Allstate Car Insurance Review for 2026 (See if They’re a Good Fit!)

Our Allstate car insurance review found it best for those wanting add-on coverages and widespread availability. However, most drivers will find plans are too expensive, as Allstate car insurance rates start at $90/month for minimum coverage. Allstate Insurance also has a high number of customer complaints.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Ty Stewart

Updated March 2025

Our Allstate car insurance review found that Allstate is a reputable company with plenty of coverage options, but there are some cons to signing up with Allstate.

The main drawback of Allstate is that it’s not one of the cheapest car insurance companies, so it ranks lower for affordability.

Read on for a full breakdown of rates, coverages, reviews, and more in our detailed Allstate insurance review. See our full ranking of The Allstate Corporation below.

Allstate Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.8 |

| Business Reviews | 4.0 |

| Claim Processing | 3.0 |

| Company Reputation | 5.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 3.4 |

| Customer Satisfaction | 4.0 |

| Digital Experience | 5.0 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.2 |

| Plan Personalization | 4.5 |

| Policy Options | 3.4 |

| Savings Potential | 3.8 |

Want to shop for affordable car insurance policies today? Compare car insurance rates with our free tool.

- Allstate has a 3.8 insurance rating for its expensive rates

- Allstate insurance policies have multiple specialty add-on coverages

- The Allstate multi-policy discount can save customers 25%

Allstate Car Insurance Rates

Allstate’s rates vary based on customers’ age and gender, as the average Allstate car insurance rates below show.

