Progressive Car Insurance Review for 2026 [See Ratings & Cost Here!]

According to our Progressive car insurance review, you can get a Progressive policy starting at $39 per month. Progressive also offers plenty of ways to save, including Progressive discounts for things like customer loyalty and being a safe driver. Safe drivers can save up to 30% by enrolling in Snapshot.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Michael Leotta

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated February 2025

Our Progressive car insurance review shows that Progressive offers drivers affordable rates, robust digital tools, and plenty of discounts.

Progressive earns its spot as one of the best cheap car insurance companies in America thanks to solid customer reviews. Drivers looking for a modern insurance experience will appreciate Progressive’s online policy management tools.

However, not everyone is pleased with Progressive. The company struggles with its customer loyalty ratings, and some drivers complain about unexpected price hikes.

Progressive Car Insurance Rating

| Rating Criteria | Score |

|---|---|

| Overall Score | 4.4 |

| Business Reviews | 4.0 |

| Claim Processing | 3.5 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.2 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.3 |

| Plan Personalization | 4.5 |

| Policy Options | 5.0 |

| Savings Potential | 4.5 |

Explore our Progressive auto insurance review to see if this company is right for you. Then, enter your ZIP code into our free comparison tool above to compare Progressive rates with other companies.

- Progressive is typically an affordable choice for insurance

- Most drivers agree Progressive is a reliable choice for coverage

- Progressive is best for drivers who want to manage their policies online

Progressive Car Insurance: Average Monthly Rates

Most drivers understand why they need car insurance, but figuring out how your premiums are determined is another story. While Progressive car insurance quotes tend to be affordable, some drivers see higher rates than others.

Factors that affect your insurance rates include your age, location, gender, credit score, driving history, and the type of vehicle you drive. Progressive is a good choice for teen drivers but may not be ideal for people with low credit scores.Ty Stewart Licensed Insurance Agent

Check below to see what your Progressive auto insurance quotes might look like.

Progressive Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 18 Female | $251 | $591 |

| Age: 18 Male | $281 | $662 |

| Age: 25 Female | $52 | $141 |

| Age: 25 Male | $54 | $146 |

| Age: 45 Female | $41 | $112 |

| Age: 45 Male | $39 | $105 |

| Age: 65 Female | $41 | $109 |

| Age: 65 Male | $38 | $103 |

Progressive car insurance rates tend to be lower than the national average, but you should always compare quotes to ensure you get the best price possible. Getting a personalized quote is easy – simply visit a provider’s website and fill out the quote request form.

If you don’t have the time to gather individual quotes this way, you can always use an online generating tool to look at multiple prices at the same time.

Progressive Car Insurance Rates for Teens

Teens figuring out how car insurance works may feel overwhelmed, especially when they see how much they’ll have to pay for coverage. Young drivers see higher rates due to the increased chances that they’ll file a claim.

Progressive tends to be an affordable option for teen drivers. Check below to see how much you might pay for teen car insurance.

Progressive Car Insurance Monthly Rates for Teens by Age, Gender & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $308 | $801 |

| Age: 16 Male | $327 | $814 |

| Age: 17 Female | $291 | $720 |

| Age: 17 Male | $313 | $746 |

| Age: 18 Female | $251 | $591 |

| Age: 18 Male | $281 | $662 |

| Age: 19 Female | $231 | $530 |

| Age: 19 Male | $256 | $590 |

Although teen car insurance is pricy, Progressive is one of the more affordable options. The good news is that your rates will decrease around age 25 as long as you keep your driving record clean.

Progressive Car Insurance Rates for Seniors

Senior car insurance from Progressive is usually affordable. In fact, older drivers won’t see their rates go up by much until about age 65.

Below, you can explore Progressive’s average rates for older drivers.

