Farmers Car Insurance Review for 2026 [What You Need to Know]

Farmers car insurance provides extensive coverage options starting at $47/month. Our Farmers car insurance review highlights their Signal program, which rewards safe drivers with discounts up to 15%, making it a top choice for those looking to save on premiums without sacrificing coverage quality.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from Seve...

D. Gilson, PhD

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Heidi Mertlich

Updated March 2025

This Farmers car insurance review highlights two standout benefits: competitive rates for older drivers and discounts for safe driving through the Signal program, offering up to 15% off.

Farmers also offers unique options, such as towing services, rental reimbursement, and different types of car insurance coverage, which add to their value. However, younger drivers might encounter steeper prices, and complaints on sites like the BBB indicate some dissatisfaction with customer service despite a relatively low issue rate.

Farmers Car Insurance Rating

Rating Criteria

Overall Score 4.3

Business Reviews 4.0

Claim Processing 3.3

Company Reputation 4.5

Coverage Availability 5.0

Coverage Value 4.1

Customer Satisfaction 4.0

Digital Experience 4.5

Discounts Available 5.0

Insurance Cost 4.2

Plan Personalization 4.5

Policy Options 5.0

Savings Potential 4.5

Farmers is an excellent option for responsible, experienced motorists seeking flexible policies and discounts. Compare insurance quotes to ensure you get the best coverage for your needs.

By entering your ZIP code above, you can get instant car insurance quotes from top providers.

- Farmers car insurance’s Signal app can reduce premiums by up to 15%

- Bundling auto and home with Farmers unlocks major discounts

- Farmers offers add-ons like roadside assistance and rental reimbursement

Farmers Car Insurance Coverage

Farmers Car Insurance Monthly Rates by Coverage Level, Age, & Gender

Age & Gender Minimum Coverage Full Coverage

Age: 16 Female $316 810.38

Age: 16 Male $317 $773

Age: 18 Female $258 597.48

Age: 18 Male $271 628.61

Age: 25 Female $66 $172

Age: 25 Male $68 179.75

Age: 30 Female $61 $160

Age: 30 Male $64 $167

Age: 45 Female $53 $139

Age: 45 Male $53 $139

Age: 60 Female $47 $120

Age: 60 Male $50 $128

Age: 65 Female $52 $136

Age: 65 Male $53 $136

The company offers a wide range of coverage options, allowing customers to build a custom policy to satisfy their needs. Standard products on Farmers’ coverage menu include:

- Liability Protection: Almost every state and the District of Columbia require this coverage. It covers property damage and medical expenses others incur when you are at fault in a car accident.

- Collision Coverage: If you are at fault in an accident or hit an animal or object, this coverage pays for damages to your vehicle.

- Comprehensive Insurance: Comprehensive coverage pays for damages to your vehicle that aren’t caused by an accident. Examples include hail damage, theft, and vandalism.

- Uninsured/Underinsured Motorist: Though most states require liability insurance, sometimes people don’t comply. This type of coverage pays for vehicle and bodily injury damages for you and your passengers if an uninsured motorist causes your accident. It also pays for damages when the at-fault driver does not have sufficient coverage.

- Medical and Personal Injury Protection: These coverages pay for your medical expenses and lost wages, no matter who is at fault in a car accident. No-fault car insurance states require their residents to carry this kind of coverage.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Farmers Car Insurance Rates Explained

How much you pay for car insurance depends on several factors, so it helps to understand your insurance policy before you commit. Where you live influences your rates. Variations exist across and within states, and urban areas tend to have higher rates than rural areas. Your age, marital status, and credit score can all impact your rate with Farmers Insurance.

