Safeco Car Insurance Review for 2026 [Get the Facts Here]

This Safeco car insurance review showcases its accident forgiveness program, which prevents rate hikes for drivers with a clean record after their first accident. Safeco Insurance is a subsidiary of Liberty Mutual and provides flexible and cheap minimum coverage car insurance starting at $27 monthly.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from Seve...

D. Gilson, PhD

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Kristen Gryglik

Updated March 2025

This Safeco car insurance review highlights its strong customer service and customizable policies, making it a top contender for dependable coverage.

Offering a range of discounts and flexible coverage options, Safeco caters to a variety of driver needs, ensuring peace of mind on the road.

Safeco Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.2 |

| Business Reviews | 4.0 |

| Claim Processing | 2.5 |

| Company Reputation | 4.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 3.9 |

| Customer Satisfaction | 3.9 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.3 |

| Plan Personalization | 4.5 |

| Policy Options | 5.0 |

| Savings Potential | 4.5 |

Safeco Insurance Company proves to be a solid choice for those seeking comprehensive protection. It stands out with its accident forgiveness program, which ensures that drivers with clean records will not see rate hikes after their first incident. Learn what to do if your vehicle is damaged in an accident.

Find the best car insurance company for you by entering your ZIP code above in our free comparison tool to get the lowest rates.

- Safeco car insurance holds a strong 4.2 rating for its reliable service

- Safeco insurance costs less than the competition starting at $27/month

- Rewind accident forgiveness program prevents Safeco rate increases

Understanding Safeco Car Insurance Pricing

Age is one of the biggest factors that affect the price of car insurance. This table shows that younger drivers, particularly those aged 16 to 18, face significantly higher Safeco insurance premiums, especially for full coverage.

Safeco Car Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $133 | $344 |

| Age: 16 Male | $146 | $360 |

| Age: 18 Female | $108 | $253 |

| Age: 18 Male | $125 | $292 |

| Age: 25 Female | $31 | $82 |

| Age: 25 Male | $32 | $85 |

| Age: 30 Female | $29 | $77 |

| Age: 30 Male | $30 | $79 |

| Age: 45 Female | $27 | $72 |

| Age: 45 Male | $27 | $71 |

| Age: 60 Female | $24 | $63 |

| Age: 60 Male | $25 | $64 |

| Age: 65 Female | $27 | $71 |

| Age: 65 Male | $26 | $69 |

As drivers age, the rates drop substantially, with 25-year-olds and above seeing far more affordable options. Older drivers generally get cheaper Safeco car insurance because they are viewed as more experienced and less likely to take risks on the road compared to younger drivers.

Safeco car insurance offers competitive rates, with 45-year-old drivers paying as low as $27 for minimum coverage.Brandon Frady Licensed Insurance Producer

