Erie Car Insurance Review for 2026 [Report of Rates and Discounts]

Reading our Erie car insurance review will reveal that Erie is an excellent, affordable choice for most drivers. Erie has high customer and business ratings and minimum rates starting at $22/mo. The downside to the company is that Erie Insurance is not sold in most states and may reject high-risk customers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Feature Writer

Rachel Bodine graduated from college with a BA in English. She has since worked as a Feature Writer in the insurance industry and gained a deep knowledge of state and countrywide insurance laws and rates. Her research and writing focus on helping readers understand their insurance coverage and how to find savings. Her expert advice on insurance has been featured on sites like PhotoEnforced, All...

Rachel Bodine

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated March 2025

Our Erie car insurance review reveals why the company is a popular option among customers due to its customer service and flexible coverage options.

Our rating of Erie Insurance considered several factors, from business reviews to insurance costs. We found that Erie is one of the best car insurance companies for most drivers, but it may not be in every driver’s state.

Erie Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 4.4 |

| Business Reviews | 4.5 |

| Claim Processing | 4.3 |

| Company Reputation | 4.5 |

| Coverage Availability | 3.5 |

| Coverage Value | 4.6 |

| Customer Satisfaction | 4.3 |

| Digital Experience | 4.0 |

| Discounts Available | 4.7 |

| Insurance Cost | 4.6 |

| Plan Personalization | 4.5 |

| Policy Options | 5.5 |

| Savings Potential | 4.6 |

Read on for a full review of Erie car insurance and see if it is the right fit for you. To shop for affordable car insurance today, use our free quote tool to compare rates.

- Erie has lower car insurance rates for most drivers

- Erie is only available to purchase in select states

- Erie has great ratings from businesses and customers

Cost of Erie Car Insurance

Erie is an affordable car insurance company for most drivers, although rates will be higher for younger drivers. Still, even young driver rates are cheaper at Erie, especially if teens join a parent’s policy (Read More: The Perks of Staying on Your Parents’ Policy).