Farmers Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 45 Female | Age: 45 Male |

|---|---|---|

| $162 | $160 | |

| $115 | $117 | |

| $139 | $139 | |

| $80 | $80 | |

| $171 | $174 |

| $113 | $115 |

| $112 | $105 | |

| $86 | $86 | |

| $98 | $99 | |

| $59 | $59 |

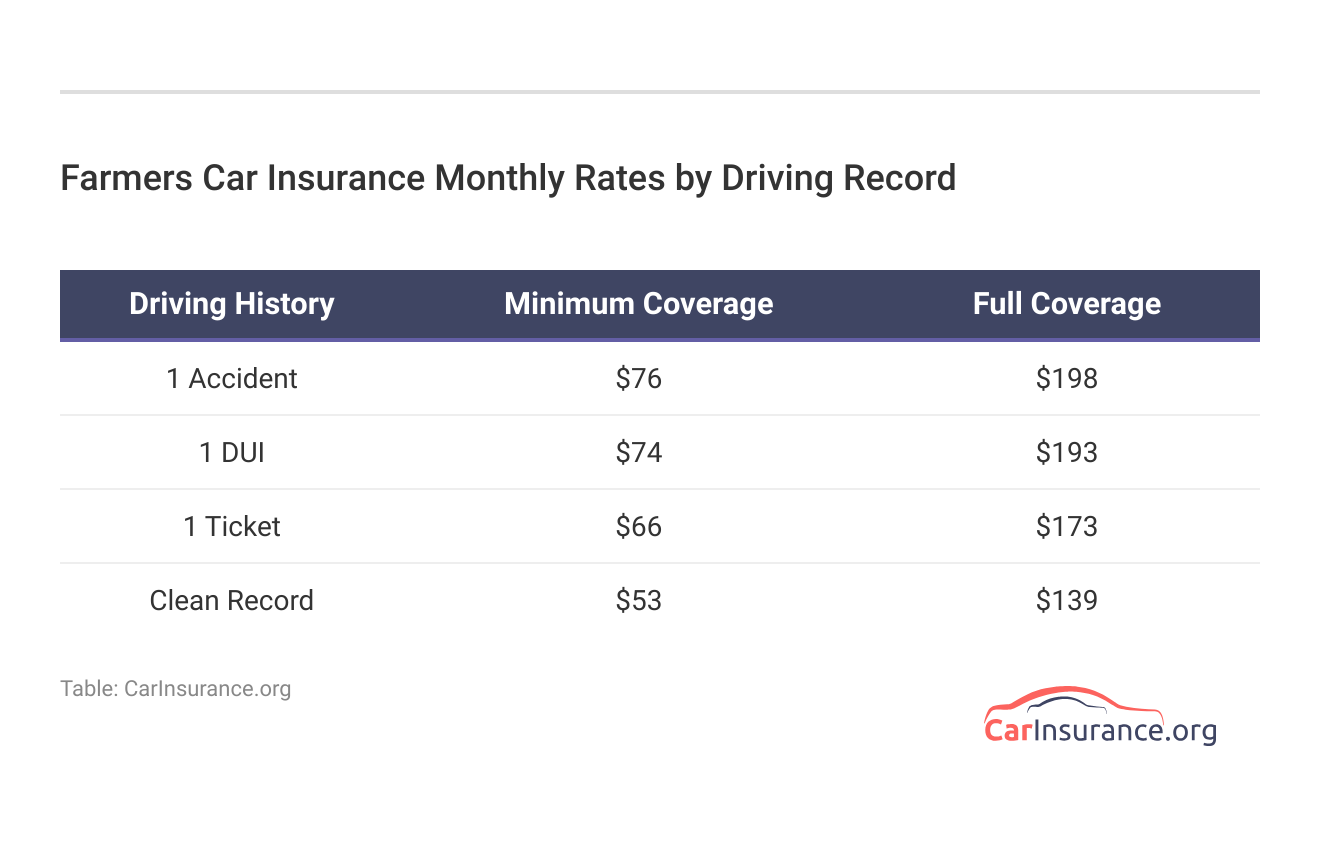

Your rates are also affected by what kind of coverage you get. The more protection you have, the more insurance costs. Your rates also vary with different deductible levels or policy limits.

