AAA Car Insurance Review for 2026 [See What Policyholders Have to Say]

Discover in this AAA car insurance review how coverage starts at $29/month. AAA roadside assistance program offers unmatched reliability, making it a top choice for drivers. With strong service options and excellent support, AAA leads in providing comprehensive protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Expert Insurance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated March 2025

Our AAA car insurance review highlights why it stands out for its comprehensive coverage options and exceptional roadside assistance.

With a solid reputation and high customer satisfaction, the American Automobile Association (AAA) delivers reliable service for policyholders. Their extensive network and range of discounts offer added value. However, you must have a AAA membership to buy auto insurance.

AAA Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 4.2 |

| Business Reviews | 4.5 |

| Claim Processing | 3.3 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.0 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 4.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.0 |

| Plan Personalization | 4.0 |

| Policy Options | 4.4 |

| Savings Potential | 4.3 |

Trustworthy and versatile, AAA auto insurance remains a top choice for drivers seeking security and support. Find more insights about what car insurance covers.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

- AAA car insurance has a 4.2 rating for reliable coverage

- Customers value AAA roadside assistance and broad coverage

- AAA has nationwide access and discounts that boost satisfaction

Exploring AAA Insurance Costs by Age and Coverage Level

AAA car insurance rates vary significantly based on age, gender, and coverage type. Younger drivers, particularly those aged 16, face higher minimum and full coverage premiums.

AAA Car Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $172 | $445 |

| Age: 16 Male | $189 | $465 |

| Age: 18 Female | $140 | $328 |

| Age: 18 Male | $162 | $378 |

| Age: 25 Female | $40 | $107 |

| Age: 25 Male | $41 | $110 |

| Age: 30 Female | $37 | $99 |

| Age: 30 Male | $38 | $103 |

| Age: 45 Female | $33 | $88 |

| Age: 45 Male | $46 | $86 |

| Age: 60 Female | $29 | $76 |

| Age: 60 Male | $30 | $77 |

| Age: 65 Female | $33 | $86 |

| Age: 65 Male | $32 | $84 |

These differences decrease as drivers age, with those aged 30 seeing much lower rates, starting at $37/month for female drivers and $38 monthly for males. Full coverage follows a similar trend, with premiums dropping as age increases.

