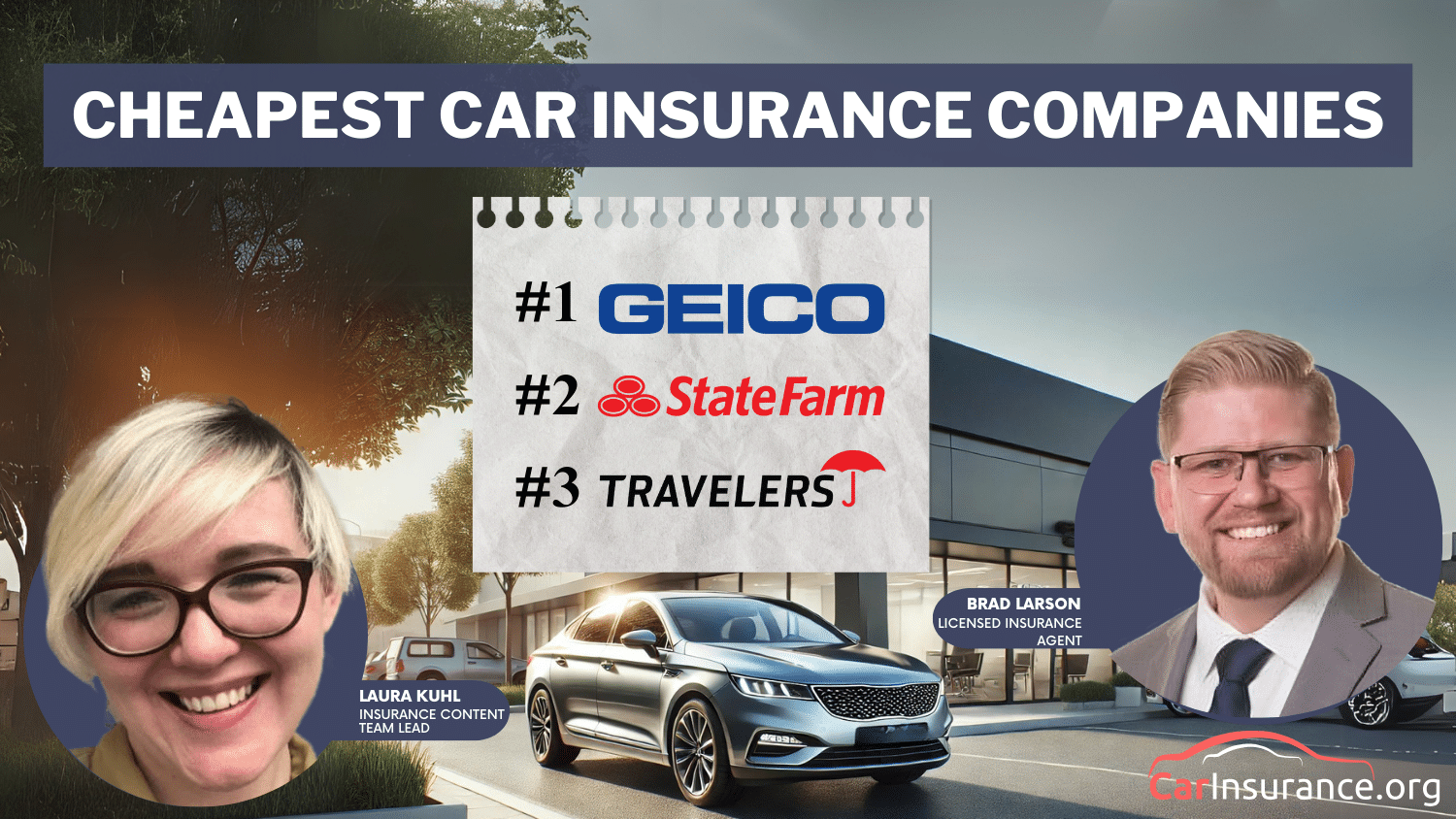

The cheapest car insurance companies are Geico, State Farm, and Travelers. Geico is the top car insurance pick for its cheap rates, starting at $34 per month. State Farm is best for its solid reputation for reliability and Travelers offers the best car insurance savings for good students.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Expert Insurance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated March 2025

18,155 reviews

18,155 reviewsCompany Facts

Min. Coverage From the Cheapest Companies

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage From the Cheapest Companies

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsThe cheapest car insurance companies include Geico, State Farm, and Travelers. Geico is the top pick overall for its balance of low rates, discounts, and strong customer support. It offers reliable rates starting at $34/month.

