American Family Car Insurance Review for 2026 [See if They’re a Good Fit!]

In this American Family car insurance review, we compare affordable rates for budget-conscious drivers. AmFam car insurance rates start at just $43 monthly, and the KnowYourDrive usage-based insurance program rewards safe driving with discounts for added savings of up to 20%.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Expert Insurance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated March 2025

This American Family car insurance review highlights AmFam’s standout feature, the KnowYourDrive program, which rewards safe driving habits with discounts.

American Family (or AmFam, Inc.) is an excellent value for drivers seeking flexible coverage. With solid financial ratings and customer service reviews, AmFam also provides superior claims service compared to the competition.

American Family Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.1 |

| Business Reviews | 4.0 |

| Claim Processing | 4.8 |

| Company Reputation | 4.5 |

| Coverage Availability | 3.9 |

| Coverage Value | 4.0 |

| Customer Satisfaction | 4.0 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.7 |

| Plan Personalization | 4.5 |

| Policy Options | 3.4 |

| Savings Potential | 4.1 |

This review covers AmFam’s unique offerings and explores how its innovative usage-based insurance program can save you money. To learn more about coverage’s ins and outs, check out how car insurance works.

You can get instant car insurance quotes from top providers by entering your ZIP code above.

- American Family holds a 4.1 insurance rating for reliability

- Flexible policies and strong financial ratings boost its score

- KnowYourDrive rewards safe drivers with 20% discounts

Affordable American Family Insurance Rates for Experienced Drivers

American Family car insurance rates vary significantly based on age. This table highlights how premiums fluctuate across older and younger drivers for minimum and full coverage plans. AmFam is the cheapest for older drivers with a few decades of experience behind the wheel.

American Family Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $161 | $414 |

| Age: 16 Male | $207 | $509 |

| Age: 18 Female | $131 | $305 |

| Age: 18 Male | $178 | $414 |

| Age: 25 Female | $46 | $124 |

| Age: 25 Male | $55 | $147 |

| Age: 30 Female | $43 | $116 |

| Age: 30 Male | $51 | $137 |

| Age: 45 Female | $43 | $115 |

| Age: 45 Male | $44 | $117 |

| Age: 60 Female | $40 | $104 |

| Age: 60 Male | $40 | $105 |

| Age: 65 Female | $43 | $113 |

| Age: 65 Male | $43 | $114 |

Premiums are higher for younger drivers, especially males, due to perceived risk. Rates decrease as drivers age, with 30-year-old women paying as little as $43/month for minimum coverage.