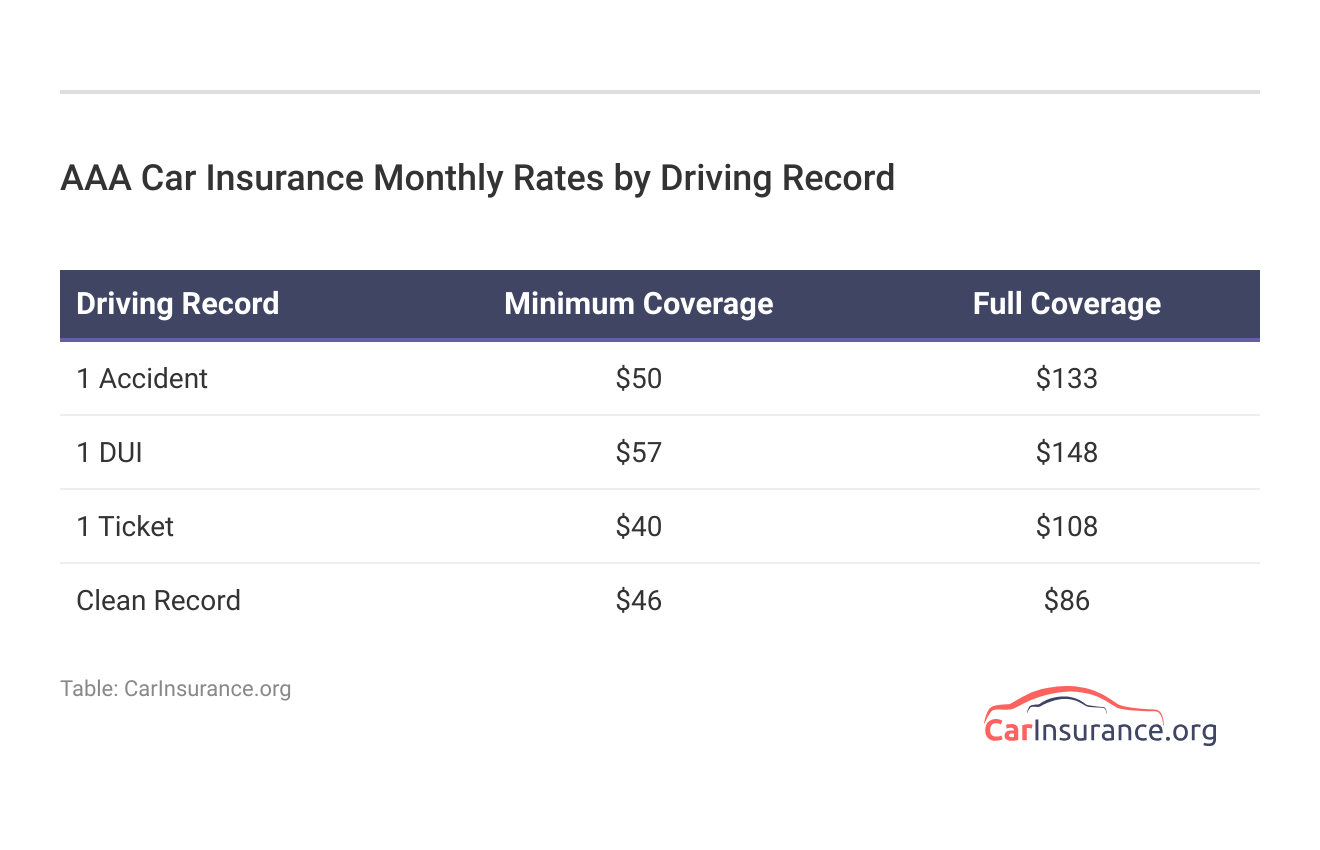

AAA auto insurance rates also vary based on driving history. Drivers with a clean record enjoy the lowest rates, while incidents like accidents, tickets, or DUIs affect the price of car insurance the most.

Now that you know how much AAA insurance costs for different ages and driving histories, let’s see how it compares to the other top insurance companies in the country.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AAA Car Insurance Rates vs. Different Providers and Age Groups

Compared to its rivals, AAA maintains an edge in affordability across most age groups and genders, making it an attractive option for drivers looking to save on auto insurance costs.

AAA Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $328 | $378 | $99 | $103 | $88 | $86 | $76 | $77 |

| $448 | $519 | $168 | $176 | $162 | $160 | $150 | $154 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $73 | $74 | |

| $522 | $626 | $174 | $200 | $171 | $174 | $148 | $159 |

| $303 | $387 | $124 | $136 | $113 | $115 | $99 | $104 |

| $591 | $662 | $131 | $136 | $112 | $105 | $92 | $95 | |

| $229 | $284 | $94 | $103 | $86 | $86 | $76 | $76 | |

| $530 | $740 | $99 | $108 | $98 | $99 | $89 | $90 |

AAA offers competitive rates compared to top competitors, especially for middle-aged and senior drivers. Younger drivers typically face higher premiums, but as drivers age, AAA offers competitive rates compared to others in the industry.

With AAA, drivers benefit from reliable service and an extensive support network.Dani Best Licensed Insurance Producer

However, that changes if you have an accident or speeding ticket on your record. AAA is not cheap for higher-risk drivers. If you have a less-than-perfect driving history, skip AAA car insurance and check out our guide on how to find the best policy for you.

AAA Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One DUI | One Accident |

|---|---|---|---|---|

| $86 | $108 | $148 | $133 |

| $160 | $188 | $270 | $225 | |

| $80 | $106 | $216 | $132 | |

| $174 | $212 | $313 | $234 |

| $115 | $137 | $237 | $161 |

| $105 | $140 | $140 | $186 | |

| $86 | $96 | $112 | $102 | |

| $99 | $134 | $206 | $139 |

The comparison highlights how age and provider impact the cost of car insurance after an accident or DUI. While still competitive, American Automobile Association insurance is more expensive than Geico and State Farm.