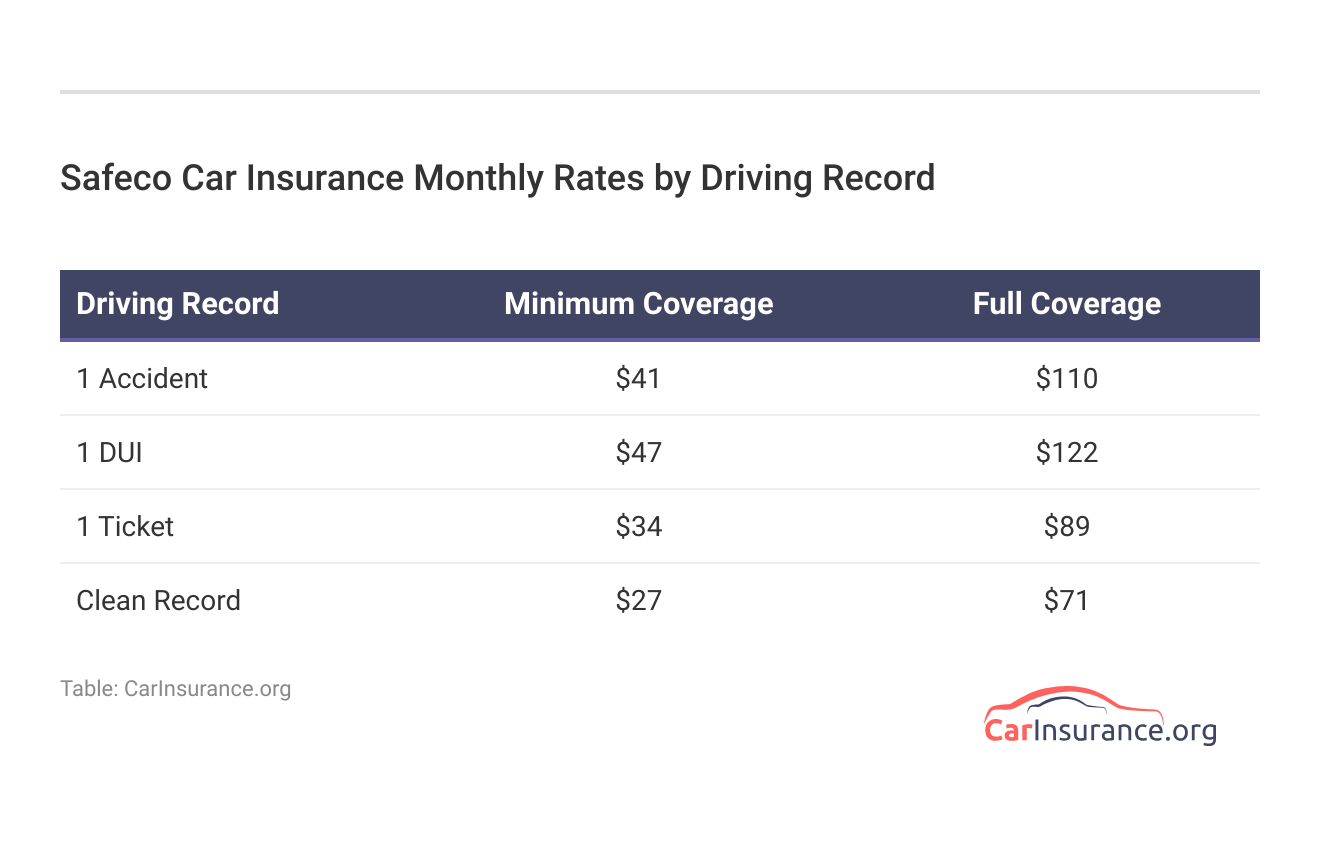

While drivers with a clean record enjoy the most affordable rates, even minor infractions like a single ticket can raise your premium.

Safeco insurance rates increase with a bad driving record because it sees drivers with accidents or violations as more likely to file claims. Keep reading to see how Safeco insurance costs compare to other top providers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Safeco Car Insurance Rate Comparison

When comparing auto insurance quotes to its top competitors, Safeco often offers lower rates, especially for drivers aged 45, providing a competitive edge for budget-conscious consumers.

Safeco Car Insurance Monthly Rates vs. Top Competitors by Age & Gender

| Insurance Company | Age: 45 Female | Age: 45 Male |

|---|---|---|

| $162 | $160 | |

| $115 | $117 | |

| $139 | $139 | |

| $80 | $80 | |

| $171 | $174 |

| $113 | $115 |

| $112 | $105 | |

| $72 | $71 | |

| $86 | $86 | |

| $98 | $99 | |

| $59 | $59 |

Even though rates vary significantly based on your driving record, Safeco is still cheaper after incidents like tickets or accidents.

Safeco Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $160 | $188 | $225 | $270 | |

| $117 | $136 | $176 | $194 | |

| $139 | $173 | $198 | $193 | |

| $80 | $106 | $132 | $216 | |

| $174 | $212 | $234 | $313 |

| $115 | $137 | $161 | $237 |

| $105 | $140 | $186 | $140 | |

| $71 | $89 | $110 | $122 | |

| $86 | $96 | $102 | $112 | |

| $99 | $134 | $139 | $206 | |

| $59 | $67 | $78 | $108 |

While Safeco consistently offers lower rates compared to other companies, even for drivers with less-than-perfect records, it’s essential to compare across providers to see where savings can be maximized.

Read More: How to Prepare for an Auto Accident

Exploring Safeco Car Insurance Coverage Options

How much insurance do I need for my car? When choosing car insurance, you’ll need coverage that meets your state’s minimum requirements.

Safeco offers a wide range of car insurance coverage options designed to protect drivers from various risks on the road.