Geico offers the most budget-friendly choice for many drivers. State Farm provides great value with personalized service and safe-driving discounts, while Travelers offers flexible policies and ways to save, helping keep costs down.

Our Top 10 Company Picks: Cheapest Car Insurance Companies

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $34 | A++ | Cheap Rates | Geico | |

| #2 | $39 | B | Military Benefits | State Farm | |

| #3 | $45 | A++ | Student Savings | Travelers | |

| #4 | $46 | A+ | Loyalty Rewards | Progressive | |

| #5 | $52 | A | Claims Service | American Family | |

| #6 | $53 | A+ | Vanishing Deductible | Nationwide |

| #7 | $60 | A | Family Plans | Farmers | |

| #8 | $63 | A+ | Customized Policies | Allstate | |

| #9 | $69 | A | Add-on Coverages | Liberty Mutual |

| #10 | $77 | A+ | Safe Drivers | The Hartford |

These companies give competitive prices, helpful discounts, and coverage options that can be tailored, making it easier for people to find affordable insurance that works for them. For more info, visit this car insurance guide.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code.

- Geico offers affordable rates starting at $34 monthly, plus great discounts

- State Farm and Travelers provide personalized service for safe drivers

- These companies offer the cheapest car insurance with flexible policies

#1 – Geico: Top Overall Pick

Pros

- Lowest Rates: Geico offers the most competitive monthly rates at $34 for minimum coverage.

- Widely Recognized: It’s a reliable choice among the cheapest car insurance companies for its comprehensive policy options. You can find more info in our Geico Car Insurance Review.

- Discount Variety: They provide multiple discounts, including good driver and multi-policy savings, making them a top pick among the cheapest car insurance companies.

Cons

- Customer Service: Some customers say the support from the cheapest car insurance companies can be hit or miss, depending on the issue.

- Limited Customization: Geico’s policies may not offer as much flexibility for unique coverage needs among the cheapest car insurance companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Military Benefits

Pros

- Affordable Rates: State Farm offers low monthly rates of $39, for minimum coverage.

- Military Discounts: Special savings for active and retired military personnel make it one of the cheapest car insurance companies.

- Local Agents: Local agents who know their stuff can help you find affordable car insurance. Check out our State Farm Car Insurance Review.

Cons

- Limited Discounts: While affordable, State Farm’s discount options may not be as extensive as those of the cheapest car insurance companies.

- Full Coverage Costs More: Full coverage plans can be pricier than the cheapest car insurance companies.

#3 – Travelers: Best for Student Savings

Pros

- Student Discounts: Travelers offers student discounts, making it the cheapest car insurance company for younger drivers.

- Reasonable Rates: Monthly rates start at $45 for minimum coverage. For more info, explore this Travelers car insurance review.

- Customizable Options: Flexible coverage options cater to various needs, making it a great choice among the cheapest car insurance companies.

Cons

- Customer Service: Some policyholders report delayed claim processing.

- Limited Availability: Travelers may not operate as the cheapest car insurance company in all areas.

#4 – Progressive: Best for Loyalty Rewards

Pros

- Loyalty Discounts: Progressive rewards long-term customers with discounts, making it one of the cheapest car insurance options over time.

- Low Starting Rates: Progressive offers cheap car insurance with rates starting at $46 per month, making it an affordable option for drivers.

- Snapshot Program: Usage-based discounts through Snapshot encourage safe driving, making it the cheapest car insurance company for safe drivers.

Cons

- Rate Increases: Some policyholders experience rate hikes upon renewal. Learn more in our Progressive Car Insurance Review.

- Policy Complexity: Certain coverage options for first-time users might feel overwhelming.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Claims Service

Pros

- Claims Support: The American Family is recognized for efficient claims processing among the cheapest car insurance companies.

- Fair Prices: Monthly rates start at $52 for minimum coverage. Read our American Family Car Insurance Review to find out more about this cheapest car insurance company.

