Mercury Car Insurance Review for 2026 [See Rates & Customer Reviews]

Our Mercury car insurance review shows it's a solid option for budget-conscious drivers. With Mercury car insurance rates starting at $59/month for minimum coverage and offering features like MercuryGO for safe driving rewards, it’s a good choice for drivers seeking affordable and customizable coverage options.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Jeffrey Manola

Updated March 2025

The Mercury car insurance review dives into the key features of Mercury’s offerings, highlighting competitive rates across multiple factors like age, gender, and coverage levels.

Mercury offers monthly rates starting at just $84 for minimum coverage, making it an appealing option for drivers wondering if it’s bad to just carry minimum coverage car insurance and seeking affordability.

Mercury Car Insurance Ratings

Rating Criteria Score

Overall Score Rating 4

Business Reviews 4

Claim Processing 3

Company Reputation 4

Coverage Availability 3

Coverage Value 4

Customer Satisfaction 4

Digital Experience 4

Discounts Available 5

Insurance Cost 4

Plan Personalization 4

Policy Options 5

Savings Potential 5

Additionally, its high customer satisfaction ratings reinforce its reputation as a reliable provider. This review examines Mercury’s affordability and how it compares to other leading companies in the market.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

- Mercury provides rates from $59/month for minimum coverage

- Features MercuryGO program rewarding safe driving habits

- Customized rates are determined by age, gender, and driving records

Mercury Insurance: Tailored Rates Analysis

Mercury Insurance provides customized car insurance rates based on key factors that affect the price of car insurance, such as coverage level, age, and gender. This review reveals how premiums fluctuate, with higher charges for young drivers and reduced rates for older, more experienced drivers.

By examining the specific costs for both minimum and full coverage, drivers can make educated decisions about their car insurance, highlighting Mercury’s commitment to affordability and coverage adaptability.

Mercury Car Insurance Monthly Rates by Coverage Level, Age, & Gender

Age & Gender Minimum Coverage Full Coverage

Age: 16 Female $149 $384

Age: 16 Male $159 $391

Age: 18 Female $121 $283

Age: 18 Male $137 $318

Age: 25 Female $35 $94

Age: 25 Male $37 $98

Age: 30 Female $33 $87

Age: 30 Male $34 $91

Age: 45 Female $30 $78

Age: 45 Male $29 $77

Age: 60 Female $27 $69

Age: 60 Male $28 $72

Age: 65 Female $29 $77

Age: 65 Male $29 $76

Mercury Insurance’s pricing structure helps drivers find policies tailored to their needs. New drivers managing costs or experienced ones seeking extensive coverage will benefit from this rate breakdown. It facilitates informed insurance decisions, allowing selection of a policy that aligns with requirements and budget. Learn how driving records influence Mercury Insurance rates.