Erie Car Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $85 | $218 |

| Age: 16 Male | $95 | $233 |

| Age: 18 Female | $69 | $161 |

| Age: 18 Male | $81 | $189 |

| Age: 25 Female | $26 | $68 |

| Age: 25 Male | $27 | $71 |

| Age: 30 Female | $24 | $63 |

| Age: 30 Male | $25 | $66 |

| Age: 45 Female | $22 | $59 |

| Age: 45 Male | $22 | $58 |

| Age: 60 Female | $21 | $53 |

| Age: 60 Male | $21 | $55 |

| Age: 65 Female | $22 | $57 |

| Age: 65 Male | $22 | $57 |

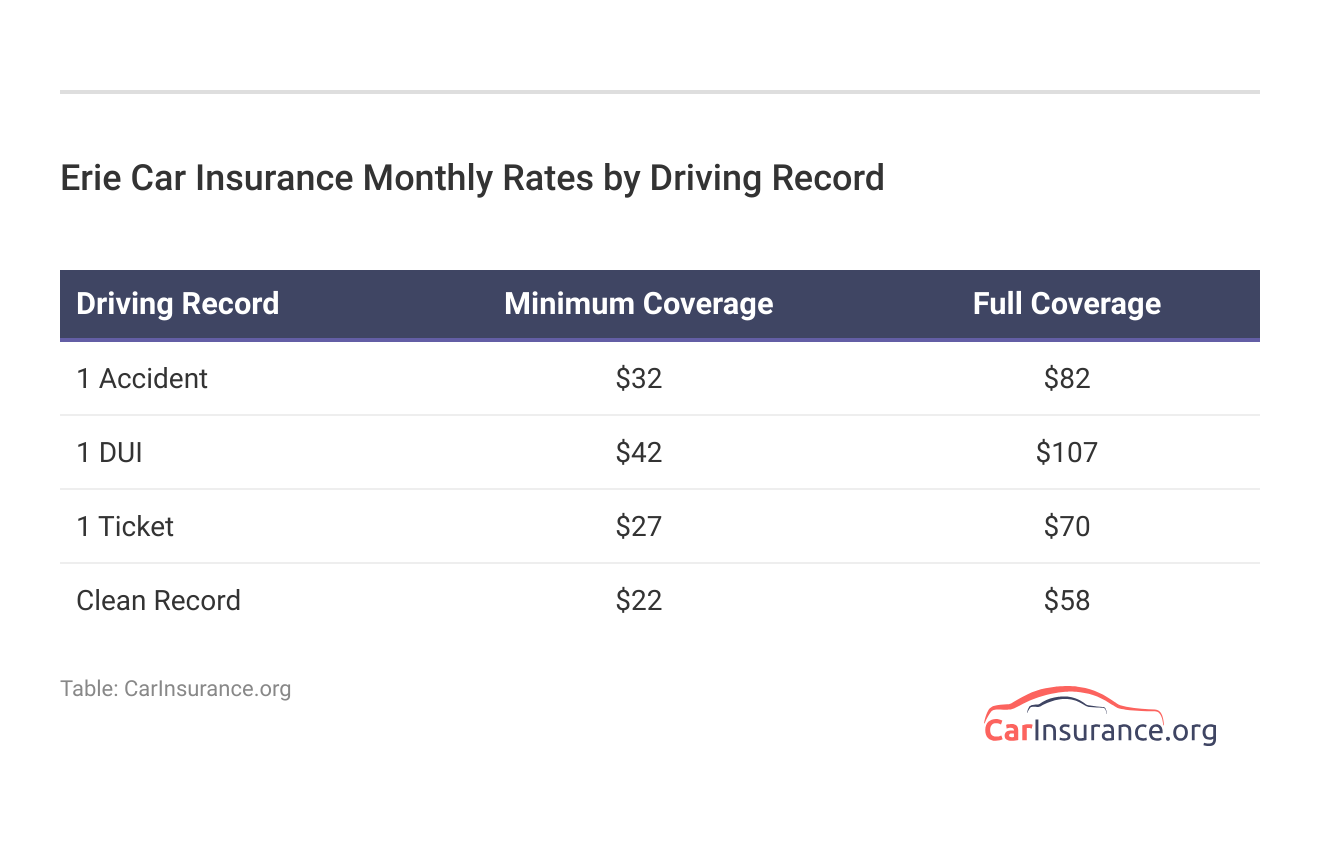

Erie rates are also affordable for drivers with poor driving records, as you can see in the rates below.

Next, see how Erie’s rates stack up against other major car insurance companies.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Erie Car Insurance Rates vs. the Competition

Erie is still an affordable company compared to other companies, even when looking at the different factors that affect the price of car insurance. First, see how Erie’s rates compare based on age and gender.

Erie vs. Competitors: Full Coverage Car Insurance Monthly Rates by Age & Gender

| Insurance Company | Age: 18 Female | Age: 18 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $448 | $519 | $168 | $176 | $162 | $160 | $150 | $154 | |

| $305 | $414 | $116 | $137 | $115 | $117 | $104 | $105 | |

| $597 | $629 | $160 | $167 | $139 | $139 | $120 | $128 | |

| $161 | $189 | $63 | $66 | $59 | $58 | $53 | $55 |

| $626 | $626 | $174 | $200 | $171 | $174 | $148 | $159 |

| $303 | $387 | $124 | $136 | $113 | $115 | $99 | $104 |

| $591 | $662 | $131 | $136 | $112 | $105 | $92 | $95 | |

| $465 | $535 | $172 | $180 | $160 | $159 | $148 | $150 |

| $229 | $284 | $94 | $103 | $86 | $86 | $76 | $76 | |

| $530 | $740 | $99 | $108 | $98 | $99 | $89 | $90 |

Erie is the best company for young drivers shopping for car insurance, as well as every age of drivers. Erie is also one of the cheapest companies for bad drivers.