Safeco Car Insurance Coverage Options

| Coverage | Description |

|---|---|

| Collision | Pays for vehicle damage from collisions |

| Comprehensive | Covers non-collision damage like theft or fire |

| Custom Equipment | Covers aftermarket parts and modifications |

| Liability | Covers injury and damage to others |

| Medical Payments | Pays medical expenses for you and passengers |

| Personal Injury Protection (PIP) | Covers medical and related expenses |

| Rental Car Reimbursement | Pays for rental car during repairs |

| Roadside Assistance | Provides towing and emergency services |

| Uninsured/Underinsured Motorist | Protects against uninsured or underinsured drivers |

Save More With Safeco Car Insurance Discount Programs

Safeco auto insurance discounts reward safe driving, payment choices, and responsible vehicle ownership. These discounts can significantly reduce premiums, making it easier for customers to save money on car insurance.

Safeco Car Insurance Discounts by Savings Potential

| Discount | |

|---|---|

| Low Mileage | 20% |

| Bundling | 15% |

| Accident-Free | 10% |

| Good Student | 10% |

| Safe Driver | 10% |

| Multi-Car | 8% |

| Homeowne | 7% |

| Anti-Theft Device | 5% |

| New Vehicle | 5% |

| Pay-in-Full | 5% |

Safeco’s discount programs provide flexibility for various lifestyles. By taking advantage of these offers, drivers can maximize their savings and maintain comprehensive protection.

Learn More: How to Lower Your Car Insurance Costs

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Safeco Car Insurance Pros and Cons Breakdown

Safeco Insurance offers several advantages, particularly in terms of its coverage and customer service. Drivers seeking a reliable and flexible insurance provider will find Safeco’s offerings appealing.

- Strong Financial Stability: Backed by a reputable parent company, Safeco demonstrates solid financial strength.

- Customizable Coverage: Safeco provides a wide range of coverage options tailored to individual driver needs.

- Accident Forgiveness: Safeco Rewind provides immediate accident forgiveness at sign-up, even for existing accidents or tickets.

Safeco stands out as a reliable option with flexible coverage solutions and valuable discount programs, but certain limitations may affect how appealing Safeco is depending on individual circumstances.

- Claims Handling Concerns: Mixed reviews from customers highlight occasional delays during the claims process. Find out what happens when filing a car insurance claim after an accident.

- Higher Number of Complaints: Safeco receives a few more customer complaints than average, which reflects varied customer service by state.

Despite these drawbacks, Safeco remains a competitive choice for many, though some drivers may need to consider these factors before choosing the company.

Comprehensive Overview of Safeco Car Insurance Ratings

Safeco car insurance receives favorable ratings across multiple reputable agencies, showcasing its reliability and customer satisfaction.

Safeco Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 844 / 1,000 Above Avg. Satisfaction |

|

| Score: A Excellent Business Practices |

|

| Score: 74/100 Good Customer Feedback |

|

| Score: 0.90 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

Safeco insurance company ratings demonstrate consistent performance, but some customer service areas still have room for improvement.

Comment

byu/XSpcwlker from discussion

inInsurance

Overall, Safeco remains a solid choice for drivers seeking dependable coverage and financial strength, especially for high-risk drivers after an accident.

Read More: Compare Car Insurance Rates by State

Safeco Car Insurance Stands Out With Cheap Rates

When you’re ready to see how much you can save on your car insurance, enter your ZIP code below into our free comparison tool.

Frequently Asked Questions

How does Safeco Insurance Company rank?

Safeco ranks highly due to its financial stability and strong customer service, earning favorable reviews from industry experts.

What is Safeco’s A.M. Best rating?

Safeco Insurance holds an A (Excellent) rating from A.M. Best, reflecting its solid financial strength and trustworthiness.

Does Safeco work best for car insurance claims?

Safeco is known for handling car insurance claims efficiently, offering reliable support to policyholders during the claims process. Learn how to file a car insurance claim after an accident.

Who owns Safeco Insurance?

Liberty Mutual owns Safeco. Learn more in our Liberty Mutual car insurance review.

How large is Safeco Insurance Company?

Safeco auto insurance operates in all 50 states through Liberty Mutual.

How long has Safeco car insurance been around?

Safeco has been serving customers for over 90 years, building a strong reputation in the insurance industry.

What is the best type of car insurance to get in Safeco?

The best types of car insurance with Safeco depend on your needs, but full coverage options, including liability and collision, offer more comprehensive protection.

How is comprehensive car insurance with Safeco?

Safeco’s comprehensive car insurance covers a wide range of incidents, from theft to natural disasters, providing thorough protection.

Does Safeco car insurance charge a credit card fee?

Safeco does not typically charge additional fees for credit card payments, making it convenient for policyholders.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which Safeco insurance is best for a car accident?