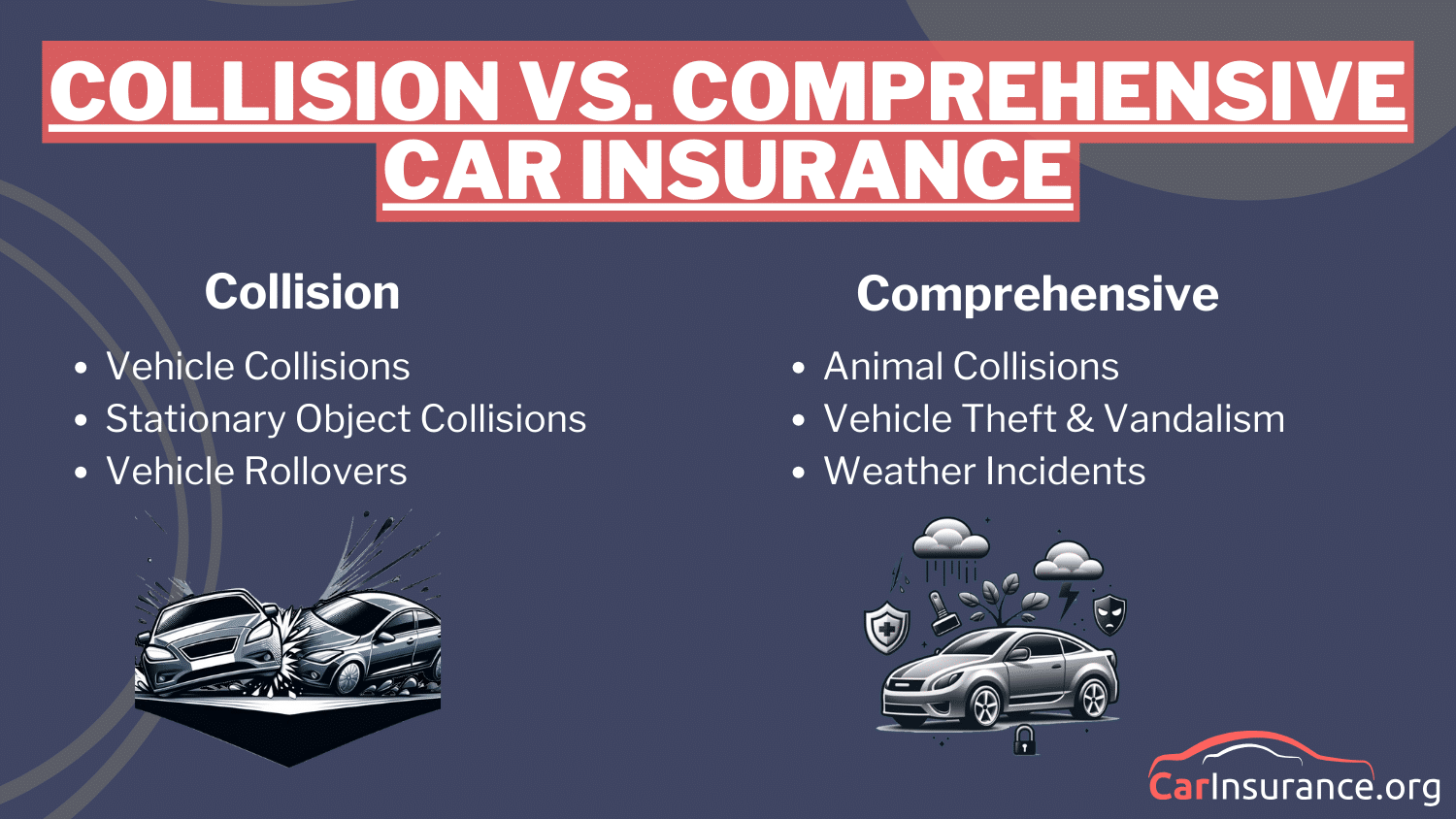

AAA Coverage Options for Every Driver

AAA offers a range of coverage options designed to protect drivers in various situations. These plans ensure drivers are well-protected in any circumstance.

AAA Car Insurance Coverage Options

| Coverage | Description |

|---|---|

| Liability Insurance | Covers injury and damage to others when at fault |

| Collision | Pays for vehicle repairs after a collision, whether at fault |

| Comprehensive | Covers damages from theft, fire, or natural disasters |

| Personal Injury Protection (PIP) | Covers medical costs and lost wages, regardless of fault |

| Uninsured/Underinsured Motorist | Protects against accidents with underinsured drivers |

| Roadside Assistance | 24/7 help for towing, jump-starts, and tire changes |

| Rental Car Reimbursement | Pays for a rental car during repairs after an accident |

| Medical Payments | Pays medical costs for all, regardless of fault |

AAA’s diverse coverage options of different types of car insurance, from liability and personal injury protection to full coverage insurance with collision and comprehensive coverage, make it a solid choice for any driver.

Whether covering medical expenses or offering rental car reimbursement, AAA provides peace of mind with every policy.

AAA Car Insurance Discounts for Big Savings

AAA offers various discounts to help lower car insurance costs. From multi-car to senior citizen discounts, these options provide ample opportunities to reduce costs.