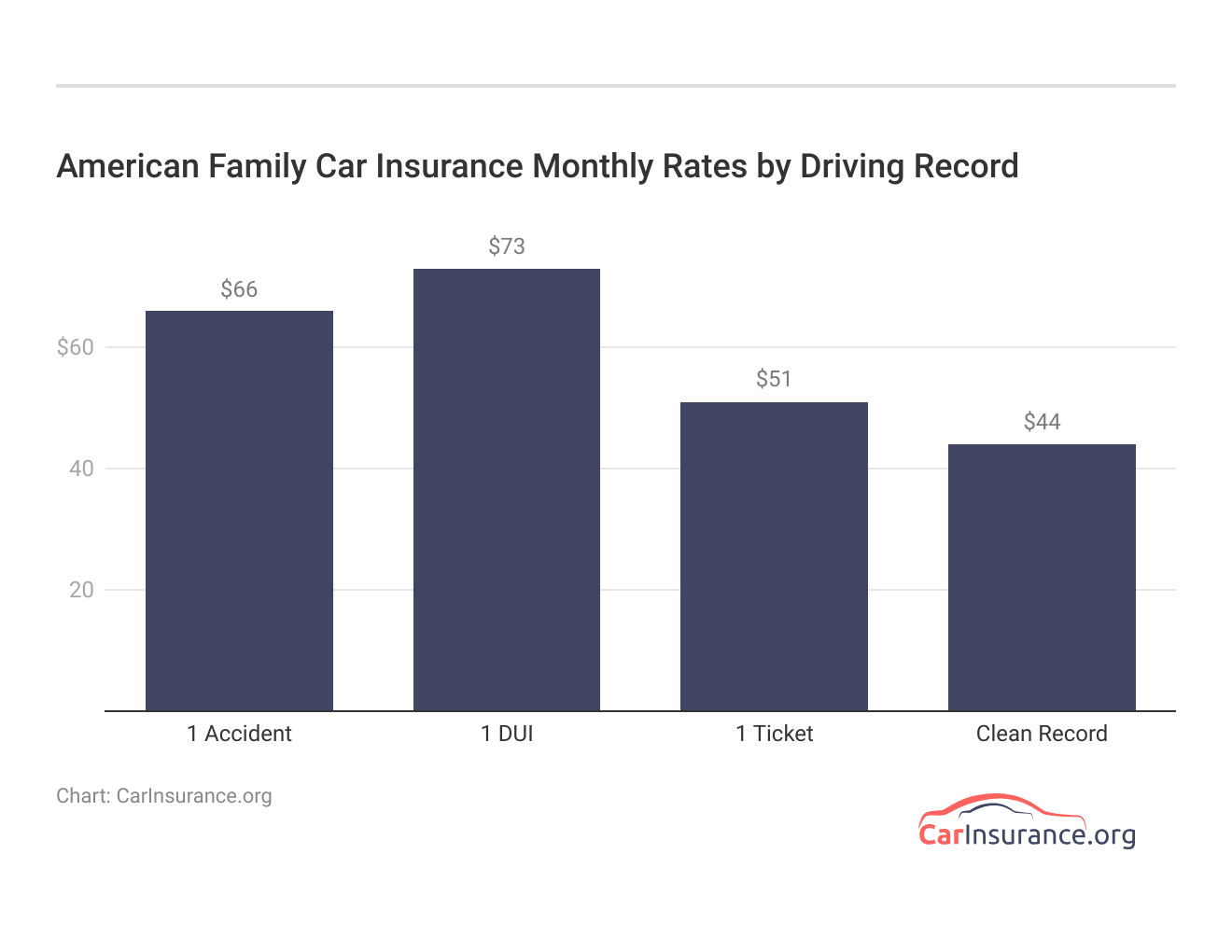

Driving record is another factor that affects the price of car insurance. The table below highlights how accidents, DUIs, and tickets impact AmFam car insurance rates.

Although your rates do increase with each infraction, American Family doesn’t raise rates very much after a speeding ticket ($7/month on average) or an accident, which only increases monthly rates by $22. DUIs have the biggest impact, and if you have too many, AmFam may drop your coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American Family Car Insurance Monthly Rates vs. Top Competitors

This table compares monthly rates for American Family Insurance and its competitors across minimum and full coverage costs:

American Family Car Insurance Monthly Rates vs. Top Competitors by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $160 | |

| $44 | $117 | |

| $33 | $87 | |

| $53 | $139 | |

| $30 | $80 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $33 | $86 | |

| $37 | $99 |

American Family costs more than popular companies like Geico and Progressive, but it’s still cheaper than Farmers, Liberty Mutual, and Allstate. It’s worth comparing AmFam to the best car insurance companies to see which has better coverage and rates in your state.

Customer Ratings & Reviews of American Family Insurance

Scroll through this table to explore American Family customer service, insurance ratings, and complaint ratio. Overall, the company has excellent financial stability and customer satisfaction.

American Family Car Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 831 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 78/100 Positive Customer Feedback |

|

| Score: 0.77 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

AmFam received an impressive 831 out of 1,000 from J.D. Power and 78/100 from Consumer Reports, indicating above-average customer satisfaction. An A+ rating from the Better Business Bureau (BBB) highlights the company’s excellent business practices and reliability, and the National Association of Insurance Commissioners (NAIC) shows it gets fewer complaints than average.

Read more: Is it bad to just carry minimum coverage car insurance?

American Family Car Insurance Discounts

American Family Insurance Group offers an impressive array of discounts, from rewards for safe driving to incentives for bundling policies. The KnowYourDrive program, for instance, can save drivers up to 30%

American Family Car Insurance Discounts by Savings Potential

| Discount | |

|---|---|

| KnowYourDrive | 30% |

| Anti-Theft | 25% |

| Bundling | 25% |

| Good Driver | 25% |

| AutoPay Discount | 20% |

| Good Student | 20% |

| Low Mileage | 20% |

| Multi-Vehicle | 20% |

| Away at School | 18% |

| Early Bird | 15% |

Anti-theft devices can net you a 25% discount, making security measures a wise investment, and American Family offers up to an additional 25% off for those who bundle their policies.