Erie vs. Competitors: Full Coverage Car Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $160 | $225 | $270 | $188 | |

| $117 | $176 | $194 | $136 | |

| $58 | $82 | $107 | $70 |

| $139 | $198 | $193 | $173 | |

| $174 | $234 | $313 | $212 |

| $115 | $161 | $237 | $137 |

| $105 | $186 | $140 | $140 | |

| $86 | $102 | $112 | $96 | |

| $99 | $139 | $206 | $134 | |

| $59 | $78 | $108 | $67 |

If you have a DUI or at-fault accident on your record, you may want to shop for an Erie car insurance quote because of its affordability.

While you can get quotes directly from Erie’s website, you may also want to get quotes using a quote comparison tool to see how rates compare at multiple companies.

Erie Car Insurance Coverage Options

Now that you know how much Erie auto insurance rates are on average, take a look at the types of car insurance coverage you can buy from Erie.

Erie Car Insurance Coverage Options

| Coverage | Description |

|---|---|

| Collision Coverage | Covers vehicle damage from a collision |

| Comprehensive Coverage | Covers non-collision damage like theft or weather |

| Gap Insurance | Covers the difference between loan and car value |

| Liability Coverage | Covers injury/damage to others if at fault |

| Medical Payments Coverage | Covers medical expenses for you and passengers |

| New Car Replacement Coverage | Replaces your car if totaled in the first year |

| Personal Injury Protection (PIP) | Covers medical and wage loss, regardless of fault |

| Rental Reimbursement Coverage | Pays for rental during car repairs |

| Roadside Assistance Coverage | Covers towing and breakdown services |

| Uninsured/Underinsured Motorist Coverage | Protects you if the other driver is under/uninsured |

Erie has several add-on coverages that can be added to a policy, such as rental car reimbursement or new car replacement coverage.

Erie Car Insurance Discounts

In addition to affordable rates that make it easy to get cheap full coverage car insurance at Erie, the company also offers customers several Erie discounts on car insurance policies.

Erie Car Insurance Discounts by Savings Potential

| Discount Name | Savings Potential | How to Qualify |

|---|---|---|

| First Accident Forgiveness | 15% | No rate hike after your first at-fault accident |

| Multi-Car | 20% | Insure multiple vehicles under one policy |

| Multi-Policy | 25% | Bundle auto with home or renters insurance |

| Pay-in-Full | 7% | Pay your premium in full upfront |

| Reduced Usage | 10% | Save for driving fewer miles annually |

| Safe Driver | 20% | Maintain a clean driving record |

| Vehicle Safety Equipment | 5% | Save for safety features like airbags |

| Young Driver | 20% | Young drivers under 21 completing driver’s ed may save |

Some discounts are very easy to get from Erie, such as its safety features discount that rewards you for having a safe vehicle.

Erie also has a young driver discount that can save drivers 20% on their policy if they complete an approved defensive driver course.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Erie Customer Reviews

Most Erie Insurance reviews from customers on places like Reddit are positive, as customers like the customer service and low prices.

FYI: If your auto insurance is increasing with Geico, Progressive, etc. Give Erie a call.

byu/Itslolo52484 innova

Negative Reddit Erie customer reviews mention slow processing after filing a car insurance claim. The majority of customers rate Erie well; however, most customers seem happy with Erie as a company choice.

Erie Business Reviews

Before buying car insurance from any company, you should check its ratings. Businesses have positive ratings for Erie in terms of customer satisfaction, financial stability, and business practices.

Erie Business Ratings

| Agency |  |

|---|---|

| Score: 880 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 82/100 Positive Customer Feedback |

|

| Score: 0.60 Fewer Complaints |

|

| Score: A+ Superior Financial Strength |

Erie has a lower complaint ratio than average from customers, according to the NAIC, and it also has an A+ rating from the BBB. A.M. Best also gave Erie an A+ rating for financial stability, so the company has excellent ratings overall.