Progressive Car Insurance Monthly Rates for Seniors by Age, Gender & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 55 Female | $39 | $106 |

| Age: 55 Male | $37 | $100 |

| Age: 65 Female | $41 | $109 |

| Age: 65 Male | $38 | $103 |

| Age: 75 Female | $43 | $116 |

| Age: 75 Male | $40 | $110 |

Older drivers may pay a bit more for their coverage, but they almost never see rates as high as teens.

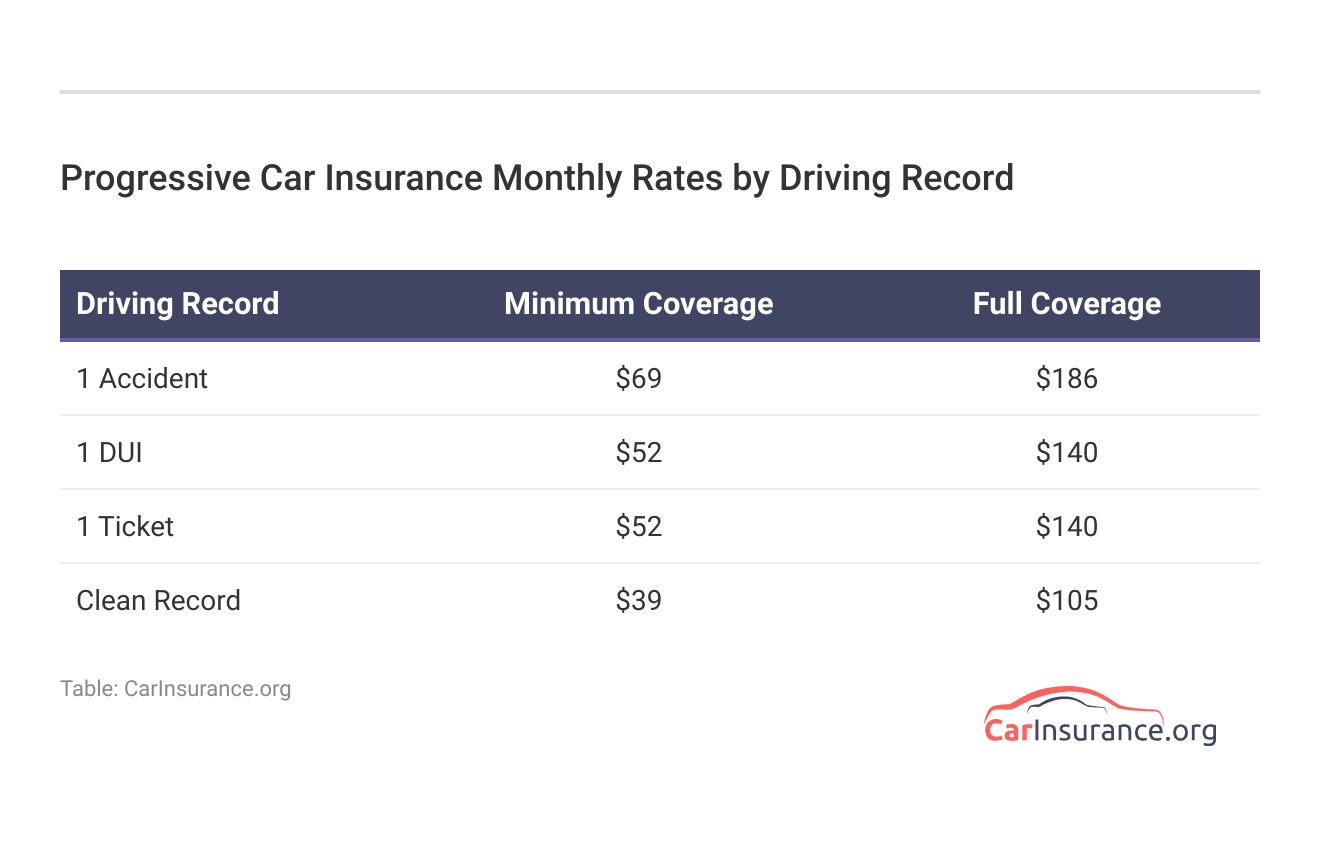

Progressive Car Insurance Rates by Driver

Progressive auto insurance rates are also affected by factors like your driving history and credit score. Of all the factors impacting your Progressive auto insurance policy, your driving record is one of the most important.