Let’s see your money-saving moves when you bundle your home and auto policies under our roof. https://t.co/mCsqNLzgey pic.twitter.com/juDkjXSHz8

— American Family Insurance (@amfam) September 13, 2023

Other discounts, such as those for good drivers, students, and multi-vehicle households, provide further opportunities to lower premiums. See more details on how to lower your car insurance cost.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

American Family Car Insurance: Pros and Cons

AmFam car insurance stands out for its diverse policy offerings and commitment to customer satisfaction. Below are some key advantages that set it apart from its competitors.

- Multiple Discounts: American Family offers discounts for policyholders with different needs and rewards loyal customers with renewal and generational discounts.

- Usage-Based Insurance: KnowYourDrive car insurance with telematics rewards safe driving with valuable discounts.

- Intense Customer Satisfaction: The company consistently receives high customer support and satisfaction ratings.

With an emphasis on customization and a customer-focused approach, American Family is an excellent choice for drivers seeking flexibility and savings through discounts.

American Family’s KnowYourDrive program can save drivers up to 30% on their premiums.Dani Best Licensed Insurance Producer

While American Family excels in several areas, a few drawbacks are worth considering compared to other top competitors:

- Limited Online Tools: The company lacks the extensive online resources and tools many leading insurers offer, which may frustrate tech-savvy users.

- Agent-Dependent Updates: Many policy changes require contacting an agent, which can be inconvenient for those who prefer self-service options.

- Regional Availability: AmFam auto insurance is only available in 26 states. Discounts and coverage option availability will also vary in these states.

Even with great customer service reviews, the lack of online tools and reliance on agents for updates may limit some customers wanting a more streamlined, mobile-friendly experience.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Insights From the American Family Car Insurance Review

Our American Family car insurance review shows it offers a solid blend of flexible coverage options, competitive discounts, and high customer satisfaction. With convenient usage-based policies like KnowYourDrive, American Family remains an affordable company.

Its reliance on agents for policy updates and fewer online tools may be limiting for some, but the overall value it provides through savings and service is undeniable.

However, AmFam auto insurance is limited to 26 states, and rates are often higher than many other companies. Compare American Family vs. State Farm car insurance to learn more.

American Family can still be a cheap provider for high-risk drivers with minor accidents or speeding tickets. Enter your ZIP code below to find the best car insurance quotes near you.

Frequently Asked Questions

What is the A.M. Best rating for American Family Insurance?

American Family Insurance has an A rating from A.M. Best, indicating excellent financial strength.

Who owns American Family Insurance Group?

American Family Insurance Group is a privately held mutual company owned by its policyholders.

How old is American Family Insurance?

American Family Insurance was founded in 1927, nearly a century old.

Does American Family charge a cancellation fee?

American Family Insurance typically does not charge a cancellation fee, but it’s best to check your specific policy terms. For details on ending your coverage, read how to cancel gap insurance.

How is American Family insurance customer satisfaction?

American Family Insurance consistently receives high customer satisfaction ratings, including an 831/1,000 score from J.D. Power.

What is the American Family car insurance claim settlement ratio?

American Family Insurance has a solid claim settlement process, supported by its A.M. Best A rating for financial stability. Read how to file a car insurance claim after an accident.

What is the American Family car insurance grace period?

American Family Insurance typically offers a 10-day grace period for late premium payments, but check your policy for specific details.

Why is American Family insurance so expensive?

Insurance prices are increasing nationwide due to higher property costs and repair expenses. However, AmFam remains a competitive option for safe drivers who qualify for usage-based discounts. If you need more affordable auto insurance, enter your ZIP code below into our free comparison tool to find the lowest prices in your area.

What is the late fee for American Family car insurance?

The late fee for American Family Insurance can vary depending on your policy, so reviewing your contract for exact charges is important. Check out things you do that can raise your premiums to learn more about factors affecting your rates.

What is the consumer rating for American Family car insurance?

AmFam has a consumer rating of 78/100 from Consumer Reports, reflecting generally positive feedback.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.