Erie Pros and Cons

Not sure if Erie is the right choice for your car insurance needs? For a recap of Erie’s pros, take a look below.

- Affordable Rates: Erie has very affordable auto insurance rates for most drivers.

- Multiple Coverages: Erie offers customers several add-on car insurance options (Read More: The Perks and Pitfalls of Car Insurance Add-Ons).

- High Ratings: Erie has positive ratings from businesses for financial ability, business practices, and more.

Of course, like all insurance companies, Erie isn’t perfect. Some of the issues of Erie insurance are:

- Availability: Erie is only available in a few states, so customers who move may have to switch providers.

- Limited App Functions: Erie makes customers contact agents to file claims rather than filing claims online.

High-risk customers with multiple accidents or DUIs may also be denied coverage at Erie if they need high-risk auto insurance coverage, so Erie may not be right for all drivers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Erie Car Insurance Recap: Deciding if it’s Right for You

Our Erie car insurance review found that Erie is a top choice, with affordable rates for the majority of drivers. The downside of Erie is that it is not widely available, so it won’t be available to purchase in most states.

Learn More: How to Lower Your Car Insurance Cost

If you want affordable car insurance coverage in your state, use our free quote tool to compare multiple companies’ rates.

Frequently Asked Questions

Is Erie car insurance reliable?

Yes, Erie Insurance is reliable, with high ratings from reputable businesses.

Does Erie Insurance pay claims well?

Yes, Erie has a good rating for claims satisfaction from J.D. Power.

Why is Erie Insurance so cheap?

Part of the reason Erie is cheaper for car insurance is that it doesn’t insure as many high-risk drivers. High-risk drivers who have trouble getting insurance may wish to check out The General for coverage (Learn More: The General Car Insurance Review).

Is Erie the same as Progressive?

No, Erie is not the same company as Progressive.

Is Erie car insurance cheaper than State Farm?

It depends on the driver’s location and driving record, as Erie and State Farm are similar in price. However, on average, State Farm is slightly more expensive. Enter your ZIP in our free quote tool to shop for cheap car insurance deals today.

Does Erie Insurance cover hitting a deer?

Erie Insurance will cover hitting a deer if you have comprehensive coverage on your vehicle. Read our article on what car insurance covers to learn more about the ins and outs of car insurance coverage.

Does Erie Insurance cover a blown engine?

Erie auto insurance will cover a blown engine if you have mechanical breakdown insurance coverage.

Does Erie Insurance have first accident forgiveness?

Yes, Erie offers first accident forgiveness in some states to customers who have been accident-free with the company for three years.

What is Erie’s rate lock?

Erie’s rate lock means that Erie locks rates for drivers and won’t raise them unless there is a change to the driver’s policy or driving record, such as an accident or adding a driver (Learn More: Things You Do That Can Raise Your Premiums).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Erie Insurance raise rates after a claim?

If you are at fault, Erie will raise car insurance rates after an Erie claim.

Yes, Erie Insurance is reliable, with high ratings from reputable businesses.

Yes, Erie has a good rating for claims satisfaction from J.D. Power.

Why is Erie Insurance so cheap?

Part of the reason Erie is cheaper for car insurance is that it doesn’t insure as many high-risk drivers. High-risk drivers who have trouble getting insurance may wish to check out The General for coverage (Learn More: The General Car Insurance Review).

Is Erie the same as Progressive?

No, Erie is not the same company as Progressive.

Is Erie car insurance cheaper than State Farm?

It depends on the driver’s location and driving record, as Erie and State Farm are similar in price. However, on average, State Farm is slightly more expensive. Enter your ZIP in our free quote tool to shop for cheap car insurance deals today.

Does Erie Insurance cover hitting a deer?

Erie Insurance will cover hitting a deer if you have comprehensive coverage on your vehicle. Read our article on what car insurance covers to learn more about the ins and outs of car insurance coverage.