- Family-Oriented Policies: Custom options cater to family needs, making it an ideal choice for the cheapest car insurance company.

Cons

- Limited Coverage Area: American Family is unavailable in all states.

- Premium Costs: Full coverage premiums can be higher than other cheapest car insurance companies.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Unique Features: Nationwide’s vanishing deductible program adds value for the cheapest car insurance companies. Read more through our Nationwide Car Insurance Review.

- Competitive Rates: Starting at $53 per month for minimum coverage, Nationwide offers the cheapest car insurance coverage.

- Discount Opportunities: Multi-policy and good driver discounts further reduce costs.

Cons

- Rate Increases: Some customers experience premium hikes over time.

- Limited Discounts: Discount offerings may not be as extensive compared to other cheapest car insurance companies.

#7 – Farmers: Best for Family Plans

Pros

- Family Discounts: Farmers excel in providing multi-vehicle and family plan discounts.

- Reasonable Costs: Monthly rates start at $60 for minimum coverage. Get more info in this Farmers Car Insurance Review.

- Customizable Coverage: Flexible policy options cater to different family needs.

Cons

- Higher Rates: Premiums can be slightly higher than other cheapest car insurance companies out there, depending on your coverage and driving history.

- Availability: Farmers insurance may not be offered in all states.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for Custom Policies

Pros

- Custom Coverage: They let you pick a coverage that fits your needs, which is great when looking for the cheapest car insurance company.

- Strong Reputation: Allstate is known for helping people and offering better service than other car insurance companies.

- Low-Cost Plans: Basic coverage starts at just $63 per month, making it one of the cheapest car insurance companies. Check out our Allstate Car Insurance Review to learn more.

Cons

- Higher Starting Rates: Allstate’s initial rates can be higher than those of the cheapest car insurance companies.

- Limited Discounts: Some discounts from Allstate have specific rules for qualifying.

#9 – Liberty Mutual: Best for Add-on Coverages

Pros

- Coverage Add-Ons: Liberty Mutual offers great add-ons like accident forgiveness, making it a good option among the cheapest car insurance companies.

- Reasonable Rates: Starting at $69 monthly, their rates are competitive compared to those of the cheapest car insurance companies in the U.S.

- Nationwide Availability: Liberty Mutual is available across the U.S., making it a reliable choice for anyone seeking coverage from the cheapest car insurance companies.

Cons

- Higher Premiums: Adding extra coverage features could increase premiums. Find everything you need in this Liberty Mutual Car Insurance Review.

- Customer Support: Some customers have reported mixed experiences with customer service.

#10 – The Hartford: Best for Safe Drivers

Pros

- Safe Driver Discounts: The Hartford offers significant savings, making it the cheapest car insurance company for safe drivers.

- Affordable Coverage: Rates begin at $77 per month for minimum coverage.

- AARP Benefits: Exclusive benefits for AARP members enhance the value of the cheapest car insurance companies.

Cons

- Membership Requirement: Certain discounts and perks are only available to AARP members.

- Limited Discounts: There are fewer discount options than at other cheapest car insurance companies. For more details, check out our The Hartford Car Insurance Review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Cheapest Type of Car Insurance

Car insurance comes in different types, and it can be confusing to figure out what you need, especially when you’re on a tight budget. Common types of coverage include collision, comprehensive, and liability, and understanding which one suits your needs can help you make an informed decision. You can often compare prices for these policies online or talk to an agent for advice.

Cheapest Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $63 | $203 | |

| $52 | $157 | |

| $60 | $172 | |

| $34 | $108 | |

| $69 | $216 |

| $53 | $158 |

| $46 | $148 | |

| $39 | $123 | |

| $77 | $224 |

| $45 | $139 |

Most states require you to carry liability insurance, which covers damages you cause to other people and property. While it’s usually best to get more coverage, the most affordable option is the state minimum. This can help you meet legal requirements without paying for unnecessary extras, especially if money is tight.

Comparing quotes from the cheapest car insurance companies is the best way to ensure you get the most value for your coverage.Jeffrey Manola Licensed Insurance Agent

If you still owe money on your car, your lender may ask for more insurance, known as full coverage. This usually includes comprehensive, collision, and uninsured/underinsured motorist coverage. Comprehensive covers damage from things like weather, theft, or animal accidents, while collision covers your vehicle repairs after an accident, no matter who’s at fault.