As you can see, auto insurance from Progressive varies in price significantly between drivers with clean records and people with traffic violations.

Another important part of your insurance rates is your credit score. Check below to see how much auto insurance from Progressive might cost you based on your credit score.

Progressive Car Insurance Monthly Rates by Credit Score

| Credit Score | Minimum Coverage | Full Coverage |

|---|---|---|

| Good Credit | $35 | $98 |

| Fair Credit | $42 | $118 |

| Bad Credit | $55 | $145 |

Drivers with good credit scores pay less for insurance than people with lower scores. However, there is an exception to this rule. California, Hawaii, Massachusetts, and Michigan don’t allow companies to look at your credit score to determine how much to charge.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Progressive Car Insurance Rates With Top Providers

Although Progressive has a reputation for offering affordable coverage, it’s not always the cheapest option. While it tends to be cheaper than the national average, you should still compare other companies with Progressive company car insurance to make sure you’re getting a good deal.

Take a look below to compare average Progressive rates with other companies.

Car Insurance Monthly Rates for Progressive vs Top Competitors by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $160 | |

| $44 | $117 | |

| $53 | $139 | |

| $30 | $80 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $33 | $86 | |

| $37 | $99 | |

| $22 | $59 |

When it comes to buying car insurance, finding the best policy for you depends on comparing quotes. You can see above that Progressive isn’t always the cheapest provider.

However, the cheapest choice isn’t always the best. Progressive may be the right choice for your needs, depending on the amount of coverage you want to purchase.

Progressive Car Insurance Options

Whether you want the bare minimum amount of coverage you need to meet your state’s requirements or a full coverage policy with all the bells and whistles, Progressive has you covered.

When you get a Progressive insurance quote, you’ll have the following types of coverage to choose from:

- Liability Insurance: When you cause an accident, you’ll need liability insurance to cover damages and injuries to others. Most states require liability insurance.

- Collision Insurance: Collision insurance covers damage to your vehicle after something hits your car, even if you’re at fault. It also covers you if you hit a stationary object, like your neighbor’s mailbox.

- Comprehensive Insurance: For everything that can damage your vehicle outside of a collision, there’s comprehensive insurance. Comprehensive insurance covers damage from things like weather, fire, floods, vandalism, and theft.

- Uninsured/Underinsured Motorist Coverage: If someone without adequate coverage hits you, uninsured/underinsured motorist insurance will pay for your car repairs and health care needs.

- Medical Payments/Personal Injury Protection: The type of coverage you can buy depends on your state, but both medical payments (MedPay) and personal injury protection (PIP) insurance pay for health care expenses after an accident.

In case you’re wondering if it’s bad to carry just minimum coverage car insurance, it depends on your needs. If you’ve financed a car or you own a vehicle that’s either new or valuable, a full coverage policy is probably best. However, if your car is older or less valuable, minimum coverage is probably enough.

Understanding how much coverage you should buy can be confusing, but you don’t have to do it alone. Progressive car insurance ratings frequently praise the customer service team for helping drivers pick the perfect policy.Kalyn Johnson Insurance Claims Support & Sr. Adjuster

While it’s never a bad idea to buy more coverage, adding insurance to your policy increases your premiums. If you need the cheapest Progressive insurance rates possible, you should choose only what you need.

Progressive Car Insurance Add-Ons

Your car is likely one of your largest investments, so it makes sense that you’d want to protect it. Progressive understands that basic coverage isn’t enough for every drive, so they offer the following add-ons:

- Gap Insurance: Gap insurance pays the difference between what you owe on your car loan and what your car is actually worth in case you total your vehicle. Essentially, gap insurance protects you from paying for a car you no longer drive.

