Nationwide Car Insurance Review for 2026 [Trustworthy Evaluation]

This Nationwide car insurance review compares rates starting from $39 per month. Drivers seeking comprehensive protection will find affordable Nationwide auto insurance in most states. Nationwide’s SmartRide program rewards safe drivers with personalized discounts, delivering notable savings and value.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Jeff Root

Updated March 2025

Our Nationwide car insurance review highlights why this insurer excels with its flexible coverage options and customer-focused programs.

This review compares the different types of car insurance coverage Nationwide Mutual Insurance Company brings to policyholders. Nationwide’s SmartRide and accident forgiveness features give drivers tailored savings and protection, setting it apart from competitors.

Nationwide Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 4.5 |

| Business Reviews | 4.5 |

| Claim Processing | 3.5 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.3 |

| Customer Satisfaction | 4.0 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.4 |

| Plan Personalization | 4.5 |

| Policy Options | 4.7 |

| Savings Potential | 4.6 |

Whether for individual or business needs, Nationwide continues to be a top choice for comprehensive insurance solutions.

Find the best comprehensive car insurance quotes by entering your ZIP code above into our free comparison tool today.

- Our review gives Nationwide car insurance 4.5 stars

- Flexible coverage and insurance discounts enhance its score

- Nationwide is more expensive than Geico and State Farm

How Age and Gender Affect Nationwide Car Insurance Rates

Nationwide auto insurance rates vary based on age, gender, and coverage level. Here is a breakdown of minimum and full coverage costs for drivers at different ages:

Nationwide Car Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $161 | $411 |

| Age: 16 Male | $195 | $476 |

| Age: 18 Female | $131 | $303 |

| Age: 18 Male | $167 | $387 |

| Age: 25 Female | $52 | $136 |

| Age: 25 Male | $57 | $150 |

| Age: 30 Female | $48 | $124 |

| Age: 30 Male | $53 | $136 |

| Age: 45 Female | $43 | $113 |

| Age: 45 Male | $44 | $115 |

| Age: 60 Female | $39 | $99 |

| Age: 60 Male | $41 | $104 |

| Age: 65 Female | $43 | $111 |

| Age: 65 Male | $43 | $112 |

Rates tend to be significantly higher for younger drivers, particularly for males. However, as drivers age, the rates decrease, with a 30-year-old female paying just $48 for minimum coverage. Full coverage rates follow a similar trend, with older drivers benefiting from lower premiums.