Allstate Car Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $210 | $608 |

| Age: 16 Male | $215 | $638 |

| Age: 18 Female | $205 | $448 |

| Age: 18 Male | $210 | $519 |

| Age: 25 Female | $90 | $181 |

| Age: 25 Male | $100 | $190 |

| Age: 30 Female | $85 | $168 |

| Age: 30 Male | $95 | $176 |

| Age: 45 Female | $80 | $162 |

| Age: 45 Male | $90 | $160 |

| Age: 60 Female | $75 | $150 |

| Age: 60 Male | $85 | $154 |

| Age: 65 Female | $75 | $158 |

| Age: 65 Male | $85 | $157 |

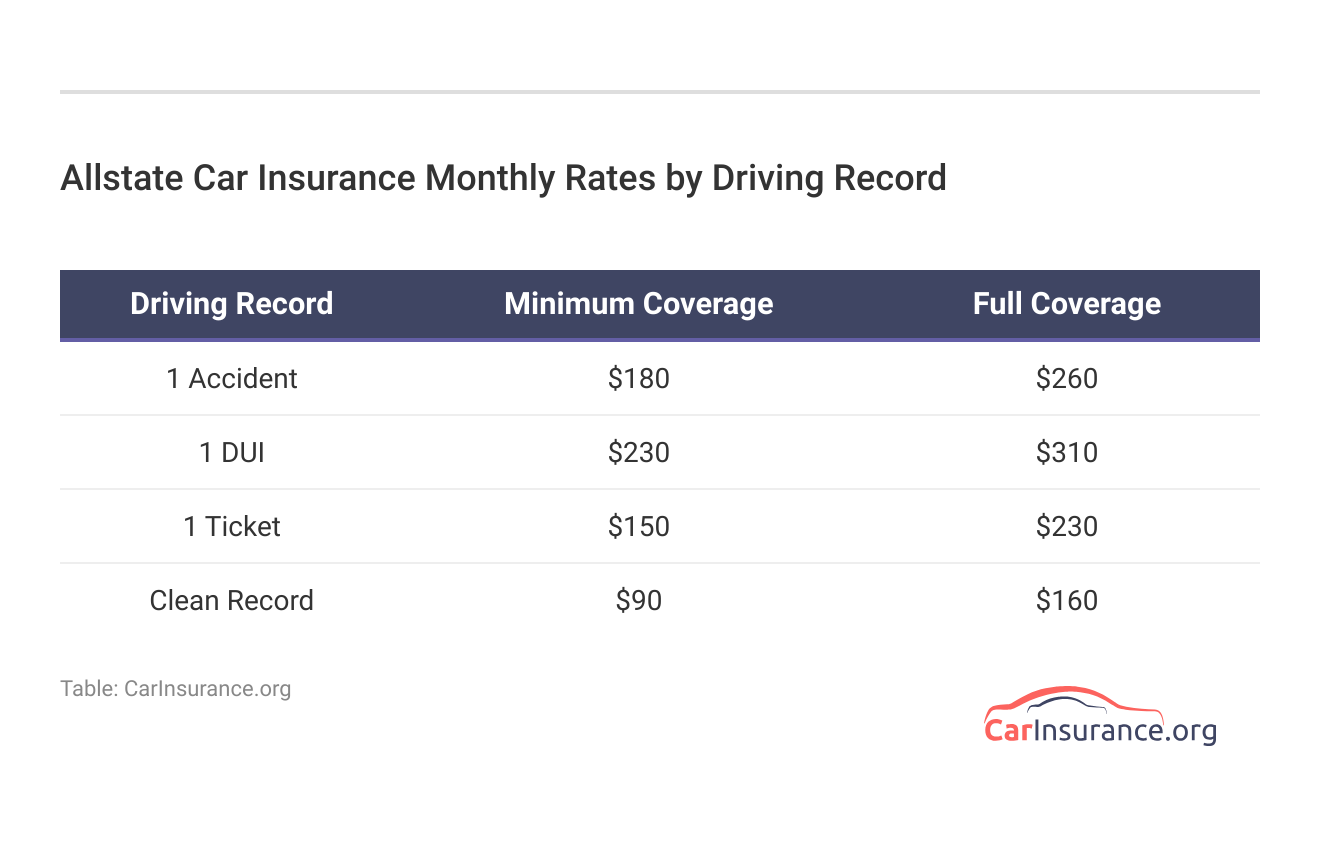

Rates at Allstate will also be best for drivers with clean driving records. High-risk drivers will pay the most at Allstate, although rates will be lower if teens and young drivers join a parent’s policy. Check out more perks of staying on a parent’s car insurance policy.

Like other companies, Allstate charges drivers with a DUI the most for car insurance. DUI drivers are often seen as the riskiest to insure and may have to purchase high-risk coverage. To find out how much you’ll pay for Allstate insurance, you can get quotes directly from its website.

You can also use a quote comparison tool, which we recommend, as it will allow you to compare multiple companies’ rates at once. Enter your ZIP code now to see how much Allstate costs near you.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate Car Insurance Rates vs. The Competition

It’s also important to consider how Allstate’s rates compare to its competition for a complete price evaluation. See how much companies charge based on age and gender below.

Allstate Car Insurance Full Coverage Monthly Rates vs. Competitors by Age & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $448 | $519 | $168 | $176 | $162 | $160 | $150 | $154 | |

| $305 | $414 | $116 | $137 | $115 | $117 | $104 | $105 | |

| $597 | $629 | $160 | $167 | $139 | $139 | $120 | $128 | |

| $220 | $254 | $90 | $87 | $80 | $80 | $73 | $74 | |

| $626 | $626 | $174 | $200 | $171 | $174 | $148 | $159 |

| $303 | $387 | $124 | $136 | $113 | $115 | $99 | $104 |

| $591 | $662 | $131 | $136 | $112 | $105 | $92 | $95 | |

| $465 | $535 | $172 | $180 | $160 | $159 | $148 | $150 |

| $229 | $284 | $94 | $103 | $86 | $86 | $76 | $76 | |

| $530 | $740 | $99 | $108 | $98 | $99 | $89 | $90 |

When compared to other national providers, The Allstate Corporation is one of the more expensive companies for all ages. Next, see how Allstate car insurance rates vary according to different driving records.