Another option you might need is gap insurance, which covers the difference between what you owe on your car and its current value if it’s totaled. If your car is new, there’s a chance you could owe more than the car is worth if it’s damaged beyond repair. Gap insurance helps cover that gap, so you’re not left paying out of pocket.

Read more: Where can I get cheap full coverage car insurance?

How Companies Determine Your Car Insurance Rates

Insurance companies use several factors to determine your rates, and each company has its own way of weighing these. Age and gender are significant, as statistics show that younger drivers and men are more likely to file claims, which makes their rates higher.

Your driving history also plays a big role in a list of cheap car insurance companies. If you have a clean record, you’ll generally pay less, but tickets or accidents will raise your rates. New drivers can face higher rates, too, because companies don’t have any history to predict how risky they might be.

The Scott Brothers are always talking sense. Protect your stuff your way today! https://t.co/0Q754BZ7mB pic.twitter.com/yeQUEDIjNj

— American Family Insurance (@amfam) September 29, 2023

Where you live matters as well. Insurance companies track ZIP codes and use them to estimate risk. Even moving a short distance could change your rates depending on how safe or risky the area is perceived to be. Compare car insurance rates by state.

The car you drive and your credit score also affect your rates. Cars that are more likely to be involved in accidents or cost more to repair tend to have higher premiums. A lower credit score can also raise your rates, as it signals a higher risk of missed payments. Since companies weigh these factors differently, it’s a good idea to compare quotes before choosing a policy.

Discounts From The Cheapest Insurance Companies

When searching for car insurance and learning how to get the cheapest car insurance, it can be tempting to consider smaller companies offering low rates with no deposit. While they might seem appealing, the best deals typically come from larger, well-established providers that have more options and discounts available.

Insurance Discounts From the Top Cheapest Car Insurance Providers

| Insurance Company | Available Discounts |

|---|---|

| Multi-policy, Safe driver, Anti-theft device, Accident-Free, Good Student, Paperless | |

| Multi-vehicle, Good student, Defensive driving course, Loyalty, Accident-Free, Pay in Full | |

| Multi-policy, Signal app usage, Good student, Safe Driver, Early Signing, Multi-Car | |

| Multi-vehicle, Defensive driving course, Military, Anti-Theft Device, Good Student, Pay in Full | |

| Multi-policy, Vehicle safety features, Hybrid vehicle, Paperless, Accident-Free, Good Payer |

| Multi-policy, SmartRide program, Accident-free, Defensive Driving Course, Good Student, Pay in Full |

| Multi-policy, Snapshot program, Homeowner, Continuous Insurance, Safe Driver, Accident-Free | |

| Multi-policy, Safe driver, Good student, Defensive Driving Course, Multi-Car, Accident-Free | |

| Multi-policy, Defensive driving course, Vehicle safety features, Accident-Free, Good Student, Pay in Full |

| Multi-policy, Homeownership, Continuous insurance, Safe Driver, Early Signing, New Car |

Some companies, advertise low rates but often end up being more expensive than other insurers. They cater to high-risk drivers, so their prices are higher for everyone. If you’re looking for more affordable coverage, consider starting with options like Geico, State Farm, or Travelers, which are known for offering competitive rates.

Read more: The Different Types of Car Insurance Coverage

How to Save Money on Insurance

When you’re trying to save on the lowest car insurance, the first thing to check is discounts. Many companies offer discounts for being a safe driver, a student, or having safety features in your car. Some also offer discounts for taking driver education courses or bundling multiple policies.

Another way to cut costs is by adjusting your deductibles and coverage. A higher deductible means a lower monthly payment, but keep in mind that it could cost you more out-of-pocket if you need to file a claim. An insurance agent can help you find the right balance between the coverage you need and what you can afford.

Lastly, maintaining a clean driving record and a strong credit score is key to keeping your rates low. Cheap but good car insurance companies often consider these factors when determining your premium, so staying safe on the road and managing your finances wisely can lead to big savings.

Read more: Buying Car Insurance: How to Find the Best Policy for You

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Finding the Cheapest Car Insurance Companies

In this section, we’ll see how these people found affordable car insurance that worked for them. These stories show you don’t have to give up quality to get a good deal.