- Rental Car Reimbursement: If your car is stuck in the mechanic’s after a covered accident, Progressive will pay for a rental car.

- Rideshare Insurance: Progressive supports drivers who work for companies like Uber and Lyft by offering rideshare insurance.

- Custom Parts and Equipment Coverage: Drivers who customize their cars should know that regular insurance doesn’t cover custom parts. If you add custom parts and equipment coverage to your policy, everything in your car will be protected.

- Roadside Assistance: Enroll in Progressive’s roadside assistance to get help when you’re stranded. Roadside assistance from Progressive includes towing, flat tire changes, dead batteries, and locksmith services.

Some drivers won’t need to add additional coverage. For example, if you’re concerned about whether Progressive car insurance covers windshield replacement, you don’t need to purchase an add-on. Instead, you’ll need comprehensive coverage.

Usage-Based Auto Insurance by Progressive

Getting car insurance with telematics can help you save a significant amount, but what is usage-based car insurance, and does Progressive offer it?

Progressive’s UBI program is Snapshot. Safe drivers can save up to 30% on their premiums by enrolling in Snapshot and consistently practicing safe driving habits. Snapshot tracks the following behaviors:

- Hard Braking

- Speeding

- Mileage

- Time of Day

- Phone Use

While Snapshot can save you money, you should only sign up if you’re a safe driver. Snapshot is one of the few UBI programs that can cause a rate increase if you don’t score well enough.