Allstate Car Insurance Full Coverage Monthly Rates vs. Competitors by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $160 | $225 | $270 | $188 | |

| $117 | $176 | $194 | $136 | |

| $139 | $198 | $193 | $173 | |

| $80 | $132 | $216 | $106 | |

| $174 | $234 | $313 | $212 |

| $115 | $161 | $237 | $137 |

| $105 | $186 | $140 | $140 | |

| $86 | $102 | $112 | $96 | |

| $99 | $139 | $206 | $134 | |

| $59 | $78 | $108 | $67 |

Allstate rates for drivers with incidents on their driving record are pricy compared to other companies, so it may not be the right fit for those looking to lower car insurance costs.

Allstate Car Insurance Coverages

While Allstate auto insurance rates are high, there are some perks to the company. Allstate has multiple specialty add-ons for customers, as shown in the list below.

Allstate Car Insurance Coverage Options

| Coverage Type | What it Covers |

|---|---|

| Collision | Protects against vehicle damage from collisions |

| Comprehensive | Safeguards against theft, fire, and non-collision damage |

| Custom Equipment | Secures aftermarket upgrades |

| Liability | Covers injuries and damage to others if you're at fault |

| Medical Payments | Supports medical expenses for you and passengers |

| Personal Injury Protection (PIP) | Includes medical expenses and lost wages |

| Rental Reimbursement | Provides a rental car during repairs |

| Roadside Assistance | Offers towing, tire changes, and jump-starts |

| Sound System | Shields high-end sound system from damage |

| Uninsured/Underinsured Motorist | Guards against underinsured or uninsured drivers |

Some less common types of car insurance coverage that Allstate offers include custom equipment and sound system coverage.

Allstate Car Insurance Discounts

One of the ways to lower insurance rates is by applying for Allstate discounts, which can save you up to 25% on your policy.

Allstate Car Insurance Discounts

| Discount Name | Savings Potential | How to Qualify |

|---|---|---|

| Anti-Theft Device | 10% | Install an approved anti-theft device |

| Early Signing | 10% | Sign up before your current policy expires |

| EZ Pay | 5% | Enroll in automatic payments |

| Good Student | 20% | Keep a B average or higher as a student |

| Multi-Car | 25% | Insure multiple vehicles on one policy |

| Multi-Policy | 25% | Bundle auto with home or renters insurance |

| New Car | 15% | Insure a car less than 2-3 years old |

| Responsible Payer | 5% | Pay premiums on time |

| Safe Driving Bonus | 10% | Keep a clean driving record |

| Smart Student | 20% | Full-time under 25 with good grades or campus housing |

Allstate also has high discounts for young drivers, such as a good student discount or a student-away discount, to help lower rates for high-risk teen drivers.

Applying as many discounts as possible will help make Allstate auto insurance policies more reasonable in price, especially if you are looking for cheap full coverage car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate Customer Reviews & Complaints

Like most companies, Allstate has mixed reviews from its customers. A great way to see what Allstate customers truly think of the company is to check out reviews on places like Reddit.

How is Allstate as an insurance company, are the nightmare stories about them true?

byu/Jcs609 inInsurance

While Allstate car insurance reviews on Reddit show some customers are happy with the company, others have issues with claims service and rate increases.

Read More: Things You Do That Can Raise Your Premiums

Business Reviews of Allstate Car Insurance

Customer reviews are just one aspect — you’ll also want to see what businesses say about Allstate. Allstate’s most important business ratings are below.

Allstate Business Ratings

| Agency | |

|---|---|

| Score: 832 / 1,000 Avg. Satisfaction |

|

| Score: A+ Strong Customer Support |

|

| Score: 74/100 Good Customer Satisfaction |

|

| Score: 1.45 More Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength |

Allstate has great ratings from most companies. However, there is a higher complaint ratio recorded at NAIC, which shows that more Allstate customers are dissatisfied with services like filing a claim after an accident or customer service than is normal for a car insurance company.

Allstate Insurance Pros and Cons

The Allstate Corporation reviews find that it may be a good choice if drivers are looking for the following features:

- Specialty Add-Ons: Allstate has more add-ons available than most car insurance companies.

- National Availability: Customers can buy Allstate auto insurance in any state.

- Discount Options: The wide variety of Allstate discounts can help most customers reduce rates.