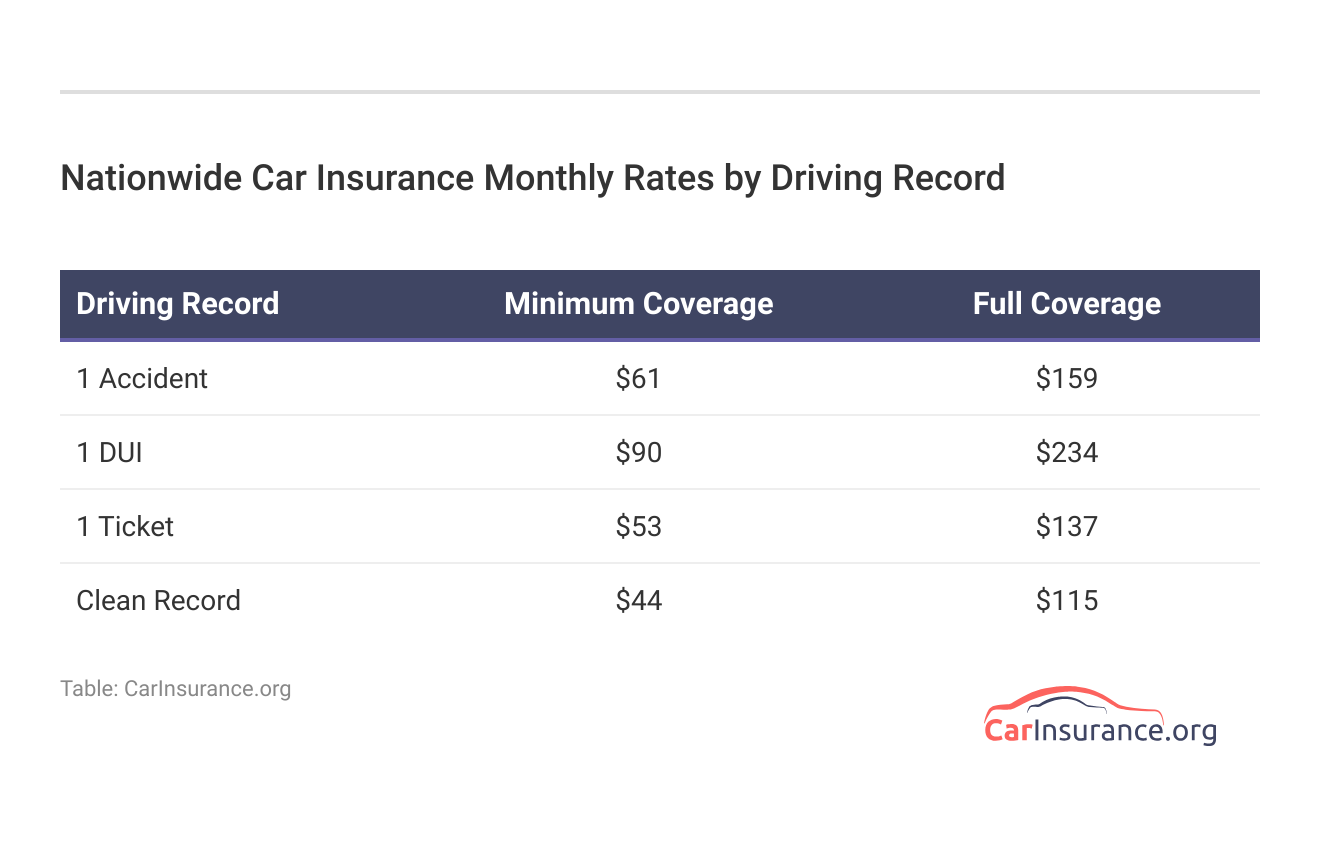

Overall, Nationwide insurance company pricing rewards more experienced drivers with reduced rates, offering affordability as drivers gain more experience behind the wheel. However, drivers with accidents or tickets can expect higher premiums, while a DUI results in the steepest cost increase.

A clean record offers the best rates, with $44 for minimum coverage compared to $90 for drivers with a DUI. Nationwide rewards safe driving but penalizes high-risk behavior with notably higher rates.

Read More: How much insurance do I need for my car?

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Nationwide Car Insurance to Competitors

Nationwide consistently stands out among its rivals for providing affordable rates to experienced drivers. By comparing these rates with top competitors, drivers can find the best options tailored to their specific needs.

Nationwide Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 45 Female | Age: 45 Male |

|---|---|---|

| $162 | $160 | |

| $115 | $117 | |

| $139 | $139 | |

| $80 | $80 | |

| $171 | $174 |

| $113 | $115 |

| $112 | $105 | |

| $86 | $86 | |

| $98 | $99 | |

| $59 | $59 |

Nationwide offers competitive car insurance rates that fluctuate based on age, gender, and coverage level. Safe drivers with clean records typically benefit from lower premiums, while those with accidents or violations may see higher costs across providers. Find out which factors affect the price of car insurance.

Below is a table comparing high-risk insurance rates from multiple companies, giving a clearer picture of how much premiums can vary. Use this comparison to see if Nationwide auto insurance fits you best.

Nationwide Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $160 | $188 | $225 | $270 | |

| $117 | $136 | $176 | $194 | |

| $139 | $173 | $198 | $193 | |

| $80 | $106 | $132 | $216 | |

| $174 | $212 | $234 | $313 |

| $115 | $137 | $161 | $237 |

| $105 | $140 | $186 | $140 | |

| $86 | $96 | $102 | $112 | |

| $99 | $134 | $139 | $206 | |

| $59 | $67 | $78 | $108 |

Nationwide tailors its pricing to account for driving behavior and is cheaper than Liberty Mutual and Progressive. However, drivers with a solid history can access the most competitive rates, while others may face surcharges due to risk factors.

How to Find the Right Nationwide Car Insurance Coverage

Nationwide offers various car insurance coverage options to suit different needs and preferences. Drivers can customize their coverage from essential liability protection to comprehensive policies based on individual circumstances and risks.

Nationwide Car Insurance Coverage Options

| Coverage | Description |

|---|---|

| Liability | Covers injuries and property damage to others |

| Collision | Pays for car damage from a collision |

| Comprehensive | Covers non-collision incidents like theft/fire |

| Personal Injury Protection | Covers medical expenses for you and passengers |

| Uninsured/Underinsured Motorist | Protects against underinsured drivers |

| Medical Payments | Pays medical bills after an accident |

| Roadside Assistance | Offers towing, flat tires, and emergency help |

| Rental Car Reimbursement | Covers rental car during repairs |

| Gap Insurance | Covers loan balance beyond car value |

| Custom Equipment | Protects aftermarket parts |

| Accident Forgiveness | Avoids rate hikes after first accident |

| Vanishing Deductible | Reduces deductible for safe driving |

Is it bad to just carry minimum coverage car insurance? No, but Nationwide’s flexible coverage allows policyholders to adjust their plans as life changes, ensuring optimal protection. With specialized programs and add-ons, Nationwide provides peace of mind for all types of drivers.

Nationwide Driver-Based Discount Options

Wondering how to reduce the cost of car insurance? Nationwide offers a wide range of discounts designed to make auto insurance more affordable for various drivers.

