21st Century Car Insurance Review for 2026 [Find Rates and Discounts Here]

This 21st Century car insurance review shows that experienced drivers get the best rates, starting at $41/month. J.D. Power ratings of 865/1,000 and A+ ratings from BBB reflect great 21st Century insurance customer service. It operates under the Farmers Insurance brand but isn't available in all states.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Expert Insurance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated March 2025

This 21st Century car insurance review reveals two standout benefits: an above-average J.D. Power rating of 865/1,000 for customer satisfaction and cheap rates for as low as $40 per month. Good drivers can save up to 20%.

As part of Farmers Insurance Group, 21st Century Insurance Company is a digitally-focused provider offering competitive rates, particularly for safe drivers over 35.

21st Century Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.6 |

| Business Reviews | 3.0 |

| Claim Processing | 3.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 4.6 |

| Coverage Value | 3.2 |

| Customer Satisfaction | 4.0 |

| Digital Experience | 3.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.9 |

| Plan Personalization | 3.0 |

| Policy Options | 2.8 |

| Savings Potential | 4.3 |

While its user-friendly website and mobile app streamline policy management and claims filing, potential customers should note that coverage is not available in all states. California drivers are now served under the Toggle brand.

Although car insurance rates by state vary, you can find cheap 21st Century car insurance quotes anywhere by entering your ZIP code.

- 21st Century Insurance offers competitive rates starting at $40 per month

- The company has a 3.6 rating for discounts and customer service

- 21st Century provides 15% discounts for multi-vehicle policies

21st Century Car Insurance Pricing & Policy Types

Our 21st Century auto insurance review compares quotes and finds that this provider is all about competitive rates and digital access. It offers the basic types of coverage — liability and full coverage.

21st Century Car Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $235 | $690 |

| Age: 16 Male | $260 | $735 |

| Age: 18 Female | $195 | $590 |

| Age: 18 Male | $215 | $630 |

| Age: 25 Female | $85 | $260 |

| Age: 25 Male | $90 | $280 |

| Age: 30 Female | $65 | $200 |

| Age: 30 Male | $70 | $215 |

| Age: 45 Female | $42 | $142 |

| Age: 45 Male | $41 | $140 |

| Age: 60 Female | $39 | $130 |

| Age: 60 Male | $43 | $135 |

| Age: 65 Female | $38 | $125 |

| Age: 65 Male | $40 | $132 |

You won’t find many different policy types at 21st Century. It only offers basic liability, collision, comprehensive, uninsured motorist, and medical payments coverage. Drivers can add roadside assistance, but it will raise your rates. If you want more policy options, check out our guide on how to find the best car insurance policy for you.