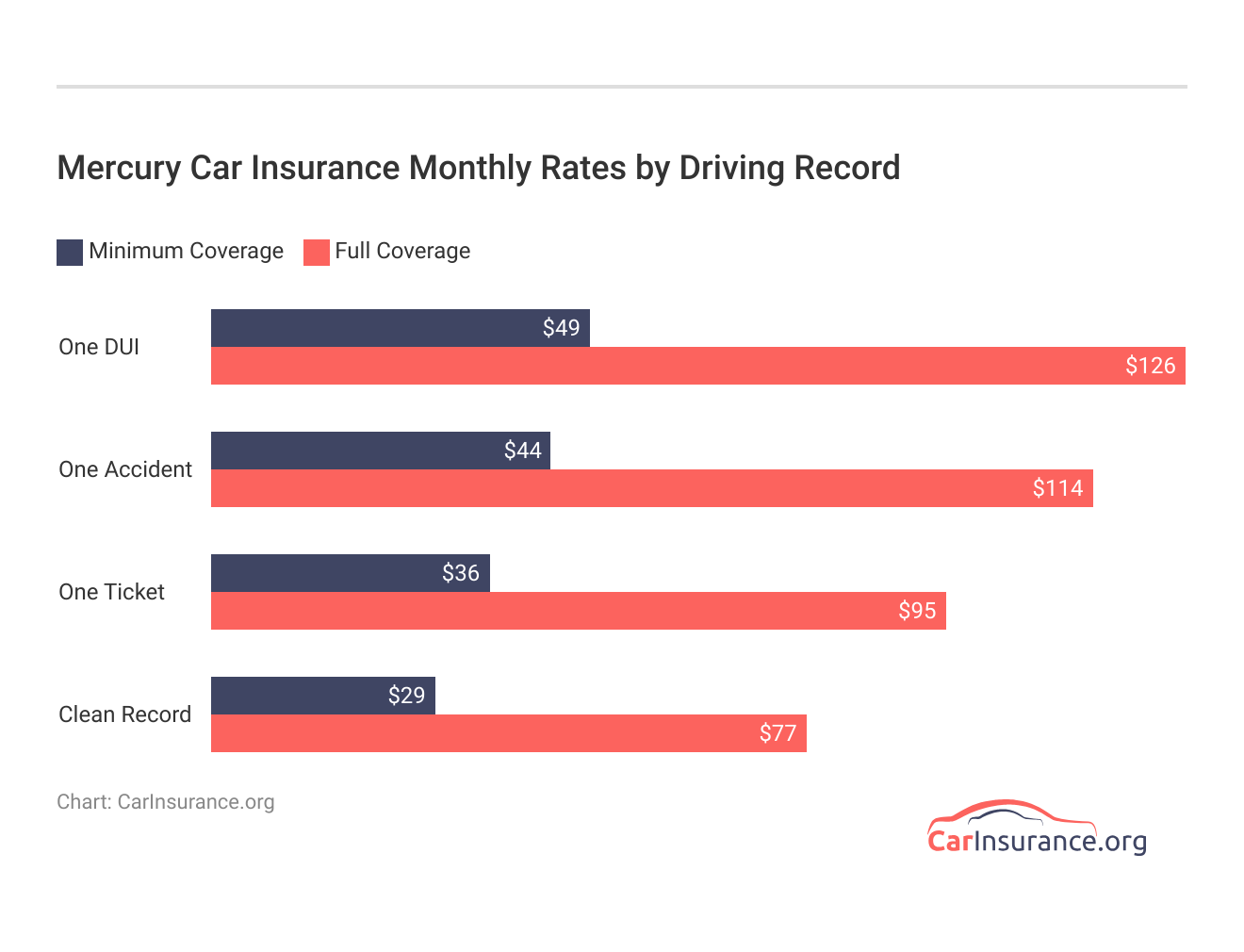

Our analysis details the impacts of DUIs, accidents, tickets, and clean records on both minimum and full coverage costs, providing clear pricing insights. Mercury Insurance’s rate breakdown highlights the financial effects of driving behaviors on insurance premiums. With this information, drivers can effectively manage their coveragef choices and expenses.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

MercuryGO: A Smart Way to Drive and Save

MercuryGO is Mercury’s telematics program designed to encourage safe driving habits while offering potential savings. By using the app, drivers receive real-time feedback on their driving behavior, including speed, braking, and phone usage. The app also provides safe driving tips to further enhance driver safety and awareness. The better you drive, the more you save on your premiums.

MercuryGO is especially beneficial for younger or less experienced drivers looking to lower their rates through responsible driving. The app’s tracking feature provides an extra layer of safety by monitoring vehicle location, making it useful for families. While participation in MercuryGO may not be mandatory, it’s a smart option for those looking to maximize savings while improving their driving skills.

How Providers Adjust Mercury Insurance Premiums

Mercury car insurance adjusts rates based on driving record and provider. This review shows how premiums vary for drivers with clean records, tickets, accidents, or DUIs, from affordable rates with USAA and Mercury to higher premiums at Liberty Mutual and Allstate. This information helps in choosing the best coverage by comparing how driving behavior affects premiums.