Allstate is not right for every customer. There are perks and pitfalls of car insurance add-ons with Allstate, and customers should also be concerned about the following:

- Customer Complaints: Allstate has a higher number of customer complaints than average.

- Higher Rates: Allstate’s average rates are higher than most companies.

The main deterrent of Allstate is its higher auto insurance rates, as most customers will pay more for coverage at Allstate than at a different company.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Deciding if Allstate is the Right Car Insurance Company for You

Our Allstate car insurance review concludes that Allstate may be a good fit for those looking for specialty add-on coverages, but its high rates make it undesirable for most drivers buying car insurance.

Mixed customer service reviews of Allstate Corporation reflect variability between states, and your experience may vary depending on the local agents in your area.Justin Wright Licensed Insurance Agent

Customers who don’t need multiple add-on coverages will be better off shopping at a cheaper company than Allstate. Enter your ZIP in our free quote tool to shop for affordable car insurance companies near you.

Frequently Asked Questions

What do people think about Allstate insurance?

Customer reviews of Allstate are mixed, with a higher compliant ratio than normal. However, Allstate’s business reviews are excellent, and it has high financial ratings.

Why is Allstate car insurance so expensive?

Every company sets different rates, and Allstate sets higher rates due to several factors, such as agent costs and claim payouts.

Is Allstate insurance coverage good?

How much insurance do I need for my car? Allstate has the basic coverages that customers need to meet state requirements plus several specialty add-on coverages.

Is there a cancellation fee for Allstate car insurance?

The Allstate Corporation does not charge a cancellation fee for customers who cancel early.

Is it better to buy Allstate or State Farm car insurance?

It depends on which is a better fit for you. State Farm is cheaper than Allstate on average but has lower financial standing ratings. Compare State Farm vs. Allstate car insurance to see which is the better company for you.

Is Allstate or Geico car insurance more expensive?

Allstate auto insurance is more expensive on average than Geico. However, because car insurance rates by city and driving record vary, you should get quotes to see which is the best for you.

Is Allstate good about paying insurance claims?

Allstate is good about paying claims, as it has a high score from J.D. Power for its claims process.

How fast does Allstate pay claims?

How long your claim will take depends on the simplicity of the claim, such as how many parties are involved or the severity of the damage. Generally, however, Allstate should be in touch within a day or two of you filing a claim.

Does Allstate deny car insurance claims?

Allstate will deny claims if customers don’t have the right coverage or try to commit claim fraud. Make sure to pick the right coverages for your car when buying car insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Allstate raise car insurance rates after a comprehensive claim?

Like other companies, Alltate may raise rates after a comprehensive claim. However, rates will be raised only slightly compared to rates after an at-fault accident claim. Use our free quote comparison tool to compare rates if you’ve recently filed a claim.

Customer reviews of Allstate are mixed, with a higher compliant ratio than normal. However, Allstate’s business reviews are excellent, and it has high financial ratings.

Every company sets different rates, and Allstate sets higher rates due to several factors, such as agent costs and claim payouts.

Is Allstate insurance coverage good?

How much insurance do I need for my car? Allstate has the basic coverages that customers need to meet state requirements plus several specialty add-on coverages.

Is there a cancellation fee for Allstate car insurance?

The Allstate Corporation does not charge a cancellation fee for customers who cancel early.

Is it better to buy Allstate or State Farm car insurance?

It depends on which is a better fit for you. State Farm is cheaper than Allstate on average but has lower financial standing ratings. Compare State Farm vs. Allstate car insurance to see which is the better company for you.

Is Allstate or Geico car insurance more expensive?

Allstate auto insurance is more expensive on average than Geico. However, because car insurance rates by city and driving record vary, you should get quotes to see which is the best for you.

Is Allstate good about paying insurance claims?

Allstate is good about paying claims, as it has a high score from J.D. Power for its claims process.

How fast does Allstate pay claims?

How long your claim will take depends on the simplicity of the claim, such as how many parties are involved or the severity of the damage. Generally, however, Allstate should be in touch within a day or two of you filing a claim.