Does Erie Insurance cover a blown engine?

Erie auto insurance will cover a blown engine if you have mechanical breakdown insurance coverage.

Does Erie Insurance have first accident forgiveness?

Yes, Erie offers first accident forgiveness in some states to customers who have been accident-free with the company for three years.

What is Erie’s rate lock?

Erie’s rate lock means that Erie locks rates for drivers and won’t raise them unless there is a change to the driver’s policy or driving record, such as an accident or adding a driver (Learn More: Things You Do That Can Raise Your Premiums).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Erie Insurance raise rates after a claim?

If you are at fault, Erie will raise car insurance rates after an Erie claim.

Part of the reason Erie is cheaper for car insurance is that it doesn’t insure as many high-risk drivers. High-risk drivers who have trouble getting insurance may wish to check out The General for coverage (Learn More: The General Car Insurance Review).

No, Erie is not the same company as Progressive.

Is Erie car insurance cheaper than State Farm?

It depends on the driver’s location and driving record, as Erie and State Farm are similar in price. However, on average, State Farm is slightly more expensive. Enter your ZIP in our free quote tool to shop for cheap car insurance deals today.

Does Erie Insurance cover hitting a deer?

Erie Insurance will cover hitting a deer if you have comprehensive coverage on your vehicle. Read our article on what car insurance covers to learn more about the ins and outs of car insurance coverage.

Does Erie Insurance cover a blown engine?

Erie auto insurance will cover a blown engine if you have mechanical breakdown insurance coverage.

Does Erie Insurance have first accident forgiveness?

Yes, Erie offers first accident forgiveness in some states to customers who have been accident-free with the company for three years.

What is Erie’s rate lock?

Erie’s rate lock means that Erie locks rates for drivers and won’t raise them unless there is a change to the driver’s policy or driving record, such as an accident or adding a driver (Learn More: Things You Do That Can Raise Your Premiums).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Erie Insurance raise rates after a claim?

If you are at fault, Erie will raise car insurance rates after an Erie claim.

It depends on the driver’s location and driving record, as Erie and State Farm are similar in price. However, on average, State Farm is slightly more expensive. Enter your ZIP in our free quote tool to shop for cheap car insurance deals today.

Erie Insurance will cover hitting a deer if you have comprehensive coverage on your vehicle. Read our article on what car insurance covers to learn more about the ins and outs of car insurance coverage.

Does Erie Insurance cover a blown engine?

Erie auto insurance will cover a blown engine if you have mechanical breakdown insurance coverage.

Does Erie Insurance have first accident forgiveness?

Yes, Erie offers first accident forgiveness in some states to customers who have been accident-free with the company for three years.

What is Erie’s rate lock?

Erie’s rate lock means that Erie locks rates for drivers and won’t raise them unless there is a change to the driver’s policy or driving record, such as an accident or adding a driver (Learn More: Things You Do That Can Raise Your Premiums).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Erie Insurance raise rates after a claim?

If you are at fault, Erie will raise car insurance rates after an Erie claim.

Erie auto insurance will cover a blown engine if you have mechanical breakdown insurance coverage.

Yes, Erie offers first accident forgiveness in some states to customers who have been accident-free with the company for three years.

What is Erie’s rate lock?

Erie’s rate lock means that Erie locks rates for drivers and won’t raise them unless there is a change to the driver’s policy or driving record, such as an accident or adding a driver (Learn More: Things You Do That Can Raise Your Premiums).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Does Erie Insurance raise rates after a claim?

If you are at fault, Erie will raise car insurance rates after an Erie claim.

Erie’s rate lock means that Erie locks rates for drivers and won’t raise them unless there is a change to the driver’s policy or driving record, such as an accident or adding a driver (Learn More: Things You Do That Can Raise Your Premiums).

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

If you are at fault, Erie will raise car insurance rates after an Erie claim.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.