Nationwide Car Insurance Discounts by Savings Potential

| Discount |  |

|---|---|

| SmartRide Program (Usage-Based) | 40% |

| Multi-Policy | 20% |

| Good Student | 15% |

| Accident-Free | 10% |

| Auto Payment | 10% |

| Pay-in-Full | 10% |

| Safe Driver | 10% |

| Anti-Theft Device | 5% |

| Defensive Driving | 5% |

| Paperless Billing | 5% |

From safe driving rewards to bundling discounts, Nationwide insurance discounts cater to different needs, ensuring drivers save based on their habits and circumstances.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Nationwide Car Insurance Ratings & Reviews

Nationwide Mutual Insurance Company ratings reflect the company’s strength in offering tailored coverage for various industries. With robust financial stability and extensive customization options, it consistently meets the needs of drivers seeking reliable coverage.

Nationwide Insurance Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 855 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 75/100 Positive Customer Feedback |

|

| Score: 0.78 Fewer Complaints |

|

| Score: A+ Superior Financial Strength |

Nationwide continues to earn top marks due to its commitment to flexible policies and customer-centric programs, making it a preferred choice for drivers.

From general liability to commercial auto insurance, its wide range of services ensures drivers are well protected at every level.

Read More: Safe Driving Tips on How to Keep Your Insurance and Car Safe

Nationwide Car Insurance Company Pros and Cons

Nationwide offers several benefits, making it a strong contender for drivers seeking flexibility and savings. Its emphasis on customizable policies and rewards for safe driving positions it as an attractive option.

- Comprehensive Coverage Options: Nationwide provides various plans and add-ons that let customers tailor their policies to specific needs.

- Accident Forgiveness and Affordable Rates: Safe drivers benefit from competitive pricing and accident forgiveness, keeping premiums lower even after a mishap.

- SmartRide Program Discounts: Nationwide car insurance with telematics rewards cautious drivers with personalized discounts, promoting safe behavior behind the wheel.

- User-Friendly Mobile App: Their robust app simplifies claims tracking and policy management, giving drivers convenient access to their insurance details.

These pros highlight Nationwide’s ability to cater to diverse driver needs, offering savings and convenience where it counts.

He’s Paintin’ Manning. He’s also *so much more* than a quarterback. #NWSoMuchMore #Nationwide pic.twitter.com/CC4Q3Zt9pl

— Nationwide (@Nationwide) September 5, 2024

While Nationwide boasts many strengths, customers have noted frustrations in a few areas. High-risk drivers and those seeking prompt service may encounter challenges.

- Extended Customer Service Wait Times: Some users have reported long delays when attempting to reach Nationwide’s customer support, which can cause frustration.

- Higher Premiums for High-Risk Drivers: Drivers with a history of accidents or violations find better rates with car insurance companies that only look back three years.

- Claims Processing Delays: There have been instances of complaints regarding delayed claims resolutions, causing inconvenience for policyholders.

While Nationwide offers value to many, these cons highlight areas where it could improve service speed and rate competitiveness for high-risk drivers.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Nationwide Car Insurance is Best for Safe Drivers

Nationwide Mutual Insurance Company delivers a well-rounded package with flexible coverage options, competitive pricing for safe drivers, and valuable usage-based discounts through the SmartRide program.

Strong financial backing and multiple discounts make Nationwide a reliable choice for drivers.Dani Best Licensed Insurance Producer

While the company stands out with its robust mobile app and customer-centric policies, our Nationwide car insurance review found some drawbacks, such as long wait times for customer service and higher rates for high-risk drivers. Learn things you do that raise your premiums.

Overall, Nationwide remains a solid choice for drivers looking for customizable insurance with added perks for maintaining a good driving record. Enter your ZIP code to see how it compares to providers in your neighborhood.

Frequently Asked Questions

Is Nationwide a reliable car insurance company?

Yes, Nationwide Insurance is highly reliable, offering strong customer service and comprehensive coverage across various policies.

Is Nationwide Mutual Insurance Company good at paying out claims?

Nationwide car insurance is known for efficiently paying out claims, with a solid reputation for handling claims promptly and fairly.

How long does Nationwide take to process a car insurance claim?

Nationwide auto insurance generally processes claims within a few days, depending on the complexity of the case. Learn more about filing a car insurance claim after an accident.

Is Nationwide business insurance financially stable?

Yes, Nationwide business insurance and other policies are supported by the company’s solid financial stability.

Who owns Nationwide Mutual Insurance Company?

Nationwide is a mutual company, which means that its policyholders rather than shareholders own it.

How does Nationwide compare to other car insurance companies?

Nationwide stands out for its comprehensive coverage, strong customer service, and personalized discounts, but it isn’t one of the cheapest car insurance companies.

What is the Nationwide Insurance Company known for?

Nationwide is known for its extensive insurance offerings, including auto, business, and home insurance, as well as its customer-friendly programs. Explore your car insurance options by entering your ZIP code below.

Can I cancel a car insurance payment on Nationwide.com?

Yes, Nationwide insurance allows you to cancel a payment, but it’s best to contact customer service for specific steps. (Read More: How to Cancel Gap Insurance)

Who underwrites Nationwide car insurance?

The Nationwide Mutual Insurance Company is in charge of underwriting nationwide auto insurance and other policies.

What is Nationwide’s A.M. Best rating?

Nationwide Insurance holds an A+ rating from A.M. Best, reflecting strong financial health.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.