Farmers Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $160 | $188 | $225 | $270 | |

| $117 | $136 | $176 | $194 | |

| $139 | $173 | $198 | $193 | |

| $80 | $106 | $132 | $216 | |

| $174 | $212 | $234 | $313 |

| $115 | $137 | $161 | $237 |

| $105 | $140 | $186 | $140 | |

| $86 | $96 | $102 | $112 | |

| $99 | $134 | $139 | $206 | |

| $59 | $67 | $78 | $108 |

Farmers rates are competitive for single adults and older adults, but the company charges significantly higher rates for teen drivers than other companies.

Maximizing Discounts Through Farmers Insurance

Taking advantage of discounts is one effective to way to lower your car insurance cost with Farmers. Drivers frequently neglect to investigate available discounts in their search for car insurance. Farmers offers the following discounts to its customers:

- Safe Drivers

- Bundled Insurance

- Multi-Car

- Auto-Pay

- Good Student

Farmers has an additional safe-driver program called Signal, which uses a device in your vehicle to track your driving habits. When you sign up for this, you receive an immediate 5% discount and can potentially lower your bill by 15% when your policy renews.

Farmers Car Insurance Discounts by Savings Potential

| Discount | |

|---|---|

| Bundling | 20% |

| Good Student | 20% |

| Accident-Free | 15% |

| Safe Driver | 15% |

| Defensive Driving | 10% |

| New Car | 7% |

| Anti-Theft Device | 5% |

| Pay-in-Full | 5% |

| Paperless Billing | 3% |

Discounts can vary depending on the state you live in. It’s a good idea to check into what your options are. Additionally, you may want to periodically check in with the company during your policy period to make sure that it doesn’t have new discounts that you may qualify for.

States Covered by Farmers Auto Insurance

While Farmers insurance is one of the largest auto insurance companies in the U.S., it is not available in every state. Despite being among the best car insurance companies, you can purchase a Farmers auto insurance policy in every state except the following:

- Alaska

- Delaware

- Hawaii

- Maine

- New Hampshire

- Rhode Island

- Vermont

- West Virginia

Farmers is also not offered in the District of Columbia.

The Better Business Bureau has accredited Farmers insurance since 1951. The BBB gives it an A- rating, but its customer rating is 1.39/5, with 195 reviews posted.

Farmers Business Insurance Ratings

| Agency | |

|---|---|

| Score: 846 / 1,000 Lower-Than-Average Satisfaction |

|

| Score: A+ Great Complaint Resolution |

|

| Score: 82/100 High Customer Satisfaction |

|

| Score: 1.70 More Complaints vs. Competitors |

|

| Score: A Excellent Financial Strength |

The National Association of Insurance Commissioners assigns the company a complaint rating of 0.79 for its auto insurance division, making it 21% less likely to receive a complaint than similar companies in the industry.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Quick Process for Farmers Car Insurance Claims

Farmers offers multiple claims filing methods. You can choose between filing online, using the company’s mobile app, or talking to a claims representative on the phone.

The website provides valuable information for customers when it’s time to file a claim. When you file a claim, be sure you have the following information ready:

- Your policy number and the accident date and time.

- Accident location, road conditions, and weather conditions.

- The name, contact, and driver’s license information for other drivers involved in the collision.

- The vehicle and insurance information for other drivers.

- Name and contact information for passengers and witnesses.

After you file your claim, you can check on the status online, via phone, or using the app. The company has a network of auto repair facilities for its customers to choose from.

Farmers Car Insurance Coverage Options

| Coverage Type | Description |

|---|---|

| Collision Coverage | Damage to your car in an accident |

| Comprehensive Coverage | Non-collision events like theft or fire |

| Custom Equipment Coverage | Protects custom parts |

| Liability Coverage | Injury and property damage to others |

| Loss of Use Coverage | Transportation costs when car is unusable |

| Medical Payments Coverage | Medical expenses for you and passengers |

| Personal Injury Protection (PIP) | Medical costs and lost wages |

| Rental Reimbursement | Rental car during repairs |

| Towing and Roadside Assistance | Towing and roadside help |

| Uninsured/Underinsured Motorist | Injuries from uninsured or underinsured drivers |

A convenient feature for those who use the app to file is that the company sends customers a link to send photos after an accident to your insurance company. You can take and submit photos of your vehicle’s damage right inside the app.