Mercury Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $160 | $188 | $225 | $270 | |

| $117 | $136 | $176 | $194 | |

| $139 | $173 | $198 | $193 | |

| $80 | $106 | $132 | $216 | |

| $174 | $212 | $234 | $313 |

| $77 | $95 | $114 | $126 | |

| $115 | $137 | $161 | $237 |

| $105 | $140 | $186 | $140 | |

| $86 | $96 | $102 | $112 | |

| $99 | $134 | $139 | $206 | |

| $59 | $67 | $78 | $108 |

Mercury car insurance’s rate structure demonstrates how factors like driving history, including things you do that can raise your premiums, influence costs. The analysis reveals the financial effects of clean records versus past infractions, helping drivers find the best value. With competitive rates, including Mercury’s affordable options, drivers can confidently select the most suitable coverage.

Mechanical Protection: Safeguarding Your Vehicle’s Health

Mercury’s Mechanical Protection program provides drivers with an extended warranty, covering essential repairs that go beyond standard maintenance. This protection plan ensures that costly mechanical breakdowns, like engine or transmission failures, are covered after the manufacturer’s warranty expires.

Mercury Car Insurance excels in offering affordable, tailored coverage that adapts to individual needs, ensuring both new and experienced drivers find value in their policies.Eric Stauffer Licensed Insurance Agent

With multiple coverage levels, drivers can choose a plan that suits their vehicle’s age and mileage, offering flexible protection. Mercury includes perks like 24/7 roadside assistance, rental car coverage, and nationwide repairs. This extended coverage helps drivers manage car maintenance expenses, avoid unexpected repair costs, and maintain smooth vehicle operation for longer.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Mercury Insurance Rate Comparison by Age and Gender

Age and gender significantly influence car insurance premiums. This review compares Mercury’s monthly rates to competitors, showing how companies adjust premiums for 45-year-old male and female drivers. It highlights affordable options from USAA and Geico versus higher rates from Allstate and Liberty Mutual, helping drivers find the best coverage for their budget.

Mercury Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 45 Female | Age: 45 Male |

|---|---|---|

| $162 | $160 | |

| $115 | $117 | |

| $139 | $139 | |

| $80 | $80 | |

| $171 | $174 |

| $78 | $77 | |

| $113 | $115 |

| $112 | $105 | |

| $86 | $86 | |

| $98 | $99 | |

| $59 | $59 |

Understanding why you need car insurance and how factors like age and gender affect premiums is crucial for selecting the appropriate provider. This comparison of Mercury’s rates with its competitors highlights significant price variations among leading companies, helping you explore your options and make a decision tailored to your specific needs.