Case Study 1: Sarah’s Budget-Friendly Choice with Geico

After buying her first car, Sarah, a recent college grad, needed cheap car insurance. She looked around and found Geico offered the best deal, starting at just $34 a month. Geico’s low rates and simple claims process made it easy for Sarah. By choosing Geico, she saved money and got good coverage. Want to learn more? Check out our guide, ” Cheap Car Insurance Companies That Only Look Back 3 Years.

Case Study 2: Mark’s Military Benefits with State Farm

Mark, a military veteran, needed affordable car insurance with military benefits. State Farm was a great choice because their military discount lowered his premium while still giving him good coverage. He really appreciated the friendly customer service and felt well taken care of by State Farm.

Case Study 3: Emily’s Savings as a Student with Travelers

As a full-time student, Emily needed car insurance that wouldn’t strain her budget. Travelers provided the best student discounts, including savings for good grades and low-mileage driving. With solid coverage and affordable premiums, Emily saved money while feeling safe and secure on the road.

These stories show how to find the cheapest car insurance companies that help drivers stay within their budget while still getting the coverage they need. Choosing the right company lets drivers feel safe, knowing they’re covered without overspending.

Choosing the Cheapest Car Insurance Option

One important lesson from these case studies is that cheap car insurance doesn’t always mean less coverage. Sarah, Mark, and Emily all found affordable plans that still gave them great protection. Whether it was Geico’s low rates, State Farm’s military discounts, or Travelers’ student savings, they all proved that with a little research, you can find a plan that fits your budget without overpaying. Read more: How Car Insurance Works

Students can save more by choosing the cheapest car insurance companies that offer discounts for good grades and low mileage.Heidi Mertlich Licensed Insurance Agent

If that doesn’t get you closer to your budget, you can check with your state’s DMV to determine if it has a program to help you. If there’s simply no way to pay for your insurance, you should consider public transportation. No matter how tempting it might be, you should never get behind the wheel of a car without coverage.

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

Frequently Asked Questions

What is the best way to find cheap auto insurance?

To find cheap auto insurance, you can compare quotes from different providers, consider your coverage needs, and look for discounts. Online comparison tools can help you find cheap car insurance quotes quickly.

What are the most affordable car insurance options?

The most affordable car insurance depends on factors like location, driving history, and vehicle type. Shopping around and comparing quotes can help you find the best deal. Find the best comprehensive car insurance quotes by entering your ZIP code into our free comparison tool today.

What are the top 10 cheapest car insurance companies?

The top 10 cheapest car insurance companies may vary by location, but popular ones include Geico, State Farm, and Progressive. Make sure to check for discounts and compare rates. For more details, see our guide, “The Car Collector’s Online Compendium.”

Where can I find inexpensive car insurance near me?

You can search online or visit local insurance agencies. Many of the most affordable insurance companies offer online quotes for local residents.

What is the cheapest auto insurance?

The cheapest auto insurance will depend on your personal circumstances. Factors such as your age, driving record, and car model will affect the rate. You can compare quotes from local providers to find affordable auto insurance near you.

How do I find the cheapest car insurance companies near me?

To find the cheapest car insurance companies near you, search online or ask for referrals from local drivers. It’s important to get quotes from multiple providers to find the lowest rates. Discover more in our guide, “Auto Haulers Car Insurance Coverage.”

What is affordable auto insurance?

Affordable auto insurance means the policy is reasonably priced for the coverage it offers. It’s important to balance affordability with sufficient protection for your needs. You may also want to consider the cheapest car insurance states to find better rates depending on your location.

Where can I get low-cost auto insurance?

You can get low-cost auto insurance by comparing different companies, looking for discounts, and maintaining a good driving record. Many companies offer low-priced car insurance options. Comparing quotes is the easiest way to find affordable car insurance. Simply enter your ZIP code into our free comparison tool to see rates in your area.

What are the top cheap insurance companies?

Cheap insurance companies include Geico, State Farm, and Allstate. These companies are known for offering competitive rates and various discounts. For additional info, check our guide, “What You Should Know About Country Financial Auto.”

Who has the cheapest car insurance?

To determine who has the cheapest car insurance, you need to compare quotes from several companies offering cheap insurance. The rates can vary based on your location, driving history, and other factors.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.