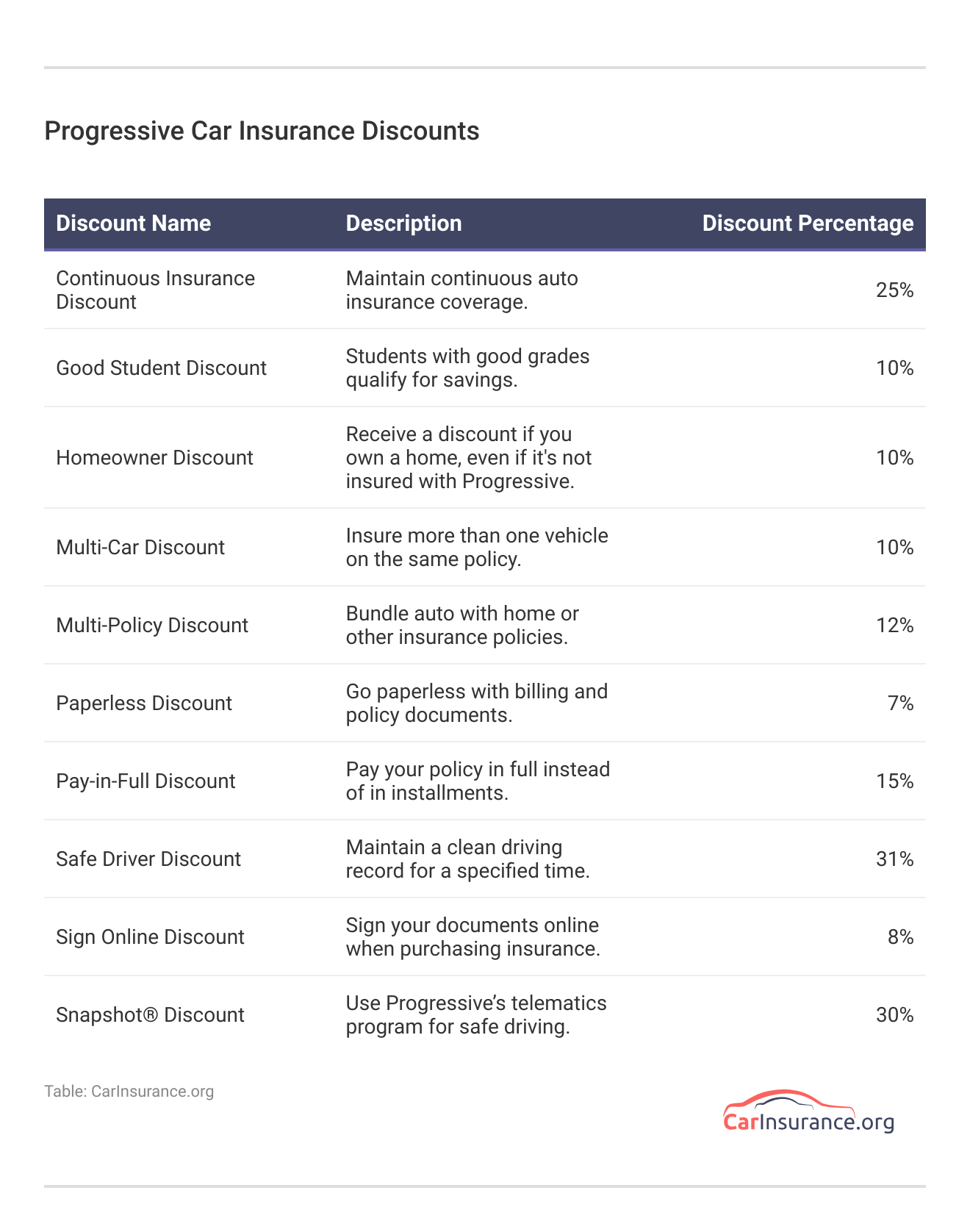

Progressive Car Insurance Discounts

While there are plenty of things you do that can increase your premiums, an easy way to save is to take advantage of Progressive’s discounts. Progressive insurance reviews frequently praise how many discounts the company offers, which you can explore below.

Progressive automatically applies most discounts to your account when you apply for a policy. Others apply when you become eligible, like the loyalty and teen driver discounts. You may need to submit proof for others, like the good student discount.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Progressive Customer Reviews

Although it has its share of complaints, Progressive is generally considered a good choice for insurance.

One major reason customers leave positive reviews is the Progressive customer service representatives. Most agree that representatives are helpful, friendly, and willing to help you make the most of your insurance.

I’m working late … cause I’m obsessed with bundling your home and auto insurance 🎵 pic.twitter.com/weEnVBKwFH

— Progressive (@progressive) August 23, 2024

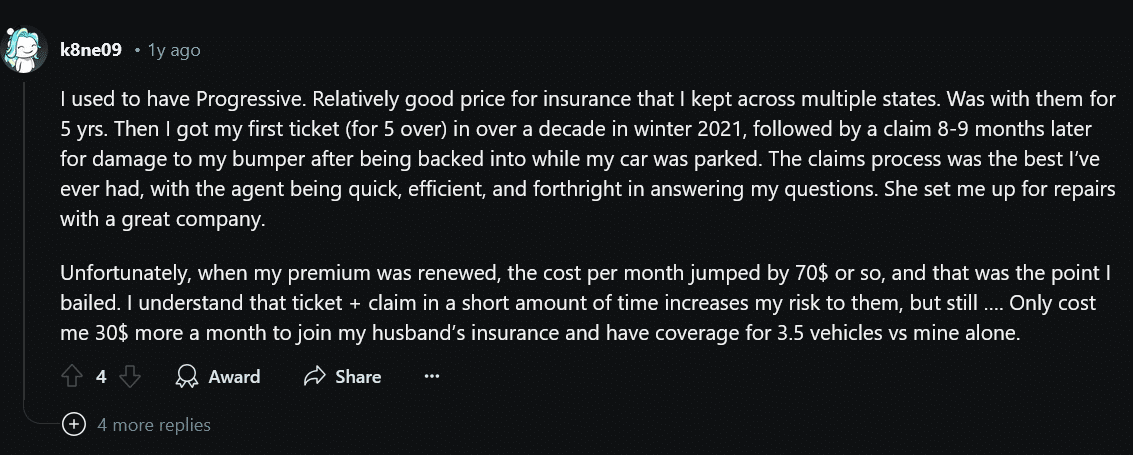

Progressive is also commonly praised for its service when you need to file a car insurance claim after an accident. However, some drivers have had issues with rate increases. This Reddit user below mentions common positive and negative issues with Progressive.