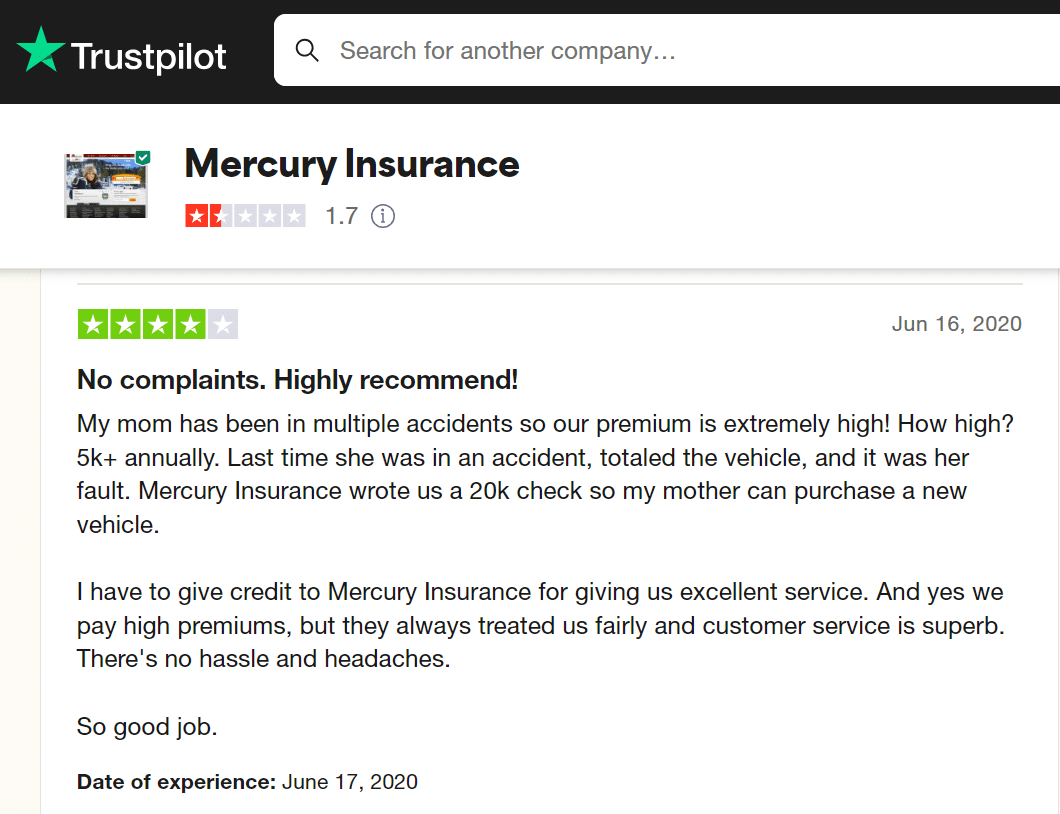

Voices from the Road: Mercury Insurance Customer Insights

Mercury Car Insurance tailors rates to meet diverse driver needs, focusing on affordability and adaptability. Reviews highlight Mercury’s pricing adjustments across demographics, noting lower rates for mature drivers and comprehensive coverage options. However, younger drivers often face higher premiums, eliciting mixed reactions.

Customers frequently praise Mercury’s responsive customer service and straightforward claims process. Positive testimonials often highlight the ease of managing policies through Mercury’s customer portal. Conversely, some reviews suggest areas for improvement, such as expanding coverage options and increasing rate transparency.

These reviews offer a balanced view, helping potential customers evaluate how Mercury addresses their insurance requirements, including coverage for car accidents & claims.

Customizable Mercury Car Insurance Options

Mercury Car Insurance offers a wide range of coverage options designed to meet various driver needs, from essential protections like liability and collision coverage to specialized policies such as gap insurance and custom parts coverage. With comprehensive solutions for medical expenses, uninsured drivers, and even rental car reimbursement, Mercury ensures you’re covered in any situation.

Mercury Car Insurance Coverage Options

| Description | |

|---|---|

| Collision Coverage | Covers repairs to your vehicle after a collision |

| Comprehensive Coverage | Covers damage from non-collision incidents like theft |

| Custom Parts and Equipment Coverage | Covers aftermarket or customized parts |

| Gap Insurance | Covers the difference between your car's value |

| Liability Coverage | Covers injury and damage if you're at fault |

| Medical Payments Coverage | Covers medical expenses for you and passengers |

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other costs |

| Rental Car Reimbursement | Covers rental car costs while your vehicle is repaired |

| Roadside Assistance | Covers services like towing and fuel delivery |

| Uninsured/Underinsured Motorist Coverage | Covers if the other driver lacks enough insurance |

Mercury Car Insurance offers a wide array of coverage options, enabling drivers to customize their policies based on individual needs, including whether will insurance cover a rental. From basic liability to more specialized protections such as roadside assistance and gap insurance, Mercury ensures flexible and dependable coverage to maintain safety on the road.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exclusive Mercury Car Insurance Savings

Mercury Car Insurance provides discounts that encourage responsible behavior and certain vehicle features, such as bundling home and auto insurance, implementing how to drive safely tips, and using anti-theft measures. This guide outlines these discounts and describes the possible savings, assisting drivers in maximizing their benefits.