Does Allstate deny car insurance claims?

Allstate will deny claims if customers don’t have the right coverage or try to commit claim fraud. Make sure to pick the right coverages for your car when buying car insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Allstate raise car insurance rates after a comprehensive claim?

Like other companies, Alltate may raise rates after a comprehensive claim. However, rates will be raised only slightly compared to rates after an at-fault accident claim. Use our free quote comparison tool to compare rates if you’ve recently filed a claim.

How much insurance do I need for my car? Allstate has the basic coverages that customers need to meet state requirements plus several specialty add-on coverages.

The Allstate Corporation does not charge a cancellation fee for customers who cancel early.

Is it better to buy Allstate or State Farm car insurance?

It depends on which is a better fit for you. State Farm is cheaper than Allstate on average but has lower financial standing ratings. Compare State Farm vs. Allstate car insurance to see which is the better company for you.

Is Allstate or Geico car insurance more expensive?

Allstate auto insurance is more expensive on average than Geico. However, because car insurance rates by city and driving record vary, you should get quotes to see which is the best for you.

Is Allstate good about paying insurance claims?

Allstate is good about paying claims, as it has a high score from J.D. Power for its claims process.

How fast does Allstate pay claims?

How long your claim will take depends on the simplicity of the claim, such as how many parties are involved or the severity of the damage. Generally, however, Allstate should be in touch within a day or two of you filing a claim.

Does Allstate deny car insurance claims?

Allstate will deny claims if customers don’t have the right coverage or try to commit claim fraud. Make sure to pick the right coverages for your car when buying car insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Allstate raise car insurance rates after a comprehensive claim?

Like other companies, Alltate may raise rates after a comprehensive claim. However, rates will be raised only slightly compared to rates after an at-fault accident claim. Use our free quote comparison tool to compare rates if you’ve recently filed a claim.

It depends on which is a better fit for you. State Farm is cheaper than Allstate on average but has lower financial standing ratings. Compare State Farm vs. Allstate car insurance to see which is the better company for you.

Allstate auto insurance is more expensive on average than Geico. However, because car insurance rates by city and driving record vary, you should get quotes to see which is the best for you.

Is Allstate good about paying insurance claims?

Allstate is good about paying claims, as it has a high score from J.D. Power for its claims process.

How fast does Allstate pay claims?

How long your claim will take depends on the simplicity of the claim, such as how many parties are involved or the severity of the damage. Generally, however, Allstate should be in touch within a day or two of you filing a claim.

Does Allstate deny car insurance claims?

Allstate will deny claims if customers don’t have the right coverage or try to commit claim fraud. Make sure to pick the right coverages for your car when buying car insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Allstate raise car insurance rates after a comprehensive claim?

Like other companies, Alltate may raise rates after a comprehensive claim. However, rates will be raised only slightly compared to rates after an at-fault accident claim. Use our free quote comparison tool to compare rates if you’ve recently filed a claim.

Allstate is good about paying claims, as it has a high score from J.D. Power for its claims process.

How long your claim will take depends on the simplicity of the claim, such as how many parties are involved or the severity of the damage. Generally, however, Allstate should be in touch within a day or two of you filing a claim.

Does Allstate deny car insurance claims?

Allstate will deny claims if customers don’t have the right coverage or try to commit claim fraud. Make sure to pick the right coverages for your car when buying car insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Allstate raise car insurance rates after a comprehensive claim?

Like other companies, Alltate may raise rates after a comprehensive claim. However, rates will be raised only slightly compared to rates after an at-fault accident claim. Use our free quote comparison tool to compare rates if you’ve recently filed a claim.

Allstate will deny claims if customers don’t have the right coverage or try to commit claim fraud. Make sure to pick the right coverages for your car when buying car insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Like other companies, Alltate may raise rates after a comprehensive claim. However, rates will be raised only slightly compared to rates after an at-fault accident claim. Use our free quote comparison tool to compare rates if you’ve recently filed a claim.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.