Although this Reddit user ended up switching to another company, many drivers choose to stay. It’s worth noting, however, that Progressive struggles with its customer loyalty ratings.

Progressive Car Insurance Pros and Cons

Still undecided about Progressive? Read through our quick pros and cons to help you make a decision. When you buy your coverage from Progressive, you’ll enjoy the following perks:

- Affordable Rates: Whether you want property damage and bodily injury liability coverage or full coverage with add-ons, Progressive tends to be a cheap option.

- Digital Tools: From the Name Your Price tool to a robust mobile app, Progressive’s innovative online tools make it easy to manage your policy.

- Ways to Save: Take advantage of Progressive’s generous discounts or enroll in Snapshot to lower your premiums.

Like all other companies, there are some drawbacks to consider with Progressive. These include:

- Unexpected Premium Hikes: A common complaint against Progressive is that many customers see rate increases unexpectedly.

- Customer Loyalty Struggles: While Progressive consistently tries to improve its service, the company struggles to keep its policyholders.

Progressive is a great choice for people with young drivers in their families. It’s also a great choice for a modernized insurance experience.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get Progressive Car Insurance Quotes Today

Whether you want the barest policy possible or full coverage with a ton of car insurance add-ons, you should consider Progressive in your search for coverage. It offers a generous number of discounts, a robust UBI program, and plenty of coverage options.

However, you should always compare multiple companies when you need insurance. Enter your ZIP code into our free comparison tool below to see how Progressive rates compare in your area.

Frequently Asked Questions

Is Progressive car insurance good?

While it struggles in some areas, Progressive is considered one of the best car insurance companies in the country. Most drivers appreciate the amount of coverage options you can add to your policy, like rideshare insurance coverage and roadside assistance.

Does Progressive pay claims well?

Yes, most customers report being completely satisfied with Progressive’s claims service. Progressive receives praise for the helpfulness of its customer service representatives and how quickly claims are paid out.

Does Progressive raise rates after six months?

Like other insurance companies, Progressive reevaluates your premium every time your policy renews. Some drivers see a rate increase after their first six months for a variety of reasons, like getting a speeding ticket. Even though the occasional rate increase is normal, you can always find a new policy if it’s too high. If that’s the case, enter your ZIP code into our free tool to compare new policies.

Who is cheaper, Progressive or State Farm?

Overall, State Farm tends to be the more expensive. Progressive tends to offer lower rates for teen drivers, but Geico is a good choice for high-risk drivers. Explore our State Farm car insurance review to compare rates.

What is Progressive Direct?

Progressive Direct indicates that you purchased your policy online, either through the website or mobile app. If you got a policy through a local agent, then your coverage wouldn’t be considered Progressive Direct.

Is Progressive Direct the same as Progressive?

Yes, Progressive Direct and Progressive are the same auto insurance company.

Is Progressive insurance reliable?

With an A+ from A.M. Best, Progressive is considered a reliable insurance provider. It also tends to offer affordable prices when you look at car insurance rates by state.

How do you get a Progressive insurance quote?

Getting a Progressive quote is easy. The simplest way is to visit the Progressive website and fill out the quote request form. Alternatively, you can call the Progressive car insurance customer service phone number to speak with a representative.

Is Progressive cheaper than Allstate?

Generally speaking, Progressive is much cheaper than Allstate. However, you should always compare quotes to find the cheapest companies for you. Read our Allstate car insurance review to see how much you might pay.

Is Snapshot worth it?

Progressive’s UBI program Snapshot is worth enrolling in if you’re a safe driver. If you regularly avoid speeding, hard braking, driving late at night, and putting a lot of miles on your car, Snapshot can save you up to 30%. However, Snapshot can increase your rates if you don’t practice safe driving habits.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.