Mercury Car Insurance Discounts by Savings Potential

| Discount | Savings Potential |

|---|---|

| Affinity Group | 10% |

| Anti-Theft | 10% |

| Bundling (Home + Auto) | 20% |

| Good Driver | 20% |

| Good Student | 15% |

| Low Mileage | 10% |

| Multiple Cars | 25% |

| Paid-in-Full | 10% |

| Senior/Retiree | 5% |

| Vehicle Safety Features | 5% |

By leveraging Mercury’s diverse discount options, drivers can significantly lower their insurance costs while maintaining comprehensive coverage. Whether you’re a good driver, student, or bundling multiple policies, Mercury’s savings opportunities are designed to reward smart decisions. These discounts make Mercury an attractive choice for those seeking affordable, tailored insurance solutions.

Mercury Car Insurance: A Balanced Look

Mercury car insurance offers competitive services for drivers, but like any provider, it comes with its strengths and weaknesses. Here’s a quick look at the pros and cons to help you decide if Mercury is right for you.

- Affordable Rates: Mercury offers some of the most competitive pricing in the industry, making it a solid choice for budget-conscious drivers.

- Comprehensive Mechanical Protection: The extended warranty covers essential repairs, providing peace of mind for costly breakdowns.

- MercuryGO Telematics: This program encourages safe driving and offers premium discounts, ideal for younger or cautious drivers.

Mercury’s affordability and practical features make it a popular choice, but there are a few areas where it falls short.

- Limited Availability: Mercury insurance is only available in a select number of states, restricting its reach.

- Fewer Discount Options: While the rates are competitive, the discount offerings are not as extensive compared to other major insurers.

Overall, Mercury car insurance is a solid choice for those seeking affordable coverage and practical features such as MercuryGO and Mechanical Protection, illustrating why you need car insurance. However, its limited availability and fewer discounts may prompt some drivers to consider other options.

Mercury Business Insurance Ratings: What to Know

Mercury Business Insurance provides various coverage options, with ratings that differ by agency. It holds an A+ from the Better Business Bureau and an A (Excellent) from A.M. Best, indicating strong financial health. Yet, lower ratings from J.D. Power and Consumer Reports, and a high complaint ratio from NAIC, suggest areas for improvement in customer service and claims handling.

Mercury Business Insurance Ratings

| Agency | |

|---|---|

| Score: 816 / 1,000 Avg. Satisfaction |

|

| Score: A Excellent Financial Strength |

|

| Score: 70/100 Positive Claims Handling |

|

| Score: 0.84 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

Mercury Business Insurance is recognized for its financial stability, attracting companies seeking substantial protection. Despite mixed customer reviews and a high complaint ratio, it remains a viable choice for those needing robust coverage with financial support. Businesses should also consider how the states rank on uninsured drivers when evaluating Mercury’s overall customer experience.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driving Forward With Mercury

Mercury Car Insurance offers a well-rounded package of affordability and adaptable coverage options, ideal for drivers seeking a budget-friendly yet comprehensive plan. Its standout features, like MercuryGO, reward safe driving habits, helping policyholders save even more.

Although higher rates may not suit younger drivers, the overall value and dedication to customer satisfaction position it as a strong choice for those emphasizing cost and coverage in their car insurance guide.

See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Frequently Asked Questions

Is Mercury a good brand?

As an insurance brand, Mercury is well-regarded in the markets it serves. It is known for competitive pricing, a range of products, and effective service, making it a good choice for many drivers looking for reliable auto insurance.

Is Mercury an A-rated company?

Yes, Mercury is typically rated ‘A’ by AM Best, which affirms its financial strength and stability as an insurance provider.

Is Mercury a good insurer?

Mercury is generally considered a reliable insurer, known for offering competitive rates, especially for drivers who might face higher premiums elsewhere. They offer a range of coverages and have a good network of agents to support policyholders.

For further details, consult our comprehensive report titled “What is a policy number on an insurance card?” for concise information.

Why is Mercury so cheap?

Mercury offers competitive pricing, which can be attributed to their efficient claims process and lower overhead costs compared to some larger insurers. They also tailor rates to individual risk profiles, which can lead to lower premiums for certain drivers.

What is Mercury auto insurance AM best rating?

