Factors That Affect the Price of Car Insurance

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Insurance Premium Auditor

With over a decade of experience in insurance premium auditing, audit department management, and business audit representation, Aaron has developed a deep understanding of audit regulations, compliance requirements, and industry best practices. As the Founder & CEO of AdvoQates, he specializes in representing businesses during their audits to ensure accurate, transparent, and fair assessments ...

Aaron Englard

Updated June 2025

You might wonder why your car insurance rates change or why various companies offer different rates. This article will dive into how your rates are calculated and what you can do to lower them.

Factors that affect the price of your car insurance include your coverage, driving record, age, and credit score. In addition, where you live and what vehicle you drive also affect your rates.

Fortunately, there are ways to affect some of those factors to lower car insurance rates. For example, although you can’t change your age, you can change your driving record and credit score.

- Many factors affect car insurance rates, such as your age and driving record

- Your vehicle, ZIP code, and coverage type also affect your rates

- Drivers can change some factors to get lower rates

Keep reading to learn what factors affect car insurance prices and how to lower rates.

Factors That Impact Car Insurance Rates

You might believe that car insurance rates are hard to figure out, especially since rates vary widely by company. However, car insurance companies typically use several factors to calculate rates.

Car insurance companies base their rates on several risk factors. The more risks you pose, the higher the rates. Insurance companies do this to avoid a loss. Drivers with certain risk factors file more claims and cost the insurance company more money.

Insurance companies look at everything about you and your vehicle to determine if you’re a risky driver and how high your rates should be.

Factors commonly used to calculate your auto insurance rates include:

- Coverage types

- Driving record

- Demographics

- Credit score

- Vehicle

- Mileage

- ZIP Code

Every company assesses factors differently, so rates vary from company to company. However, knowing what car insurance companies look at helps you find the lowest rates possible.

Some car insurance companies overlook certain factors. For example, many auto insurance companies don’t charge higher rates for a traffic ticket or offer accident forgiveness for your first claim.

However, these factors provide an overall view of you as a driver. Therefore, even if your car insurance company doesn’t raise your rates based on certain factors, it still looks very closely to determine risk.

Let’s dive into these factors to see just how much they affect rates and how to reduce the cost of car insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Coverage Affects Your Car Insurance Rates

Most states require at least a minimum amount of car insurance to drive legally. Typical requirements include liability, personal injury protection, and uninsured/underinsured motorist coverages.

While liability coverage pays for bodily injuries and property damages to others, it doesn’t offer you any protection. Collision and comprehensive coverages pay for damages to your vehicle, whether from an accident, theft, vandalism, fire, or acts of nature. (For more information, read our “Best Car Insurance by Vehicle: How Your Car Affects Insurance“).

Experts recommend full coverage insurance that combines liability, collision, comprehensive coverages, and other coverages required by your state. However, more coverage comes at a cost.

This table shows average rates from top car insurance companies based on coverage type.

Car Insurance Monthly Rates by Coverage Type

| Company | Low | Medium | High |

|---|---|---|---|

| $386 | $408 | $428 | |

| $281 | $295 | $285 |

| $327 | $347 | $375 | |

| $250 | $268 | $286 | |

| $484 | $505 | $530 |

| $283 | $288 | $292 | |

| $311 | $335 | $363 | |

| $255 | $273 | $288 | |

| $352 | $372 | $385 | |

| $200 | $212 | $222 |

Read more:

- Allstate vs. Nationwide Car Insurance

- American Family vs. Liberty Mutual Car Insurance

- American Family vs. State Farm Car Insurance

Full coverage costs around $30 a month more than liability-only coverage. Remember that while rates are higher, so is coverage. If your car is damaged without full coverage, you may be left paying for expensive repairs yourself.

Car insurance rates also increase with add-ons. For example, rental car coverage and roadside assistance costs add to your overall rates.

In addition to the type of coverage you choose, your deductible also affects rates. A deductible is an amount you pay before car insurance kicks in.

Raising your deductible lowers car insurance rates since the company pays less for a claim. However, if you want little out-of-pocket costs, reduce your deductible. (For more information, read our “What if you can’t pay your deductible?“).

Keep in mind that you may not have a choice in how much car insurance you carry if you have a car loan or lease. Most lenders require full coverage for the most protection.

How Driving Record Affects Car Insurance Rates

One of the most significant factors that affect car insurance is your driving record. Car insurance companies use your driving history to determine if you’re likely to file an accident claim in the future.

Most states issue points for each moving violation received. Every state decides on the number of points given for each infraction and how long they stay on your record. If you get enough points, your driver’s license can be suspended or revoked.

Your state also decides how long an insurance company can look back at your driving record. Points and infractions typically stay on your record for three to five years and can increase car insurance rates for that long.

However, reckless driving or DUIs may stay on your record much longer since these are very dangerous. Some states allow major infractions to remain on your record for up to 10 years.

This table shows average car insurance rates based on driving records.