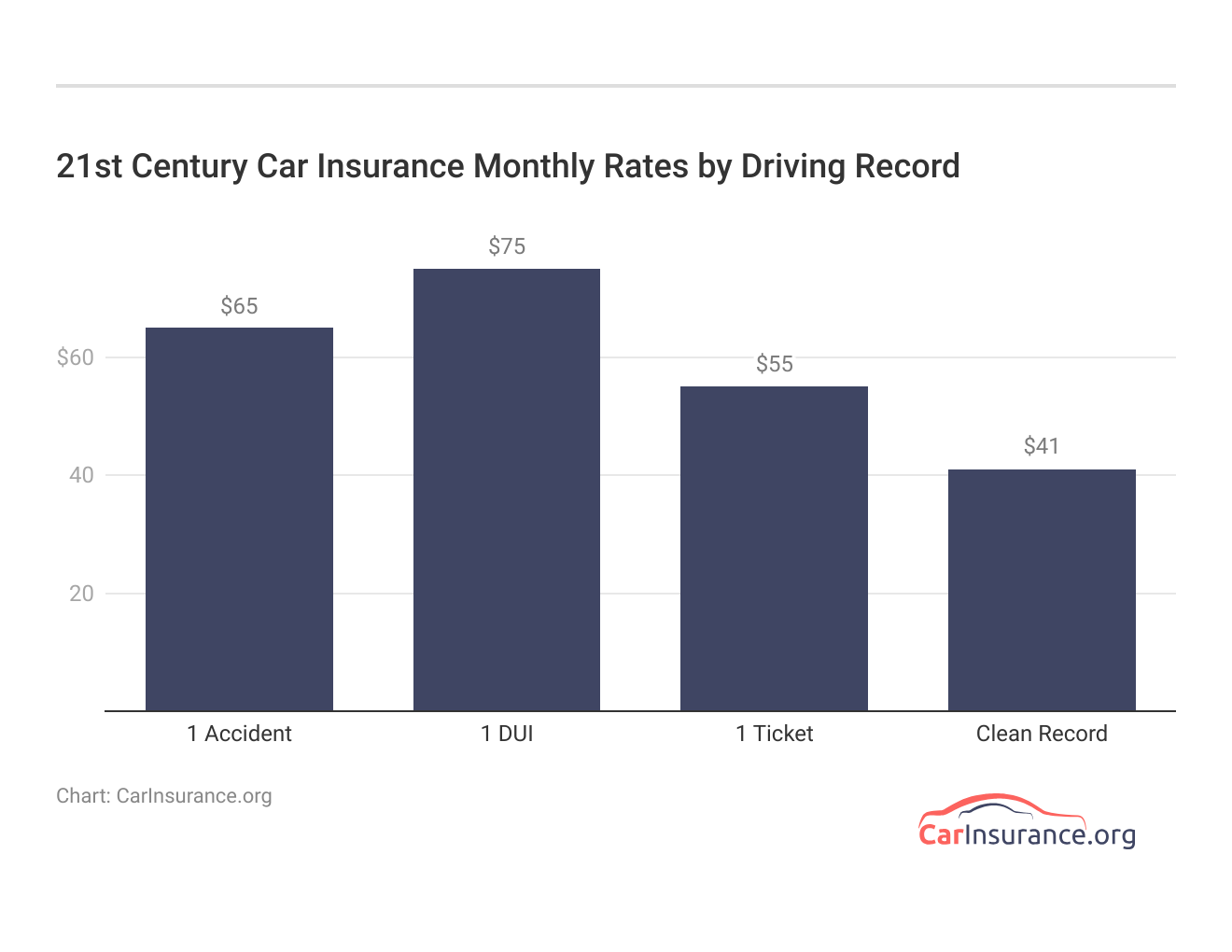

Along with coverage and policy type, your driving record will also have a big impact on 21st Century car insurance rates.

This graph demonstrates 21st Century’s risk-based pricing model, where safer drivers are rewarded with lower premiums while high-risk behaviors result in substantially higher insurance costs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Showdown: 21st Century vs. Top Companies

Even as part of the Farmers Insurance Group, 21st Century Insurance still has higher rates than its parent company. When comparing 21st Century vs. Liberty Mutual, we can see that 21st Century generally charges more across all age groups, with particularly notable differences for younger drivers.

Similarly, in a State Farm vs. 21st Century comparison, State Farm offers significantly lower rates, sometimes less than half of what 21st Century charges for teenage drivers.

21st Century Car Insurance Monthly Rates vs. Top Competitor by Age & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 65 Female | Age: 65 Male |

|---|---|---|---|---|---|---|---|---|

| $260 | $280 | $145 | $155 | $125 | $132 | $115 | $120 |

| $181 | $190 | $145 | $155 | $158 | $157 | $142 | $147 | |

| $172 | $180 | $140 | $145 | $136 | $136 | $125 | $130 | |

| $97 | $93 | $85 | $90 | $78 | $78 | $75 | $80 | |

| $187 | $215 | $155 | $160 | $167 | $170 | $150 | $155 |

| $136 | $150 | $120 | $130 | $111 | $112 | $105 | $108 |

| $141 | $146 | $118 | $122 | $109 | $103 | $100 | $105 | |

| $101 | $111 | $90 | $95 | $84 | $84 | $80 | $85 | |

| $107 | $116 | $98 | $102 | $96 | $97 | $91 | $94 | |

| $80 | $85 | $70 | $75 | $58 | $57 | $52 | $55 |

Looking at 21st Century vs. Geico, the difference is even more striking – Geico consistently offers some of the lowest rates across all age groups, with premiums often $100-150 less per month than 21st Century.

While 21st Century now operates in California as Toggle, the overall pricing strategy and coverage options remain similar to the parent company’s standards.

21st Century Insurance Discount Programs

Perhaps most noticeable is what 21st Century car insurance discounts could save you, which is as much as 25% for safe drivers and multi-policy holders.

21st Century Car Insurance Discounts by Potential Savings

| Discount Name |  |

|---|---|

| Good Driver | 20% |

| Superior Driver | 18% |

| Anti-Theft Device | 15% |

| Good Student | 15% |

| Multi-Vehicle | 15% |

| Mature Driver | 2% |

Good student discounts and safety feature incentives are also available for customers to save. These discounts make 21st Century particularly attractive for safe drivers and students with good academic performance.

Combined discounts reduce the cost of auto insurance. For instance, though the 2 percent discount for senior drivers looks small, it can be bundled with other discounts to make for greater savings.

21st Century Customer Service Reviews & Insurance Ratings

21st Century Insurance reviews can be assessed through multiple independent rating agencies that evaluate various aspects of their service. Each agency provides insights into different aspects of the company’s performance, creating a comprehensive picture of its standing in the insurance industry.