The company performs the estimate and sends the customer the payment for repairs, and the customer can utilize any auto repair service they want.

Additional Insurance Options with Farmers

Farmers car insurance is just one product the company offers. Farmers Insurance Group is a parent company for Farmers and its subsidiaries.

Let’s dive face-first into auto insurance knowledge. pic.twitter.com/xFIgq8Laam

— Farmers Insurance (@WeAreFarmers) July 13, 2024

If you want to put all your policies under one company, you can do so with this company. In addition to car insurance, Farmers offers the following types of insurance:

- Rideshare Car Insurance

- Homeowners Insurance

- Life Insurance

- Business Insurance

- Specialty Vehicle Insurance

Having multiple policies through a single company can help you manage your policies and payments. Farmers also offers discounts when you bundle multiple insurance products. However, you may still want to compare rates with other companies to ensure you get the best overall value for the coverage you need.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

A Closer Look at Farmers Car Insurance

Farmers is one of the largest insurers in the U.S. The company operates in 42 states, providing a wide range of auto insurance products. The NAIC gives it a higher-than-average rating, but customers may pay higher rates for their policies, especially teen drivers.

Farmers stands out by offering roadside assistance and rental reimbursement as affordable add-ons.Tracey L. Wells Licensed Insurance Agent & Agency Owner

While Farmers offers comprehensive coverage, it’s important to compare options with the cheapest car insurance companies to ensure you’re getting the best value. For those looking to bundle all their insurance products under one company, Farmers gives you that option, and it may also save you money.

Ready to shop around for the best car insurance company? Enter your ZIP code below and see which one offers the coverage you need.

Frequently Asked Questions

How good is Farmers insurance?

Farmers insurance is highly rated for its wide range of coverage and strong customer service, but rates can be higher for younger drivers.

What do Farmers insurance reviews say?

Farmers insurance reviews often highlight its comprehensive coverage options and discounts, though some customers report higher rates and mixed experiences with customer service.

What are Farmers auto insurance discounts?

Farmers auto insurance offers discounts for safe drivers, multi-car policies, bundling, auto-pay, and good student discounts.

Learn more by reading our guide titled, “Safe Driving Means Checking Your Bad Attitude at the Car Door.”

What is the average Farmers auto insurance rate?

Farmers auto insurance rates vary, but the average full coverage policy starts around $47 per month, depending on factors like location and driving history.

How does Farmers bundle insurance work?

Farmers allows you to bundle auto, home, and other policies, which can result in significant savings on your monthly premiums.

Ready to find affordable car insurance? Get started today by entering your ZIP code below into our free comparison tool.

Does Farmers auto insurance include rental car coverage?

Yes, Farmers auto insurance offers rental car coverage as an add-on, reimbursing you for rental costs while your car is being repaired after an accident.

Access comprehensive insights into our guide titled, “If my car breaks down, will insurance cover a rental?”

What do Farmers business insurance reviews say?

Farmers business insurance reviews typically praise the customizable policies and comprehensive options available for small and large businesses alike.

How can I get Farmers car insurance quotes?

You can get a Farmers car insurance quote by visiting their website, calling an agent, or using an online comparison tool to see competitive rates.

What is Farmers comprehensive coverage?

Farmers comprehensive coverage protects against non-accident-related damages, such as theft, vandalism, and natural disasters like hail or floods.

Explore more details in our complete resource titled, “What are ‘Acts of God’ and when are they covered?”

How does the Farmers good student discount work?

The Farmers good student discount offers lower premiums for students who maintain good grades, providing savings for young drivers with a GPA above a certain level.

What do Farmers insurance claims reviews say?

What does the Farmers homeowners insurance review say?

Does Farmers insurance offer rental car reimbursement?

Does Farmers insurance offer roadside assistance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.