Car Insurance Monthly Rates by Driving Record

| Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $87 | $124 | $152 | $103 | |

| $62 | $94 | $104 | $73 |

| $76 | $109 | $105 | $95 | |

| $43 | $71 | $117 | $56 | |

| $96 | $129 | $178 | $116 |

| $63 | $88 | $129 | $75 | |

| $56 | $98 | $75 | $74 | |

| $47 | $57 | $65 | $53 | |

| $53 | $76 | $112 | $72 | |

| $32 | $42 | $58 | $36 |

Although one ticket raises rates an average of $45 a month, an accident increases rates by around $80 a month. If you get a DUI, expect rates to go up about $150 a month.

Accidents, tickets, and DUIs cause significant increases in your rates. In addition, car insurance companies can refuse to cover you if you have multiple infractions. As a result, you may need expensive, high-risk auto insurance.

Keep your driving record clear to avoid high auto insurance rates. In addition, take a defensive driving course to earn a discount and reduce or remove points in some states.

Also, carefully consider costs before filing a claim. For example, it may be cheaper to pay out of pocket for repairs rather than be charged higher car insurance rates for years.

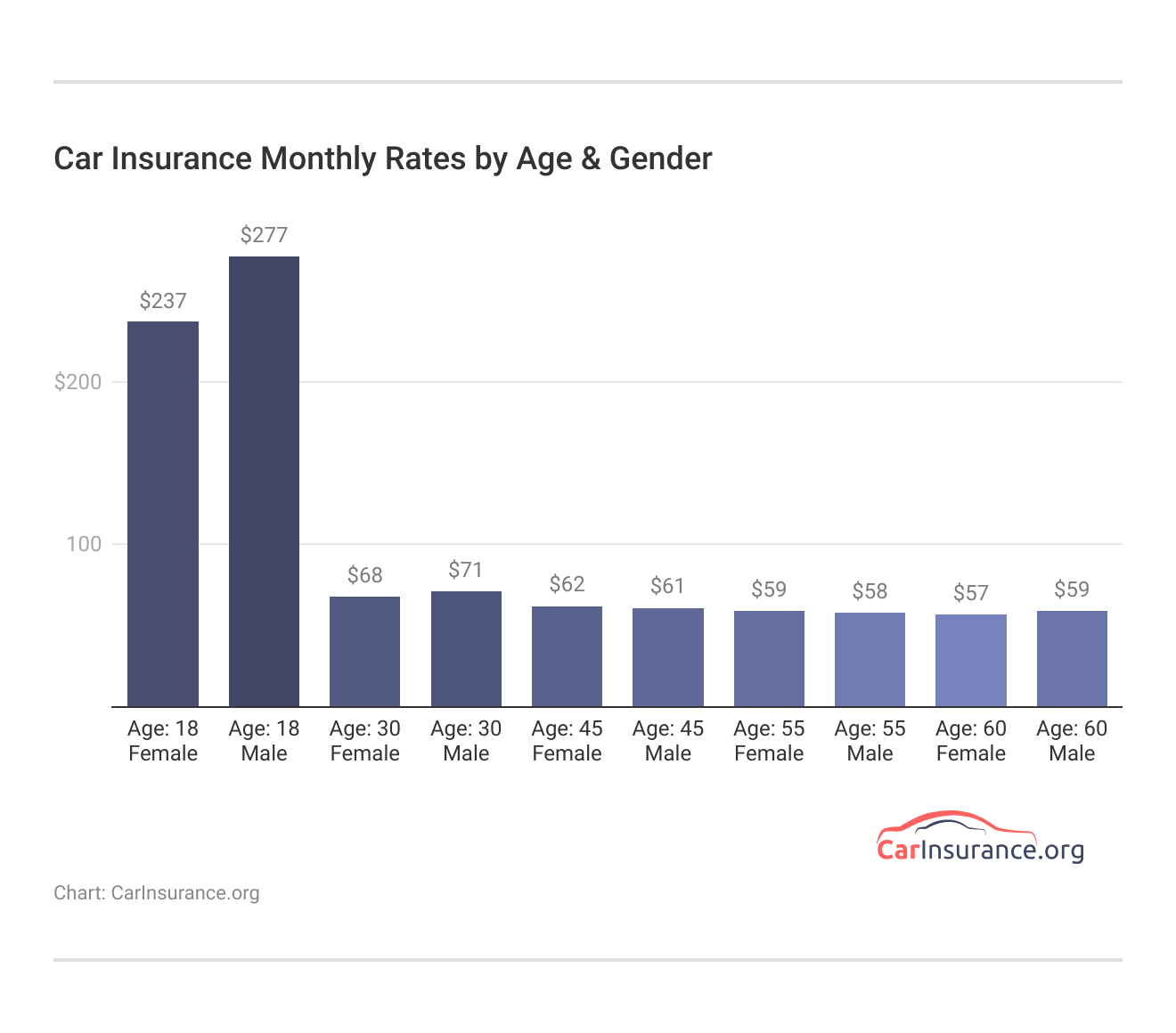

How Age, Gender, & Marital Status Affect Car Insurance Rates

It’s no surprise how age relates to car insurance pricing. But did you know that your gender and marital status also determine rates?