Mercury Insurance typically receives an “A” rating from AM Best, indicating a strong ability to meet ongoing insurance obligations. This rating reflects financial stability and a strong capacity for meeting policyholder and contract obligations.

Can you trust Mercury?

Yes, Mercury is a trustworthy insurer with a long-standing history in the industry. They are known for their straightforward business practices and generally receive favorable reviews in terms of customer satisfaction and trustworthiness.

To enhance your understanding, consult our detailed handbook titled “Why You Need Car Insurance” for more insights.

What is Mercury Insurance AM best rating?

Mercury Insurance holds an AM Best rating of “A”, which is an excellent rating that signifies the company’s strong financial health and its ability to pay out claims.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Is Mercury a reliable car brand?

This question seems off-context as Mercury is primarily known as an insurance provider, not a car manufacturer. If referring to the defunct Mercury automobile brand, it was generally considered reliable during its time.

Is mercury good at paying claims?

Mercury has a reputation for a straightforward claims process. Most customers report satisfaction with the timeliness and fairness of claims handling, although experiences can vary depending on the complexity of the claim.

To deepen your knowledge, consult our extensive guide titled “Filing a Car Insurance Claim After an Accident” for detailed information.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Mercury Financial safe?

Mercury Financial, related to Mercury Insurance, is considered safe with robust financial backing and a solid track record in financial stability and claims payment.

As an insurance brand, Mercury is well-regarded in the markets it serves. It is known for competitive pricing, a range of products, and effective service, making it a good choice for many drivers looking for reliable auto insurance.

Yes, Mercury is typically rated ‘A’ by AM Best, which affirms its financial strength and stability as an insurance provider.

Is Mercury a good insurer?

Mercury is generally considered a reliable insurer, known for offering competitive rates, especially for drivers who might face higher premiums elsewhere. They offer a range of coverages and have a good network of agents to support policyholders.

For further details, consult our comprehensive report titled “What is a policy number on an insurance card?” for concise information.

Why is Mercury so cheap?

Mercury offers competitive pricing, which can be attributed to their efficient claims process and lower overhead costs compared to some larger insurers. They also tailor rates to individual risk profiles, which can lead to lower premiums for certain drivers.

What is Mercury auto insurance AM best rating?

Mercury Insurance typically receives an “A” rating from AM Best, indicating a strong ability to meet ongoing insurance obligations. This rating reflects financial stability and a strong capacity for meeting policyholder and contract obligations.

Can you trust Mercury?

Yes, Mercury is a trustworthy insurer with a long-standing history in the industry. They are known for their straightforward business practices and generally receive favorable reviews in terms of customer satisfaction and trustworthiness.

To enhance your understanding, consult our detailed handbook titled “Why You Need Car Insurance” for more insights.

What is Mercury Insurance AM best rating?

Mercury Insurance holds an AM Best rating of “A”, which is an excellent rating that signifies the company’s strong financial health and its ability to pay out claims.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Is Mercury a reliable car brand?

This question seems off-context as Mercury is primarily known as an insurance provider, not a car manufacturer. If referring to the defunct Mercury automobile brand, it was generally considered reliable during its time.

Is mercury good at paying claims?

Mercury has a reputation for a straightforward claims process. Most customers report satisfaction with the timeliness and fairness of claims handling, although experiences can vary depending on the complexity of the claim.

To deepen your knowledge, consult our extensive guide titled “Filing a Car Insurance Claim After an Accident” for detailed information.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Mercury Financial safe?

Mercury Financial, related to Mercury Insurance, is considered safe with robust financial backing and a solid track record in financial stability and claims payment.

Mercury is generally considered a reliable insurer, known for offering competitive rates, especially for drivers who might face higher premiums elsewhere. They offer a range of coverages and have a good network of agents to support policyholders.

For further details, consult our comprehensive report titled “What is a policy number on an insurance card?” for concise information.

Mercury offers competitive pricing, which can be attributed to their efficient claims process and lower overhead costs compared to some larger insurers. They also tailor rates to individual risk profiles, which can lead to lower premiums for certain drivers.