AAA Car Insurance Discounts by Savings Potential

| Discount |  |

|---|---|

| Renewal | 23% |

| Multi-Car | 22% |

| Affinity | 21% |

| Military | 20% |

| Prior Coverage | 20% |

| Senior Citizen | 20% |

| Safe Driver | 18% |

| Good Student | 15% |

| Welcome Back | 15% |

| Homeowner | 13% |

With savings of up to 23%, AAA car insurance discount programs make it an attractive choice for many policyholders.

By taking advantage of these discounts, you can lower your insurance expenses while enjoying comprehensive coverage. However, you must be a AAA member to qualify, which other companies don’t require.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AAA Car Insurance Ratings and Customer Service Reviews

AAA insurance ratings reflect its strong industry standing, with high marks from trusted sources like J.D. Power and an A+ from the BBB.

AAA Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 823 / 1,000 Avg. Satisfaction |

|

| Score: A Good Business Practices |

|

| Score: 74/100 Good Customer Feedback |

|

| Score: 0.58 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

Despite a slightly higher complaint index, overall ratings remain impressive, underscoring AAA’s reliable service and financial strength. Customers also report high claims satisfaction with American Automobile Association auto insurance.

Comment

byu/MShorter02 from discussion

inInsurance

AAA is a solid choice for business insurance with consistent ratings across multiple platforms. It offers a balance of trustworthiness and service reliability. Its slightly elevated complaint index does little to overshadow its excellent overall performance.

Read More: How much insurance do I need for my car?

The Pros and Cons of AAA Car Insurance

We know its customer satisfaction and business ratings are intense, so let’s explore some more pros of American Automobile Association coverage:

- Coverage Options: AAA has many coverage options available in many states.

- Roadside Assistance: AAA has one of the highest-rated roadside assistance programs on the market.

- Financial Strength: AAA has excellent A.M. Best ratings.

- Competitive Discounts: AAA insurance discounts for good drivers and multiple vehicles offer 20% savings or more.

There are a few negatives when it comes to AAA car insurance, and that’s due to the limiting nature of its membership. Other reasons to not buy AAA include:

- Membership Required: There are additional fees for non-members.

- Claims Service: Customers in some states report slow processing when filing a car insurance claim after an accident.

- Expensive After an Accident: AAA isn’t the best option for drivers with high-risk profiles.

Weigh the AAA pros and cons carefully before you buy car insurance online. Then, compare it against other companies in your area to find the best policy.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Buying Guide for AAA Car Insurance

AAA provides reliable coverage options alongside its highly regarded roadside assistance program, making it an attractive option for many drivers. Compare car insurance rates by state to see if it’s the cheapest nearby company.

However, this AAA car insurance review finds that policies and benefits are only available to AAA members. AAA membership fees can increase the cost of car insurance, which could deter some customers.

Fortunately, AAA car insurance rates are cheaper than average, with competitive quotes for middle-aged and senior drivers. High-risk drivers may find their premiums less favorable, but overall AAA stands out for its service reliability and comprehensive protection.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Frequently Asked Questions

What is the best rating for AAA car insurance?

AAA car insurance holds an excellent rating of 4.2 for its reliable coverage and customer service.

Is AAA car insurance company reliable?

Yes, AAA car insurance is known for dependable service, offering comprehensive coverage and trusted roadside assistance. Compare it to the best car insurance companies to determine if it’s right for you.

What does AAA stand for in AAA car insurance?

In AAA car insurance, AAA stands for the American Automobile Association.

Who owns AAA insurance?

No one. AAA is a non-profit auto club without shareholders.

Does AAA car insurance offer the most affordable rates?

AAA car insurance offers competitive rates, but affordability depends on individual driver needs and locations. Enter your ZIP code below to find the most affordable car insurance rates in your city.

Which is the most expensive form of AAA car insurance?

Full coverage, including collision and comprehensive, is typically the most expensive form of AAA car insurance. Find out where to get cheap full coverage car insurance here.

What is the other name for AAA car insurance?

AAA car insurance is also known as Triple A Insurance or American Automobile Association insurance.

What is the AAA A.M. Best rating?

AAA car insurance has a strong financial stability rating of “A” from A.M. Best.

How long has AAA car insurance been available?

AAA car insurance has been serving customers for over a century, offering trusted services and coverage.

What is the most common type of AAA car insurance?

The most prevalent type of policy that AAA car insurance offers is property damage and bodily injury liability insurance coverage.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.