This table shows average auto insurance rates from top companies based on demographics.

After age 25, car insurance rates for males and females are very similar. While gender and marital status affect rates, the most significant factor is age.

Young and new drivers lack experience behind the wheel. Car insurance companies realize that less experience leads to more accidents and claims. Unfortunately, drivers can’t change their age, but they can drive safely to avoid accidents and tickets.

According to the Centers for Disease Control and Prevention, teen drivers are three times more likely to be involved in a fatal accident.

On the other hand, drivers over 65 also pay higher car insurance rates. The chance of an accident increases as drivers age and have physical conditions that may slow reaction times.

Most states also allow insurance companies to use your gender to calculate rates. States that prohibit insurers from looking at gender include California, Hawaii, Massachusetts, Montana, North Carolina, and Pennsylvania. (For more information, read our Massachusetts“).

Read more: Hawaii

Statistics show that male drivers are more likely to take risks, such as speeding and aggressive driving. Young male drivers pay the highest car insurance rates.

Married drivers also take fewer risks statistically and are seen as more responsible drivers. Their rates may be slightly lower than unmarried drivers.

If you get married, let your auto insurance company know. In addition to lower rates, some insurance companies offer a discount for being married.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Credit Score Affects Car Insurance Rates

Most drivers don’t know that their credit score affects their car insurance rates. Insurance companies believe that drivers with a higher credit score are less likely to file claims and are more likely to pay for damages themselves.

This table shows average annual rates from top insurers based on credit scores. Credit scores below 580 are considered poor, scores between 508 and 699 are fair, and anything above 700 is good.

Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good | Fair | Bad |

|---|---|---|---|

| $189 | $219 | $342 | |

| $173 | $202 | $329 |

| $184 | $215 | $334 | |

| $190 | $220 | $324 | |

| $282 | $315 | $411 |

| $208 | $238 | $354 | |

| $225 | $265 | $415 | |

| $123 | $144 | $289 | |

| $234 | $272 | $396 | |

| $146 | $175 | $248 |

Drivers with poor credit scores can pay an average of approximately $165 a month more than drivers with a good credit score.

It’s also important to note that every state lets insurance companies look at credit scores. California, Hawaii, Massachusetts, and Michigan don’t allow your credit score to influence your rates. Maryland, Oregon, and Utah place restrictions on how insurance companies view credit.

In addition to lowering car insurance rates, raising your credit score saves you money on a home or auto loan, credit card interest rates, and other major purchases.

Make payments on time and use credit wisely to increase your score. It’s also a good idea to request a copy of your credit report. Then, work with your credit reporting agency to correct any errors.

How Vehicle, Mileage, and ZIP Code Impact Car Insurance Rates

The type of car you drive, how much you’re on the road, and your ZIP code affect car insurance rates. Fortunately, these are factors that you can control.

First, the vehicle you insure affects your rates. New and expensive cars are more costly to repair or replace. The same is true for custom and classic cars.

Even a custom paint job or parts can raise rates. Anything that increases the amount your car insurance company has to pay for repairs increases your rates.

However, your car can earn you coverage discounts. Most newer cars come with a variety of safety features and anti-theft systems. Auto insurance companies offer discounts for features that help avoid an accident, prevent your car from being stolen, and help recover it if it’s stolen.

Next, how far you drive also affects your rates. Simply put, more time on the road equals a greater chance of being in an accident.

Some insurance companies offer low-mileage discounts for drivers who spend less time behind the wheel than average. Additionally, pay-per-mile insurance offers cheaper coverage.

Drivers who work from home, take public transportation, or are retired may save money if they drive less than average.

However, you have to report your estimated mileage to your insurance company. Car insurance companies can deny claims if your mileage is much higher than reported.

Finally, where you live affects your rates. Because your insurance company is more likely to pay a claim, drivers who live in areas with a high vehicle theft rate or traffic congestion generally see higher rates.

Although it may not be feasible for you to move, there are other ways to keep rates low. For example, buy a less expensive vehicle, keep your mileage low, and consider crime and traffic rates when moving to reduce car insurance rates.

Factors That Affect the Price of Car Insurance

Many different factors affect the cost of car insurance. Typical factors used to determine rates include your coverage, driving record, demographics, credit score, vehicle, mileage, and ZIP code.

While some factors like age are out of your control, other factors can save you money.

For example, cleaning up your driving record and raising your credit score helps lower rates. In addition, consider the type of coverage you need and your vehicle. More coverage and an expensive car mean higher rates.

In addition, drivers can reduce mileage and carefully consider where they live to get the lowest rates available.

Shop around to find coverage and rates that fit your budget and needs. Every company weighs these factors differently, so compare multiple companies to find your best deal on car insurance. (For more information, read our “Best Car Insurance Companies“).

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.