For car accidents, Safeco’s full coverage with accident forgiveness is the best option, minimizing the impact of claims on your rates. Shop for cheap car insurance quotes after an accident by entering your ZIP code below.

Safeco ranks highly due to its financial stability and strong customer service, earning favorable reviews from industry experts.

Safeco Insurance holds an A (Excellent) rating from A.M. Best, reflecting its solid financial strength and trustworthiness.

Does Safeco work best for car insurance claims?

Safeco is known for handling car insurance claims efficiently, offering reliable support to policyholders during the claims process. Learn how to file a car insurance claim after an accident.

Who owns Safeco Insurance?

Liberty Mutual owns Safeco. Learn more in our Liberty Mutual car insurance review.

How large is Safeco Insurance Company?

Safeco auto insurance operates in all 50 states through Liberty Mutual.

How long has Safeco car insurance been around?

Safeco has been serving customers for over 90 years, building a strong reputation in the insurance industry.

What is the best type of car insurance to get in Safeco?

The best types of car insurance with Safeco depend on your needs, but full coverage options, including liability and collision, offer more comprehensive protection.

How is comprehensive car insurance with Safeco?

Safeco’s comprehensive car insurance covers a wide range of incidents, from theft to natural disasters, providing thorough protection.

Does Safeco car insurance charge a credit card fee?

Safeco does not typically charge additional fees for credit card payments, making it convenient for policyholders.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which Safeco insurance is best for a car accident?

For car accidents, Safeco’s full coverage with accident forgiveness is the best option, minimizing the impact of claims on your rates. Shop for cheap car insurance quotes after an accident by entering your ZIP code below.

Safeco is known for handling car insurance claims efficiently, offering reliable support to policyholders during the claims process. Learn how to file a car insurance claim after an accident.

Liberty Mutual owns Safeco. Learn more in our Liberty Mutual car insurance review.

How large is Safeco Insurance Company?

Safeco auto insurance operates in all 50 states through Liberty Mutual.

How long has Safeco car insurance been around?

Safeco has been serving customers for over 90 years, building a strong reputation in the insurance industry.

What is the best type of car insurance to get in Safeco?

The best types of car insurance with Safeco depend on your needs, but full coverage options, including liability and collision, offer more comprehensive protection.

How is comprehensive car insurance with Safeco?

Safeco’s comprehensive car insurance covers a wide range of incidents, from theft to natural disasters, providing thorough protection.

Does Safeco car insurance charge a credit card fee?

Safeco does not typically charge additional fees for credit card payments, making it convenient for policyholders.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which Safeco insurance is best for a car accident?

For car accidents, Safeco’s full coverage with accident forgiveness is the best option, minimizing the impact of claims on your rates. Shop for cheap car insurance quotes after an accident by entering your ZIP code below.

Safeco auto insurance operates in all 50 states through Liberty Mutual.

Safeco has been serving customers for over 90 years, building a strong reputation in the insurance industry.

What is the best type of car insurance to get in Safeco?

The best types of car insurance with Safeco depend on your needs, but full coverage options, including liability and collision, offer more comprehensive protection.

How is comprehensive car insurance with Safeco?

Safeco’s comprehensive car insurance covers a wide range of incidents, from theft to natural disasters, providing thorough protection.

Does Safeco car insurance charge a credit card fee?

Safeco does not typically charge additional fees for credit card payments, making it convenient for policyholders.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which Safeco insurance is best for a car accident?

For car accidents, Safeco’s full coverage with accident forgiveness is the best option, minimizing the impact of claims on your rates. Shop for cheap car insurance quotes after an accident by entering your ZIP code below.

The best types of car insurance with Safeco depend on your needs, but full coverage options, including liability and collision, offer more comprehensive protection.

Safeco’s comprehensive car insurance covers a wide range of incidents, from theft to natural disasters, providing thorough protection.

Does Safeco car insurance charge a credit card fee?

Safeco does not typically charge additional fees for credit card payments, making it convenient for policyholders.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which Safeco insurance is best for a car accident?

For car accidents, Safeco’s full coverage with accident forgiveness is the best option, minimizing the impact of claims on your rates. Shop for cheap car insurance quotes after an accident by entering your ZIP code below.

Safeco does not typically charge additional fees for credit card payments, making it convenient for policyholders.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

For car accidents, Safeco’s full coverage with accident forgiveness is the best option, minimizing the impact of claims on your rates. Shop for cheap car insurance quotes after an accident by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.