What is Mercury auto insurance AM best rating?

Mercury Insurance typically receives an “A” rating from AM Best, indicating a strong ability to meet ongoing insurance obligations. This rating reflects financial stability and a strong capacity for meeting policyholder and contract obligations.

Can you trust Mercury?

Yes, Mercury is a trustworthy insurer with a long-standing history in the industry. They are known for their straightforward business practices and generally receive favorable reviews in terms of customer satisfaction and trustworthiness.

To enhance your understanding, consult our detailed handbook titled “Why You Need Car Insurance” for more insights.

What is Mercury Insurance AM best rating?

Mercury Insurance holds an AM Best rating of “A”, which is an excellent rating that signifies the company’s strong financial health and its ability to pay out claims.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Is Mercury a reliable car brand?

This question seems off-context as Mercury is primarily known as an insurance provider, not a car manufacturer. If referring to the defunct Mercury automobile brand, it was generally considered reliable during its time.

Is mercury good at paying claims?

Mercury has a reputation for a straightforward claims process. Most customers report satisfaction with the timeliness and fairness of claims handling, although experiences can vary depending on the complexity of the claim.

To deepen your knowledge, consult our extensive guide titled “Filing a Car Insurance Claim After an Accident” for detailed information.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Mercury Financial safe?

Mercury Financial, related to Mercury Insurance, is considered safe with robust financial backing and a solid track record in financial stability and claims payment.

Mercury Insurance typically receives an “A” rating from AM Best, indicating a strong ability to meet ongoing insurance obligations. This rating reflects financial stability and a strong capacity for meeting policyholder and contract obligations.

Yes, Mercury is a trustworthy insurer with a long-standing history in the industry. They are known for their straightforward business practices and generally receive favorable reviews in terms of customer satisfaction and trustworthiness.

To enhance your understanding, consult our detailed handbook titled “Why You Need Car Insurance” for more insights.

What is Mercury Insurance AM best rating?

Mercury Insurance holds an AM Best rating of “A”, which is an excellent rating that signifies the company’s strong financial health and its ability to pay out claims.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Is Mercury a reliable car brand?

This question seems off-context as Mercury is primarily known as an insurance provider, not a car manufacturer. If referring to the defunct Mercury automobile brand, it was generally considered reliable during its time.

Is mercury good at paying claims?

Mercury has a reputation for a straightforward claims process. Most customers report satisfaction with the timeliness and fairness of claims handling, although experiences can vary depending on the complexity of the claim.

To deepen your knowledge, consult our extensive guide titled “Filing a Car Insurance Claim After an Accident” for detailed information.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Mercury Financial safe?

Mercury Financial, related to Mercury Insurance, is considered safe with robust financial backing and a solid track record in financial stability and claims payment.

Mercury Insurance holds an AM Best rating of “A”, which is an excellent rating that signifies the company’s strong financial health and its ability to pay out claims.

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

This question seems off-context as Mercury is primarily known as an insurance provider, not a car manufacturer. If referring to the defunct Mercury automobile brand, it was generally considered reliable during its time.

Is mercury good at paying claims?

Mercury has a reputation for a straightforward claims process. Most customers report satisfaction with the timeliness and fairness of claims handling, although experiences can vary depending on the complexity of the claim.

To deepen your knowledge, consult our extensive guide titled “Filing a Car Insurance Claim After an Accident” for detailed information.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Is Mercury Financial safe?

Mercury Financial, related to Mercury Insurance, is considered safe with robust financial backing and a solid track record in financial stability and claims payment.

Mercury has a reputation for a straightforward claims process. Most customers report satisfaction with the timeliness and fairness of claims handling, although experiences can vary depending on the complexity of the claim.

To deepen your knowledge, consult our extensive guide titled “Filing a Car Insurance Claim After an Accident” for detailed information.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Mercury Financial, related to Mercury Insurance, is considered safe with robust financial backing and a solid track record in financial stability and claims payment.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.