21st Century Car Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 865 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Great Business Practices |

|

| Score: 72/100 Avg. Customer Satisfaction |

|

| Score: 2.85 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

On the financial side, the A rating from A.M. Best demonstrates excellent financial strength and a strong ability to meet insurance obligations.

Save extra cash in 2022 with 21st Century Insurance®! Did you know customers who switch to 21st Century save up to $378*?! Drivers can get additional discounts, too! Learn more: https://t.co/xPXJshogNd pic.twitter.com/AsOla8YFpW

— 21st Century (@21stCenturyAuto) January 3, 2022

Check out a real customer that writes a review to determine 21st Century Insurance customer service ratings, like Rachel B.’s 5-star Yelp rating highlighting their efficient claims handling.

Prospective customers should weigh these factors and reviews against their specific insurance needs and priorities when comparing 21st Century auto insurance quotes to other companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of 21st Century Car Insurance

Before you make a decision to go with 21st Century car insurance it is important to review its strengths and weaknesses. This is a complete analysis of the main advantages and disadvantages of 21st Century Insurance.

- Competitive Discounts: Offers up to 20% savings for good drivers and multiple discount options for various driver profiles.

- Digital Experience: User-friendly website and mobile app provide easy policy management and claims filing.

- Financial Stability: An “A” rating from A.M. Best signifies outstanding financial strength and a dependable ability to fulfill claims.

For experienced drivers and those who want the convenience of going digital and the savings that go with it, 21st Century Insurance is a particularly strong choice among the options.

- Limited Availability: 21st Century no longer sells California insurance (operates as Toggle) and is not available in all states.

- Higher Youth Rates: Significantly higher premiums for drivers under 25 compared to competitors like Geico and USAA.

The higher rates for younger drivers and the limited state availability might turn off some, but the company’s strong financial backing and efficient claims processing will make it a good choice for some drivers.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Deciding on 21st Century Insurance

In our 21st Century Insurance car insurance review, we find that the company’s biggest strength is its competitive discount program, which allows good drivers to save up to 20%. Before buying car insurance, note that its weakness is that it only operates in a limited number of states, including the conversion to Toggle in California.

We find that 21st Century Insurance's biggest strength is its competitive good drivers and multiple discount program.Michelle Robbins LICENSED INSURANCE AGENT

For experienced drivers over 35 with clean driving records and a desire for digital service options, the insurance provider is the best fit. 21st Century Insurance really stands out for its impressive J.D. Power score of 865 out of 1,000 and above average for customer satisfaction in claims handling and overall service.

Ready to find cheaper car insurance coverage in your state? Enter your ZIP code to begin to compare 21st Century Insurance quotes.

Frequently Asked Questions

How good is 21st Century Insurance?

21st Century car insurance is well-rated, especially for customer satisfaction, with an above-average J.D. Power score of 865/1,000. Its competitive rates, starting at $40 per month, and digital convenience make it a strong choice, particularly for experienced drivers with clean records.

Who owns 21st Century car insurance?

21st Century is part of the Farmers Insurance Group. Farmers is one of the best car insurance companies to look for.

Is 21st Century Insurance Company legit?

Yes, 21st Century is a legitimate insurance provider with an A.M. Best rating of “A” for financial strength, ensuring its ability to meet claims obligations. Its positive customer reviews also highlight efficient claims handling.

Get the right car insurance at the best price — enter your ZIP code to shop for coverage from the top insurers.

What is 21st Century Insurance called now?

In California, 21st Century operates under the Toggle brand. However, in other states, it still operates under the name 21st Century Insurance.

Is 21st Century Insurance the same as Farmers Insurance?

21st Century is part of the Farmers Insurance Group, but it operates independently with a digital-focused approach and distinct branding, especially outside California. Learn more in our Farmers review.

How do 21st Century insurance policies differ from Farmers?

Although it’s under the Farmers’ umbrella, 21st Century offers a digital-first approach, appealing to experienced drivers over 35. Farmers provides more extensive in-person support and a broader range of policy options tailored to different demographics.

What happened to 21st Century Insurance in California?

21st Century rebranded to Toggle in California, though it maintains a similar coverage structure under this new name in the state.

Is 21st Century Insurance now Toggle?

Yes, in California, 21st Century Insurance has rebranded to Toggle. Based on Toggle car insurance reviews, they focus on a similar target market and coverage options.

What is the coverage of the 21st Century?

21st Century Insurance offers various types of car insurance coverage, including liability, collision, and comprehensive insurance.

Can I cancel my 21st Century policy online?

While 21st Century Insurance provides a user-friendly digital platform for policy management, you may need to contact customer service directly to complete a cancellation, as online cancellation policies vary. Enter your ZIP code to find cheap car insurance after canceling coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.